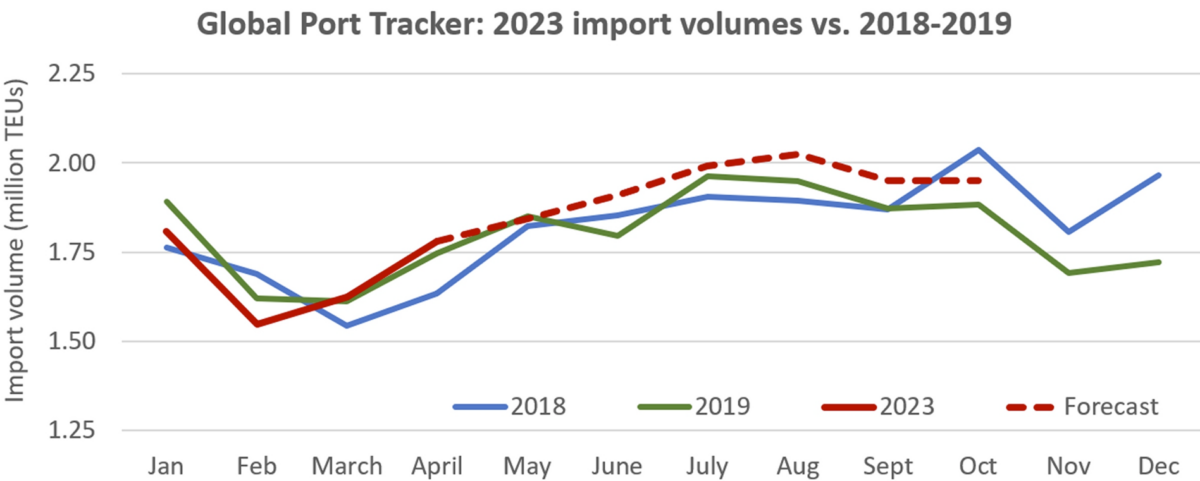

May import numbers are in and yet again, the trend is closely aligned with pre-COVID levels in 2018-2019. But there are two big differences between now and then.

Port labor disruptions are now impacting Asian cargo flows to the West Coast and low water levels in the Panama Canal are affecting Asian cargo flows to the East and Gulf coasts. If these issues persist and there is a “normal” peak season volume upswing in the months ahead, importers could face higher-than-normal complications.

May imports rise versus April

U.S. ports handled 2,097,313 twenty-foot equivalent units of imports in May, according to Descartes. That’s down 20% year on year, but 2022 numbers were heavily skewed by a one-off event — the pandemic-induced shipping boom.

May’s imports were up 3.8% from April and 0.5% from May 2019, pre-pandemic.

“As with the first four months of 2023, the growth in import volume in May continued to track 2019 volumes,” said Chris Jones, executive vice president of industry and services at Descartes Systems Group.

Imports from China were the biggest gainer in May, up 37,991 TEUs versus April, with imports from Vietnam the second-largest driver, up 20,362 TEUs.

Descartes uses customs data to generate import figures. Another data source, Global Port Tracker, published by the National Retail Federation and Hackett Associates, covers imports to 12 leading U.S. ports using official numbers released by the ports.

Final numbers are not in yet, but Global Port Tracker estimates May volumes will total 1,844,625 TEUs for the ports it covers. That’s up 3.6% month on month and tracking very close to pre-COVID levels: down 0.3% versus May 2019 and up 1.1% versus May 2018.

The NRF and Port Tracker predict this year’s peak season will follow a typical pattern and be up slightly versus the pre-COVID years. Its latest projection is for June-October volumes to be 4% higher than the same period in 2019 and 3% higher versus 2018.

More container ships headed to US

“We’ve got 52 ships on the way now from Asia to Los Angeles and Long Beach with a total capacity of 470,000 TEUs,” Port of Los Angeles Executive Director Gene Seroka said during a board meeting Wednesday.

“This is the highest number I can recall since last August, when cargo started to be purposefully moved to the East and Gulf Coast ports [due to concerns over labor disruptions]. So, we’re starting to see a little bit of an uptick, with more cargo coming.

“Our estimate is that our traditional peak season, which caters to Christmas and Hanukkah and other holiday celebrations, will probably be in September and October this year — and will not be super-long or super-elevated,” said Seroka.

He expects elevated inventory levels to keep peak season subdued, but foresees “a more traditional cadence” akin to pre-pandemic import timing.

Seroka’s comments on the rising number of inbound vessels echoed a report by Alphaliner on Tuesday. “Outbound trans-Pacific cargo movements spiked to their highest level in six months in May, giving some optimism to carriers,” it said.

Alphaliner cited statistics from the Japan Maritime Centre showing that monthly outbound trans-Pacific volumes exceeded 1.5 million TEUs for the first time since October.

Labor disruptions impacting ship schedules

Rising seasonal volumes could come head-to-head with labor disruptions on the West Coast and water-level limits at the Panama Canal.

