Deciphering today’s container-shipping market is like trying to solve a puzzle when the pieces are rescrambled after every move.

To better understand what has already happened, what’s going on right now and what could be just around the corner, FreightWaves interviewed Nerijus Poskus, vice president and global head of ocean freight at Flexport, a San Francisco-based digital freight forwarder and customs broker. The following is an edited version of a lengthy conversation on Monday:

The past

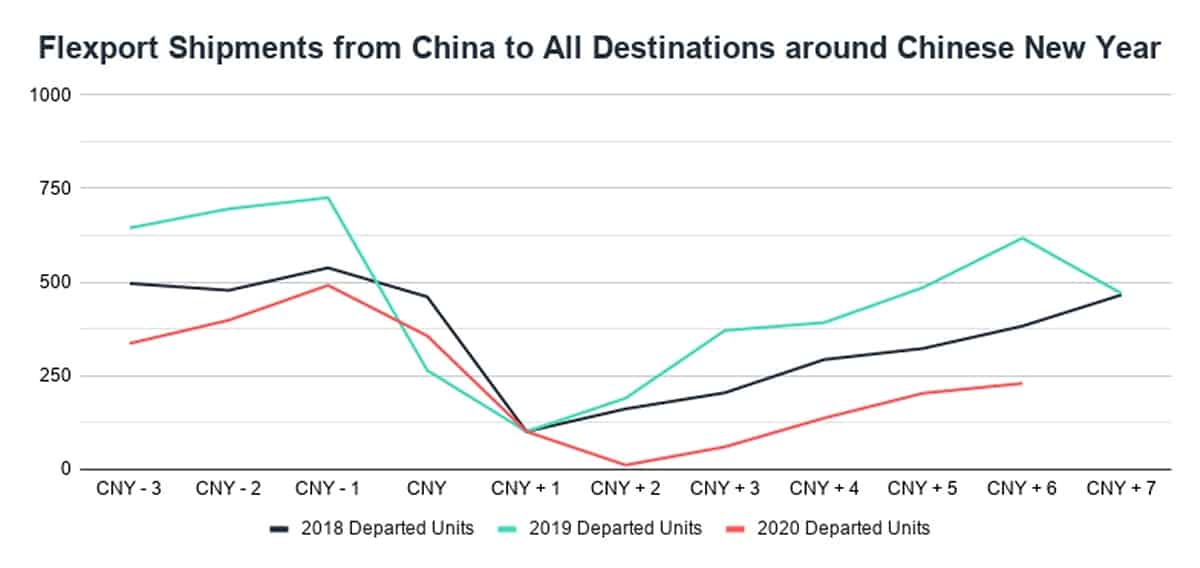

FreightWaves: Let’s go back to the period right after Chinese New Year, when Chinese factories and that country’s whole export system shut down. What were you seeing in the market at that time?

Poskus: “With most of the factories in China closed, buyers in the U.S. had no options. They simply had to wait, and the carriers had to announce a lot more blank [canceled] sailings.

“As soon as China came back to work, we saw a high level of cancellations by [Chinese] suppliers. They had taken more orders than they could actually produce. There would be a buyer in the U.S. that had placed a booking for 10 containers and the shipper would accept it and three days before sailing, they would say, ‘Sorry, the goods are delayed. We only have six containers.’

“There was also quite a lot of new demand for premium ocean services. People were looking for a faster way to get containers to the U.S. With premium, there is guaranteed ‘no roll,’ so bookings don’t get canceled; there is an expedited ocean transit time; and you have priority discharge at the terminal to reduce dwell time. It can add up to a significant amount of time saved between when the container leaves Shanghai and when it gets to your D.C. [distribution center] in the U.S.”

The present

At that point, the U.S. buyers were trying to catch up after the Chinese New Year shutdown. Today, the situation has completely changed. China’s export infrastructure is back up and running, but there are now widespread business shutdowns across the U.S. and Europe due to social distancing and quarantines. What are you seeing in the market currently and how does it contrast with what you were seeing in the weeks after Chinese New Year?

“In a normal situation, you’ll see about 10% of your bookings get canceled. When coronavirus hit China, that spiked to 30-40%, because suppliers in China were canceling. What we’re seeing now on our platform is the buyers in the U.S. have started canceling — at least 25% of our bookings last week. That is completely different than anything we’ve ever seen before. And as a result, a few of the shipping lines I’ve spoken to are already planning for more blank sailings.

“The reason for the cancellations is that some of the DCs are closing down and the buyers are not sure they’ll be open in a week or two, so they’re proactively reducing orders. Cancellations for furniture companies are especially high — we’re seeing cancellations from these companies of 50% or more.

“In general, what I’m seeing is that the nonessential businesses and stores that are closing are the companies that are canceling orders, but at the same time, orders are actually going up for the stores that remain open. Demand for certain things is extremely hot.”

I would assume that credit issues are becoming more important with all of these business shutdowns.

“Flexport has a financing product called Flexport Capital and we’re seeing more requests than usual. With my own clients I have spoken to in the last week, I am hearing more questions about whether it is possible to extend credit terms. I have not had that happen before, which tells me they have some cash-flow issues.”

What about the situation with container equipment? There have been reports in recent weeks about the world’s boxes being scattered to the wrong places and out of position as a result of market disruptions. The reports seem somewhat contradictory, with some saying there are too many boxes in some destinations and others saying there are too few.

