On the surface, a national chassis pool might appear to be a panacea for American shippers and their truckers, who continue to struggle with managing this crucial equipment for their intermodal container moves. But this type of pool would quickly prove disastrous, according to one industry representative who opposes the concept.

“We believe shippers and especially truckers are being led astray,” said Ryan Houfek, chief commercial officer of DCLI. “This one-size-fits-all approach of a single gray pool would have only marginal efficiency benefits while dramatically undermining the incentive to invest and improve the chassis.”

Ocean container carriers once controlled the chassis business in the U.S. market. In recent years, however, most of these operators divested ownership of these assets to third-party service providers.

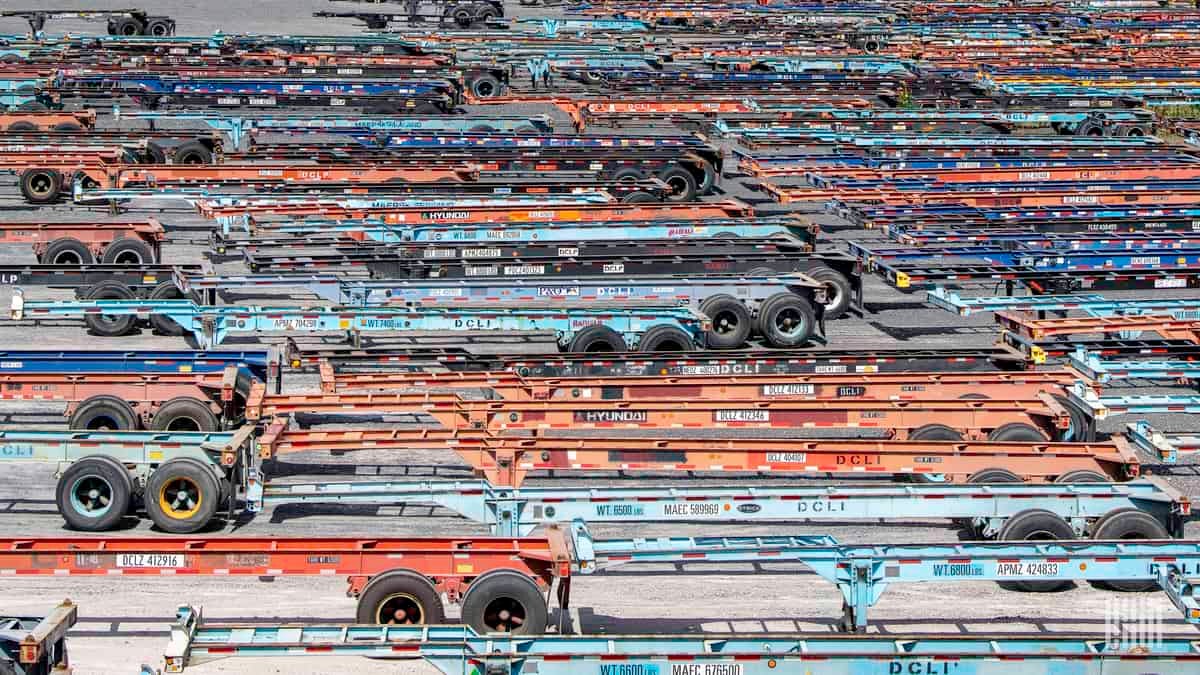

DCLI (Direct ChassisLink), formerly Maersk Equipment Service Co., was rebranded by the Danish carrier in 2009 and then spun off to new ownership in 2012. The company, based in Charlotte, North Carolina, started out renting chassis to truckers and has since expanded its offerings.

In fact, most container chassis are now owned by three leasing companies. In addition to DCLI, they include TRAC Intermodal and Flexi-Van Leasing. There is also the North American Chassis Pool Cooperative (NACPC), which was formed by a group of 12 motor carriers.

DCLI is one of the largest chassis pool operators, with more than 450 locations on or near major port facilities and intermodal hubs, and manages a fleet of more than 212,000 marine and domestic chassis.

Yet, many shippers and truckers argue that the chassis industry is fragmented and lacks interoperability, making their jobs of securing chassis a costly logistics frustration.

Calls for a national chassis pool have been amplified in Washington in recent years, with some U.S. lawmakers and the Federal Maritime Commission entering the debate.

Houfek joined DCLI in 2016, after spending nine years in senior management positions with CSX Transportation’s intermodal division. He has worked as director of procurement for ocean carrier CMA CGM and before that helped Norfolk Southern develop its equipment management program to transport containers by rail.

