The number of railcars sitting idle is climbing to multi-month highs, reflecting the downturn in freight and transportation demand. Nowhere is that more evident than in dry bulk commodities, with some markets likely facing structural shifts into permanently lower demand.

Some 56,425 railcars have been put into storage since January 2019. This brings the total railcars in storage close to 350,000, “which is definitely on the high side,” said Martin Lew, Chief Executive Officer of online railcar storage, leasing and purchasing marketplace Commtrex.

Echoing that view, data from the Association of American Railroads (AAR) shows that about 22 percent of the North American railcar fleet is in storage, the highest level since May 2018.

“We’re trending towards having over 400,00 cars in storage which are levels we haven’t seen since 2016 when storage levels peaked around 425,000,” Lew said.

Part of the rise in railcar storage stems from the implementation of policies related to Precision Scheduled Railroading (PSR). “Those policies,” Lew said, “are forcing shippers to turn over railcars more quickly and not let them sit idle on tracks owned by the Class I railroads. Otherwise, shippers face increasing demurrage fees.”

Lew added, “The flexible storage policies at Class I railroads are changing due to the PSR model. So they are hiking up the penalties to push more cars into private storage.”

Those changes are coinciding with a downward trend in rail freight demand. Ten of the 11 rail freight groups that AAR tracks are showing volume declines.

