Share prices of less-than-truckload carriers fell on Wednesday following Old Dominion Freight Line’s lackluster first-quarter result. The company said freight volumes have stabilized but that there hasn’t been an uptick in demand this spring as originally expected earlier in the year.

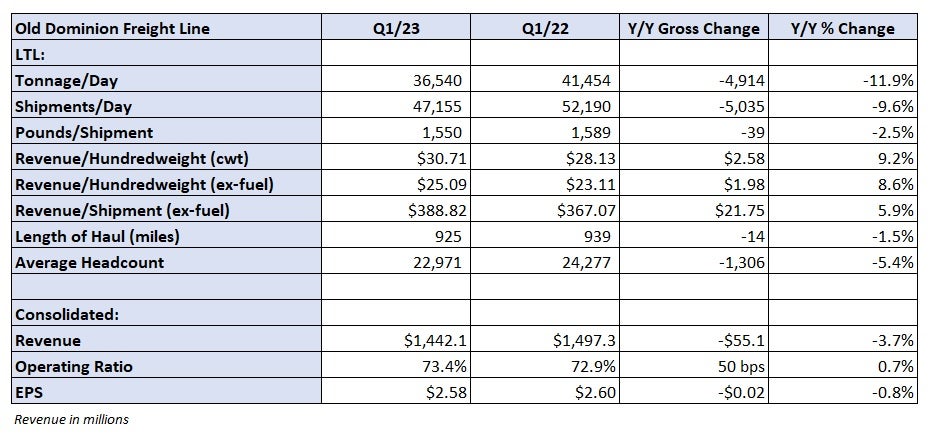

Old Dominion (NASDAQ: ODFL) reported first-quarter earnings per share of $2.58 before the market opened Wednesday, which was 12 cents light of the consensus estimate and 2 cents lower year over year (y/y). Consolidated revenue was down 4% y/y to $1.44 billion, but most of the decline was offset by a 3% reduction in operating costs.

Tonnage has flatlined

Tonnage per day declined 12% y/y as shipments dropped 10% and weight per shipment was off 2.5%. Daily tonnage was down more than 4% from the fourth to the first quarter, when the change historically has been just a 0.5% decline.

So far in April, tonnage is down 15% y/y.

“As we look forward to the remaining quarters of this year, we currently anticipate the softer demand environment will continue,” said Chief Operating Officer Marty Freeman on a call with analysts. “The second quarter is generally the period when volumes begin to accelerate but we have yet to see an inflection toward growth.”

He said revenue is increasing with customers in which Old Dominion directly engages, or “direct accounts.” However, transactional revenue managed by 3PLs has waned as the macroeconomic environment has cooled. He noted contractual 3PL business remains steady.

Shipments per day in April are usually 0.5% higher than in March but this year shipments are down 2.5% so far during the month. May normally sees a 2.5% to 3% sequential increase, with June shipments stepping another 2% higher. Whether that happens is unclear at this point, management said, noting its average volumes in the month of April are usually indicative of what the rest of the year holds.

April is Old Dominion’s last notable positive comparison (up 6% y/y in April 2022). The y/y comps flatten in May and turn negative in July, with the declines accelerating through the end of the year.

Shares of Old Dominion were off 9% at 1:25 p.m. Wednesday compared to the S&P 500, which was flat.

Competitors Yellow Corp. (NASDAQ: YELL), Saia (NASDAQ: SAIA) and ArcBest (NASDAQ: ARCB) were down 14.4%, 10.6% and 6.3%, respectively.

XPO (NYSE: XPO) was down just 1.4% after surging 25% since announcing it brought on another Old Dominion veteran to help it push through efficiency initiatives.

What investors may have found most troubling was Freeman’s comments that some of its customers are making shipment decisions based on pricing and have moved freight to lower-priced carriers.

“There is some challenging pricing out there as there always is during low freight levels,” Freeman said. However, he noted that most of the rate pressure is from smaller shippers not under contract.

Revenue per hundredweight, or yield, was up 9% y/y with and without fuel surcharges in the quarter. Management said yields continue to tick higher sequentially, which implies yield (excluding fuel) will be up in the high-single-digit range y/y in the second quarter. It’s up 7% y/y so far in April.

“In some cases, due to the economy and due to internal pressures, there are some shippers that have to look for cheaper-priced carriers,” said CFO Adam Satterfield. “Oftentimes we’ll hear feedback from shippers that are making that short-term decision that they’re doing it to meet internal thresholds and intend to give the volume back to us.”

Average revenue per day is down 15% y/y so far in April but that number includes lower diesel fuel surcharges as prices are down approximately 20% in the month, management said.

Satterfield said if volumes don’t begin to increase, revenue could be flat sequentially in the second quarter, when there would normally be a 10% increase.

Cost control mitigates top-line headwinds

Old Dominion was largely able to reduce costs and offset the revenue decline, posting a 73.4% operating ratio, 50 basis points worse y/y. Growth in costs per shipment outpaced growth in revenue per shipment by 90 bps.

Average full-time headcount was down 5% y/y to just under 23,000. Salaries, wages and benefits were down 20 bps as a percentage of revenue.

Most other expense lines were up modestly as a percentage of revenue, with operating supplies (mostly fuel) up 60 bps and depreciation and amortization up 80 bps as the company took delivery of equipment at an accelerated pace. Purchased transportation expense was down 140 bps.

Management previously guided to sequential OR deterioration of 200 bps from the fourth to the first quarter. The normal sequential change in most years is 100 bps but the fourth quarter of 2022 benefited from a favorable insurance adjustment, which produced a 70-bp headwind in the first quarter.

The OR result was 20 bps worse than expected.

Without a volume inflection, Satterfield said it is likely the OR would remain steady sequentially in the second quarter versus historical improvement of 200 bps each year.

The company lowered capital expenditures guidance by $100 million to $700 million. The new guide includes $260 million in real estate investments (a $40 million reduction), $365 million on tractors and trailers (a $35 million reduction) and $75 million for information technology projects (a $25 million reduction).

Old Dominion previously announced that Freeman will succeed Greg Gantt as president and CEO effective July 1.

More FreightWaves articles by Todd Maiden

- Teamsters add seat on Yellow’s board

- Yellow, Teamsters to hash out operational changes by reopening NMFA early

- Schneider will be strategic carrier on CPKC north-south intermodal line

Elton

Employed with Old Dominion over a decade. This slow down is no coincidence as it correlates with the introduction of a political policy change from the past administration that had future consumer confidence high compared to the policys instigated now, against affordable abundant traditional dependable energy replacing that security to the insecure future of unrealistic wind solar and deforestation for wood. The only “climate change” is made by “POLITICAL SOCIAL ENGINEERS” the likes of World economic forum ” the U.N. and other Marxist control groups using extortion and strong arm tactics against corporations with E.S.G. programming thats antithetical to providing individuals an income for the cost of living! This debacle impacted my budget plan to coordinate paying off my home mortgage in the timeliness charted to retire and depleted my 401 k savings so it won’t be there to have for retirement and I may lose my home and become homeless at age 67. Thanks but no thanks E.S.G. devotees and Biden advocates of anti capitalism and anti America. I entered the working class during Carter administration and worked 50 years only to be shot out of the saddle by another Democrat administration.