He has been an outspoken proponent of allowing the current chassis business to continue its evolution without government interference.

American Shipper recently caught up online with Houfek to discuss why he sees the formation of a national chassis pool as a disaster for shippers and truckers.

Interoperable chassis fleet

American Shipper: Much has been said about anticipated benefits of neutral gray chassis pools by American shippers and truckers. In your view, what has gone missing in this discussion? Are shippers and truckers being led astray in the debate?

Houfek: “Advocates of a single gray pool envision a market with complete interoperability and assume the current environment offers no interoperability. In reality, proprietary pools like DCLI’s offer significant interoperability already because of their scale.

“In most markets, DCLI serves five of the largest ocean carriers in the world with a broad network of convenient pickup and drop-off locations. In fact, truckers tell us that they can plan their drivers’ days without being harmed or impeded by multiple pool sources.

“Multiple pools create choice, choice leads to competition, and competition promotes continuous improvement.

“Proprietary pools like DCLI’s are rapidly upgrading chassis from bias ply to radial tires, from incandescent to LED lights, investing in full chassis refurbishments, adding brand new chassis to their fleets, and investing in technology to more seamlessly integrate ourselves into the broader supply chain and enhance the user experience. So, many benefits that are being touted by the proponents of a single gray pool solution are, in reality, being delivered by the IEP [intermodal equipment provider]-managed proprietary pools.

“There is no one-size-fits-all solution. Each market of the country operates differently. And even within a given market, there tends to be a combination of solutions that works best.

“Take a market like Houston, for example, where you have several proprietary pools competing for business in a growing market. Our research indicates motor carriers value equipment reliability most of all, so last year we made the public commitment to convert 100% of our proprietary pool fleet in the market to radial tires. Our competitors, in turn, are also investing in their fleets.

“And, of course, a significant percentage of the motor carrier community — perhaps up to half — owns or long-term leases its own chassis instead of using the pools.

“To force all those participants into a single gray pool would undermine the incentive to invest while inflating the purported efficiency gains.”

U.S. chassis fleet nationalization

American Shipper: Is DCLI concerned that a neutral gray chassis pool could become a reality in the years ahead? What will drive this movement? What would this mean to your company’s chassis investments, as well as the industry at large, if these pools emerge?

Houfek: “We are certainly tracking the discussions closely. A single gray pool solution would be the de facto nationalization of the U.S. chassis fleet, which we believe is unlikely and counterproductive for many reasons.

“We estimate there are 10 companies that operate chassis pools in the U.S., which, combined, support roughly one-half to two-thirds of the market’s chassis needs. The balance is served by truckers who own or long-term lease their own equipment — some 100,000 chassis or more — which is the model used everywhere else in the world. Are we going to have all these players contribute their assets into a single gray pool?

“We believe the primary driver behind this movement is the economic self-interest of a relatively small group of players who believe they should be able to dictate economics to chassis providers without themselves taking any risk or making any investment in the fleet or infrastructure required to run a chassis pool. They claim this solution is required to address a lack of choice in the marketplace, even though there is more choice today than ever before and a single gray pool solution, by definition, removes all choice.

“Chassis providers like DCLI have invested billions of dollars in their fleets with the intention of earning a profit on that investment. We are motivated by the forces of competition to service our customers, or risk losing them.

“To remain competitive, we must continually enhance the customer experience. We must invest in technology. We must control costs. We must improve the quality of our assets. We must be better than the alternative chassis option. These are the forces of competition at work.

“A single gray pool promotes a monopoly environment and would undermine these market forces and the incentive to invest. No other asset-based service provider would allow their core assets to be part of a pool where they lose substantially all ability to directly influence their customers’ experiences or otherwise differentiate themselves on service/quality dimensions.”

Where chassis pools make sense

American Shipper: Do you foresee instances where pooling chassis could be beneficial to all stakeholders? How would these operations need to be structured to deliver positive results for everyone?

Houfek: “Pooling can certainly make sense for certain markets when incentives are properly aligned. This was the case for the ‘Pool of Pools’ (PoP), which was created when the terminal operators, ocean carriers, ports and truckers in the Los Angeles/Long Beach market approached the chassis providers for a solution to help address the massive, highly complex operation with myriad permutations of pickup and drop-off across 15 marine terminals and rail ramps.

