UPS Inc. today posted solid fourth quarter 2018 results, setting the table for what the shipping and logistics giant predicted will be one of its best years in recent memory.

The Atlanta-based company posted fourth quarter revenue of more than $19.8 billion, a 4.6 percent increase over the year-earlier period, a quarterly record, and the closest it has ever come to hitting the $20 billion top-line mark in a quarter. Revenue rose 5.2 percent on a currency-neutral basis, while revenue yield, defined as revenue per-piece, rose 4.1 percent, with gains reported across its three product lines, UPS said. For the year, revenue rose 7.9 percent to $71.9 billion. Revenue yield systemwide grew by 4.3 percent, UPS reported.

In the fourth quarter, UPS’ core U.S. package segment posted a 6.3 percent year-over-year revenue increase to more than $12.5 billion, while revenue per-piece rose by 4.8 percent. Next-day air revenue jumped 10 percent on a 7.8 percent increase as customers selected faster delivery options during the peak holiday shipping season. Operating profit declined to $999 million from $1.087 billion, impacted by a pension charge due to equity market weakness and the start-up costs of opening several large facilities in the quarter.

During the six-week holiday peak period, UPS delivered, on average, 31 million packages a day. It also showed the best year-over-year delivery improvement of either of its two rivals, FedEx Corp (NYSE:FDX) and the U.S. Postal Service, according to data from ShipMatrix, a consultancy.

UPS’ international package revenue rose 2.9 percent in the quarter to $3.82 billion, with operating profit up 6.3 percent. The supply chain and freight division posted revenue of $3.44 billion, up slightly from the year-earlier period. Operating profit at the unit fell $17 million to $224 million, due mostly to a $60 million profit reduction at UPS Freight, the company’s less-than-truckload unit. On November 1, 2018, UPS Freight, embroiled in a contract dispute with the Teamsters union, said it would not accept any new shipments after November 9 and would clear out its existing pipeline by that date rather than expose shippers to the chances of their freight being stuck in limbo should its 12,000 Teamsters members have gone on strike. A five-year agreement was eventually ratified.

UPS said the fourth quarter results were the clearest indication yet that its multi-year “transformation” plan, the centerpiece of which is the development of what the company refers to as “highly automated” package sortation facilities designed to boost throughput and reduce unit costs, is bearing fruit. The benefits should accelerate in 2019 when the company expects to post well-above-average gains in revenue per package, as well as across-the-board operating profits in the low- to mid-teens, UPS said. The latter event hasn’t been experienced in years, according to company executives.

UPS opened 22 automated facilities worldwide last year, and launched 14 of them in the U.S. during the fourth quarter; the new facilities led to improved throughput and better delivery metrics during the peak period, the company said. The company reported it plans to open 18 new and retrofitted facilities systemwide by the 2019 peak season.

Juan Perez, UPS’ CIO, said on the analyst call today that by the end of 2019, 80 percent of the company’s “eligible packages” – company lingo for all packages other than those moving in low-density rural areas where advanced hubs can’t be justified – will move through the automated facilities. UPS expects to be at 100 percent of eligible volumes by the end of 2021. In 2018, that figure was 70 percent.

According to UPS spokesman Steve Gaut, the advanced sortation facilities are 25 to 35 percent more efficient than the company’s traditional hubs, a figure calculated by measuring volume throughput relative to the number of employees. The new facilities will accommodate hundreds of thousands more packages per hour and at a faster speed, Gaut said. This results in faster trailer turns, reduced transit times and fewer damage claims, he said.

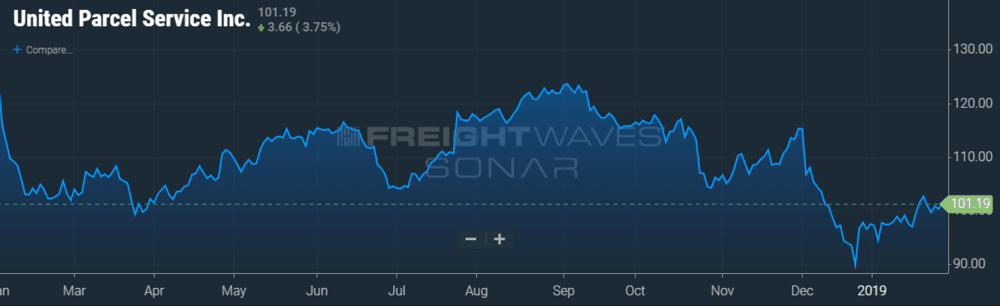

UPS shares closed up more than $4 a share in today’s trading. It had bene much higher than that during the session.