Dockworker slowdowns are starting to affect the schedules of ships calling at West Coast ports. So far, the impact has been minimal, but that change. Ship-location data from MarineTraffic showed eight container ships waiting offshore of U.S. West Coast ports as of mid-day Thursday. By Friday morning, the situation had improved and only three ships were waiting.

“I hope the [labor contract] negotiations end soon, because it’s in nobody’s best interest to have unrest on that front as we move into peak season,” said Rolf Habben Jansen, CEO of ocean carrier Hapag-Lloyd, during a presentation Monday.

According to Jonathan Gold, vice president for supply chain at the NRF, “Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year, bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports.

“If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways,” said Gold.

Canal water restrictions to increase

The problem with taking cargo to the East Coast and Gulf Coast gateways is that Panama is experiencing its worst drought since 1950, restricting ships drafts in the canal. The Panama Canal Authority (ACP) warned Monday that water levels could continue to fall and “unfortunately, current estimates indicate that the economic impact is unavoidable.”

The maximum draft for the larger Neopanamax locks has been reduced to 44.5 feet, with expectations for a reduction to 43 feet by August. “A limited number of ships have had to lower their drafts to comply,” said the ACP.

According to Habben Jansen, the current situation in the Panama Canal is worse than in previous droughts. “At the moment, we are not diverting ships,” he said. “But the effect is that you can simply load less boxes on the same ships, which is of course not a good thing.”

Lars Jensen, CEO of consultancy Vespucci Maritime, said in an online post, “Shippers using the Asia-U.S. East Coast service through the Panama Canal might want to consider contingency plans for services routed through the Suez and/or plan for further surcharges.”

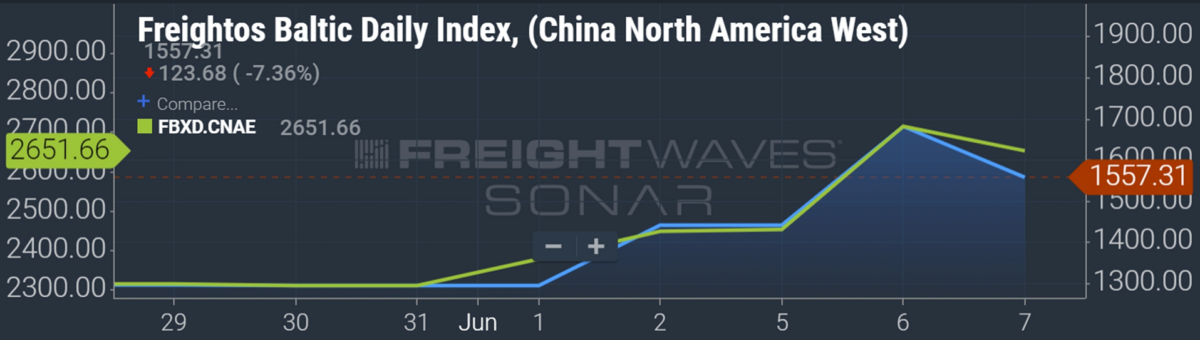

Trans-Pacific spot rates rising

Trans-Pacific spot rates could rise more than they otherwise would have if peak season volumes coincide with labor and canal disruptions.

Spot rates have recently improved. A June 1 general rate increase is one driver, but labor and canal disruptions may also be playing a role.

The Drewry World Container Index (WCI) spot assessment for Shanghai to Los Angeles rose 6% in the week ending Thursday versus the prior week, to $1,896 per forty-foot equivalent unit, the highest level since the week ending March 23 and 31% above rates at this time in 2019, pre-COVID.

The WCI Shanghai-New York index rose 5% week on week to $2,975 per FEU, the highest level for this index since the week ending Feb. 16 and 18% above pre-COVID levels. Drewry said it expects rates to continue to rise over the next few weeks.

The Freightos Baltic Daily Index (FBX) China-West Coast spot assessment was $1,557 per FEU on Thursday, up 20% over the past week.

The FBX China-East Coast index was at $2,652 per FEU, up 15% week on week.

Click for more articles by Greg Miller

Related articles:

- West Coast dockworkers making $200K demand higher pay

- West Coast container ports hit as labor talks take ominous turn

- Trans-Pacific spot container shipping rates are inching up

- Container shipping under pressure as peak season hopes dim

- Shipping boom hangover: When measuring markets gets tricky

- US imports up again in April as market mirrors pre-COVID ‘normal’

- Port of LA boss: Good Friday work stoppage was ‘a call to action’

- LA-LB outlook darkens as labor unrest briefly shutters ports

- West Coast wipeout: Los Angeles, Long Beach imports still sinking

Alex D.

There is no “normal” when everyone is broke has no money and in debt. Normal customer spending is required to drive the goods (buying) industry. Truckers as well as caro ships alike will and are suffering at a low level of consumers buying because they are tapped out of money. Freight waves seems to be telling the obvious things nowadays