“The sheer size of the operation combined with carrier vessel alliances that constantly affect where a container is to be picked up and returned all contribute to the extreme complexity. In this particular market, the three contributing IEPs have delivered great benefits for the PoP’s stakeholders including increased operational efficiency within the port complex, reduced terminal congestion, improved equipment repositioning to match demand, and decreased pollution due to reduced engine emissions.

“However, even this model has created some unforeseen negative consequences. As the FMC has recently highlighted, container ‘dislocations’ in LA/Long Beach caused by one-way container flows (import boxes arriving at one terminal, and those empty or export boxes coming back to a different terminal) can be a drag on cargo and trucker efficiency, because dual (drop one, pick up another) transaction opportunities go down.

“Interestingly, in the time since we formed the Pool of Pools in 2015, multiple private pools have popped up to serve unique situations within the LA/Long Beach market. These private pools are not interoperable with PoP chassis.

“Combined with an ever-increasing number of trucker owned or leased chassis, we estimate that one-third of all container moves in LA/LB now use a non-PoP chassis. We believe this goes to show that the market will find a way to satisfy the unique requirements of stakeholders without any mandated solution and that a single gray pool is not the answer.”

Way to improvement

American Shipper: In your view, are the current operational challenges involving chassis in the U.S. market solvable in the next two to three years? What difficult decisions for the industry lie ahead? What is your vision for an optimal U.S. chassis service model?

Houfek: “This question could be asked of every service provider in the supply chain; we all have room to improve. Regional chassis markets are different and, therefore, each market has its own operational challenges.

“DCLI believes that the first step in addressing these operational challenges involving chassis, as it is with any issue, is to accurately define and quantify the extent of the problem and insist that everyone engaging in that analysis be forthright and honest about their motivations for doing so. Once the root cause(s) have been identified, incremental improvements can be made by addressing the cause amongst the interested stakeholders, and the impact of those improvements can be measured.

“As for the challenges that DCLI is working to address, we need to develop better forecasting to make sure we have chassis in the right place at the right time and minimize surprises. We need to convert 100% of our fleet to radial tires. We need to deliver better technology solutions to make doing business with us easier and better. This is our vision: our proprietary pool, the DCLP, delivering dependable service to motor carriers and the customers they serve. And, for truckers that want to balance their use of pools with running their own fleets, to be a competitive provider of leasing services as well.”

Bumpy road with COVID-19

American Shipper: How would you describe the current economic and operating condition of the U.S. chassis business? Are conditions better or worse since the start of the coronavirus pandemic? Where are the service chokepoints?

Houfek: “Like many businesses in our industry, we saw our volumes drop precipitously at the start of the pandemic. So much so that terminals and ramp operators ran into storage issues and had us remove bare chassis from their facilities.

“We have since seen some encouraging signs that volumes are returning and, in fact, have recently experienced some spot chassis shortages at certain terminals. On the surface, this is puzzling because the fleet size overall in the U.S. is the same, if not larger, than a year ago and while container volumes are increasing, they are still lower than a year ago. This inconsistency indicates something unusual is happening within the supply chain.

“Anytime there is a ‘black swan’ event like a natural disaster, a trade war, and, now, a pandemic, we tend to see sudden volatility which can stress the supply chain. For instance, we are hearing that warehouses are full, perhaps because the pandemic has reduced the number of workers available to unload containers and return empties (along with the chassis) to the terminal or rail ramp.

“We are also hearing that shippers are struggling to find truck power and appointments to return empty containers (and chassis) to the terminals. And, we are seeing tens of thousands of loaded containers sitting on chassis at the terminals waiting to be picked up by truckers for delivery. Factors like these can result in fewer bare chassis even as total import volume is down.

“At the same time, we are seeing markets where rail ramps are overrun with bare chassis due to a surge in exports without a corresponding import to balance the chassis flow. In these cases, the ramp operators are having us remove excess chassis as quickly as possible.

“In other words, we are living through unprecedented times and managing accordingly. We can react quickly because in most of our markets we are in the driver’s seat, so to speak, with no third-party manager between us and our chassis.

“To that end, we are working overtime to repair chassis faster, repositioning assets around the country from surplus to deficit locations, and working closely with ports, terminals and customers to find ways to free up chassis stranded under empty containers.”

Related news

Q&A: US container chassis industry still finding itself

Drayage truckers, ocean carriers discuss chassis lease rate disparity

American shippers, draymen want ocean carriers out of chassis pool

Click for more FreightWaves/American Shipper articles by Chris Gillis.