“I believe all of the stories you’ve heard are true even though they may sound contradictory. In the U.S., two weeks ago, you had a surplus of equipment in Los Angeles and shipping lines were bringing in extra loaders [additional sailings] to bring empty equipment back to China. At the same time, Chicago didn’t have enough equipment and it’s very expensive to reposition equipment, for example, from Kansas City to Chicago. You have to dray it and it can cost $1,000 [per box].

“The same thing is happening in Europe. Some ports in Germany have equipment while equipment in the hinterland is very limited. In general, one port in a country may have too much equipment and another port in the same country may have no equipment. I know this is true because I’m facing this situation on a daily basis.

“It’s more difficult for shipping lines at this time than ever before to control equipment flows and have equipment where it’s needed because of all the blank sailings and because the trade flows are significantly different than they were before.

“Before, everything was more or less consistent. Shipping lines knew roughly how many containers they needed on a weekly and monthly basis in any single location. So, for example, for a location like Memphis, once they had enough bookings [to move the necessary equipment there], they would start raising prices on the spot market to reduce equipment flows. But because of all that’s happening, I think they’ve given up on that. They’ve lost their grip on where the equipment is flowing and it’s going to take months to clean all this up.”

Another issue is the annual contracting season for shippers and carriers. There is a lot of speculation that given the extreme uncertainty, this process will happen later this year. What are you seeing at Flexport?

“About half of our clients are on contract. It’s too early to say that the contracting season is going to be postponed. We are not seeing people push [the process] out till May or June. Instead, we are seeing people postponing by one or two weeks at a time.

“Let’s say we submitted our bid for Client X at the beginning of March and they said they’ll tell us where they stand in mid-March. They are pushing it back to April 1 and saying we’ll see what happens then.

“It’s not as if no one is signing [contracts]. Some companies have started signing, but it’s less than in a typical year. With Flexport, it’s significantly less than usual. The number is in the single digits and usually half of the clients should be signed by now. It worries me, and I think, everybody, that it’s taking longer, but I understand why. People clearly don’t want to sign for an unknown.”

Yet another concern involves potential delays or roadblocks for ocean shipping itself due to coronavirus. There are fears regarding 14-day waiting periods before ship calls can be made at certain ports, as well as the risk of port closures if terminal workers become infected.

“I’ve heard the same rumors about the 14-day periods. If it happens, it’s going to be more of a headache for shipping lines than for us, although it would affect transit times for our clients. Let’s say there’s a restriction into Shanghai and there’s a [service] string that goes Korea-Shanghai-Los Angeles. All of a sudden, the ship could not go to Korea before it goes to China, so maybe it would instead have to go Korea-Los Angeles-Shanghai. The shipping lines may need to change their network designs.

“Regarding port closures, we have seen companies shipping through a single port start to ask us if some of their cargo [destinations] could be diversified [to multiple ports] after Houston shut down [it closed for one day, last Thursday]. I would not recommend that, because I just don’t believe the ports can be closed for an extended period — we would run out of food.”

The future

Let’s talk about how coronavirus will change the market going forward. First, what about future cargo sourcing? Do you think what happened after Chinese New Year will lead to a permanent change as buyers insist upon being less beholden to a single country source?

“Yes, people got scared when China shut down. They realized that single-sourcing is a risk. And it’s not just coronavirus, it was the tariffs before that. People have realized it’s too risky to have all their eggs in one basket in any one country. There will be more multiple-sourcing outside of China, including in Southeast Asia and in India.”

What about the huge disruptions to air cargo? Do you think a portion of that volume will switch to ocean transport on a permanent basis?

“I do. The premium ocean products are now running at almost full capacity. Some of that is shippers shifting their [nonpremium] ocean cargo to premium ocean simply because of tight deadlines. But we’ve also seen quite a few companies shifting from air to premium ocean. One reason is price. Last week, it cost a half-million dollars to charter a plane from Hong Kong to the U.S. This week it’s one million and the price may go higher. Another reason is that there is no air capacity. If you want to charter a plane, the wait is two to three weeks, so it’ll take you longer than getting your cargo on a premium ocean ship.

“I am actually of the opinion that once some people shift from air to premium ocean, it may prove difficult to shift back, not because the air capacity won’t eventually be there again, but because the supply chains will become accustomed to premium ocean. If you’re doing air, it’s either because the cargo is very high value or you have huge demand. The high-value cargoes will stay with air but [for high-demand cargoes] premium ocean services are reliable and you can do weekly departures to get your goods every seven days or multiple services to get your goods in even fewer days. So, I actually think that in the long term, premium ocean services will be winning significant share from air.”

What other longer-term changes do you predict after the dust finally settles?

“I think we’ll see increased pricing volatility. If everything is running consistently and supply and demand is more or less balanced, the spot market is stable. But it’s going to be very difficult for carriers to control supply. There will be a lot of changes to carrier services and whenever you change services, you initially have too much capacity or too little capacity, and you see spot markets go up and down significantly. I really believe the volatility index is going to be higher every single year.

“And just as I think there will be more focus on premium ocean services, I believe customers in general will have higher expectations. They will want more accountability from forwarders and shipping lines in terms of performance. I’m not talking about how long it takes for ships to sail between Shanghai and Los Angeles — you can’t control the weather. I’m talking about controlling what you can control at the terminals, about where the cargo is stacked on the ship, and which cargo is discharged first.

“On-time performance is going to be a lot more important than it is today, which is going to change the role of forwarders. It won’t be as simple as: get large and have enough scale to be competitive on rates. It will be much more about controlling the data and the bookings and managing on-time performance. That’s what I think is going to happen.” Click for more FreightWaves/American Shipper articles by Greg Miller