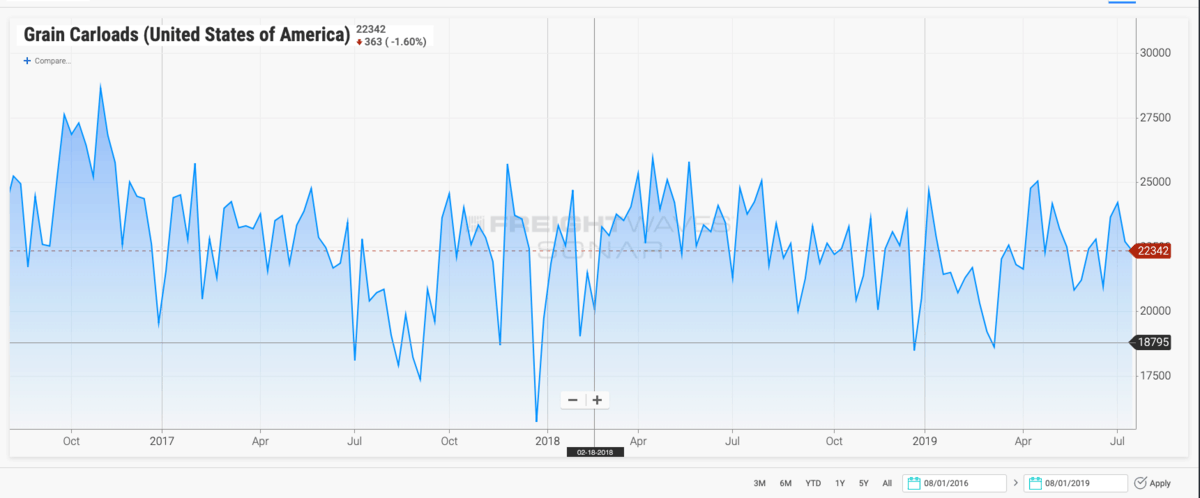

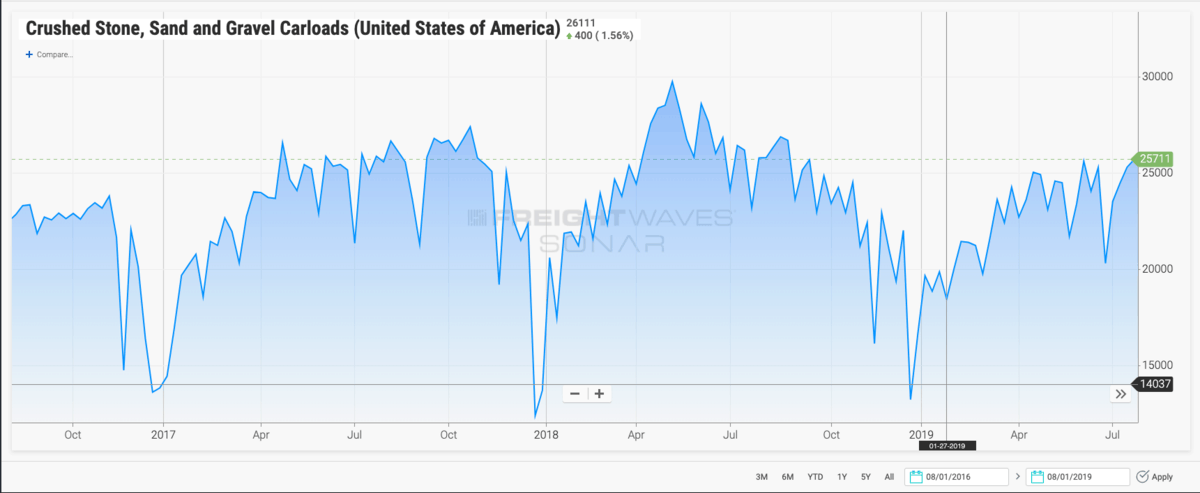

Dry bulk commodities, particularly grain and sand used for hydraulic fracturing of oil wells, are seeing big downturns.

AAR data shows that the roughly 21,000 carloads of grain, originating the week ending August 10, was the lowest for the period since 2017. Grain markets are reeling under the decline in exports to China along with severe flooding that delayed Midwest planting.

As for frac sand, Canadian National Railway reported a 2 percent decline in second quarter 2019 revenue for its metals and minerals business due to lower sand volumes. Chief Executive Jean-Jacques Ruest told analysts that frac sand demand did not turn out “near to what our customers indicated that the market would require.”

Small covered hoppers are the most common railcar for carrying those commodities and the most common heading into storage. Lew said about 8,800 covered hoppers went into storage in July, up 8.2 percent since June. And the cost of storing a covered hopper has naturally gone up with demand. Lew said based on the Commtrex Railcar Storage Price Index, spot switch charges in the Midwest are currently $150 to store a car, up from $115 in the first quarter of 2019 and daily fees are currently $2.54.

“This year from May to July, we’ve seen an increase in storage for covered hoppers,” Lew said. “We’ve had a lot of members actively searching for railcar storage in our marketplace, which could be an additional data point that indicates there are too many small covered hoppers in the fleet. Due to the downturn in the sand industry it feels as though there was an overbuild of C-112s in the railcar fleet.”

Lew said the build-up in covered hoppers going to storage is partially seasonal. Shippers will not need the cars until the end of the harvest season and the start of the September-November grain shipping season. But given the number of negative factors in the grain market, it is unclear how many of those stored cars will be put back into service.

“There’s an oversupply of corn, it’s been a super wet planting season and farmers are behind schedule,” Lew said.

Frac sand, though, is undergoing a structural market change as shale drillers begin to source sand directly from mines closer to west Texas oil basins. That sourcing shift is limiting the need to transport frac sand from upper Midwest mines.

“Part of the shift was due to the cost savings realized with sourcing brown sand within a shorter distance of the fracking site,” Lew said. “The premium Wisconsin white sand needs to travel a longer distance, thus shale drillers optimized around a cheaper brown sand that can be shipped by truck versus a longer haul rail move.”

Just over half of the covered hoppers in service are owned by lessors, including The Greenbrier Companies and Trinity Industries. On the last earnings conference call, Greenbrier executives said that they are working with at least one customer to defer delivery of grain and sand cars.

Given the low utilization and high numbers going into storage, Lew said it is possible that lessors may find other uses for these cars. “Railcar lessees and owners have been exploring different ways to retrofit these cars for other services,” Lew said. “If they can’t, we will probably continue to see weak demand for these cars.”