A ship full of Porsches, Bentleys and Lamborghinis catches fire and sinks in the Atlantic. A container vessel ignites and goes down off Sri Lanka. In a sequel to the Even Given accident in the Suez Canal, another Evergreen ship runs aground, this time in Chesapeake Bay. More containers full of goods topple off ships and vanish into the Pacific. Ships stuck in the queue off Southern California drag anchor in a storm and allegedly damage an oil pipeline.

It’s dangerous out there on the high seas.

The safety alarm bells began ringing two years ago, after the onset of COVID. The pandemic trapped hundreds of thousands of beleaguered seafarers aboard ships for months beyond their contracts. Then came the supply chain crisis, causing container ship volumes to spike and keeping even the oldest vessels in service. Then war broke out, affecting even more seafarers.

Allianz, one of the world’s largest insurance companies, published its annual review of shipping casualties this month. To put shipping’s 2021 track record in context, American Shipper spoke with Capt. Rahul Khanna, Allianz’s global head of marine risk consulting.

The good news is that despite headline-grabbing fires, sinkings, groundings, collisions and explosions, the casualty numbers have not skyrocketed. Every accident is one too many, but shipping’s multi-decade trend toward improved safety remains intact.

The bad news is that risks remain elevated and bigger ship sizes are leading to ballooning monetary claims.

Total ship losses down, total accidents up

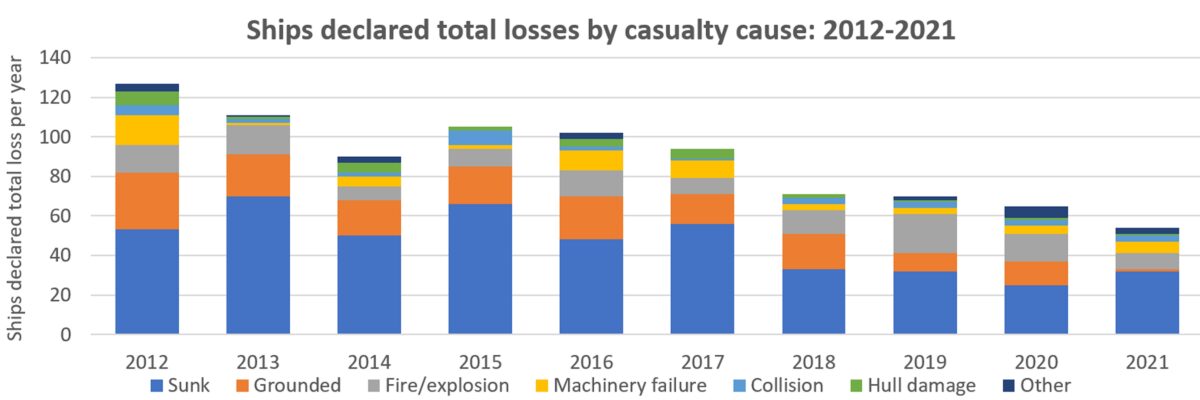

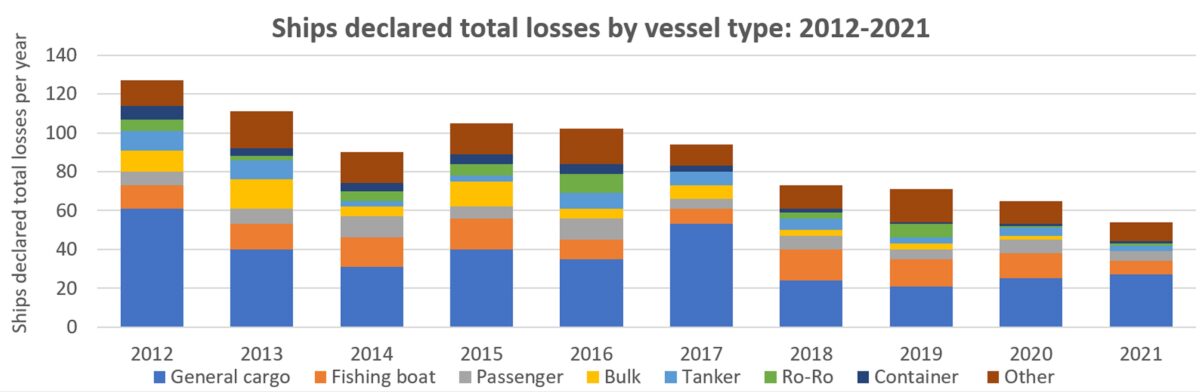

Fifty-four ships were declared total losses in 2021. That’s down 17% from the year before, according to Allianz, citing casualty data from Lloyd’s List Intelligence. The top three causes were sinking (59%), fire (15%) and machinery failure (11%).

These numbers are a huge improvement versus the days of the Exxon Valdez spill in Alaska. Three decades ago, there were around 40% fewer commercial vessels on the water, yet four times as many ships lost per year.

According to Khanna, “The trend [toward fewer total losses] continues, which is great, but when it comes to the quantum of these losses, there’s an absolutely very clear trend. The big casualties are shaking the market. The trend of increased cost of claims and complicated big claims, unfortunately, continues.”

There were 3,000 maritime accidents altogether in 2021, up 10% from the year before. Machine failure was the largest cause, responsible for 44% of incidents. Khanna maintained that the increased number of accidents does not yet signal a clear trend; it could be a year-to-year fluctuation or the result of lockdown-induced shipping reductions in 2020.

Asked about the new risks to shipping safety, he said, “Does the combination of factors — the aftermath of COVID, the Ukraine-Russia war and the global supply chain crisis — have the potential to reverse the [positive safety trend]? Yes, it does have that potential. It could happen.

“But I think that if we start to see a trend in that direction, one that would derail the excellent safety progress we’ve made in the last decades, the industry will work together to resolve it. I don’t see it ever going back to 200 total losses a year. But this is a situation that needs to be watched.”

More containers, more accident risk

“The global supply chain crisis is a big one,” said Khanna of recent safety risks.

The race to import more cargo has filled container ships to the max. The more boxes onboard, the higher the risk that one could contain undeclared hazardous materials, a leading source of shipboard fires.

Mediterranean Shipping Company (MSC) hiked its penalty fee on misdeclared and undeclared hazardous goods to $15,000 per container on May 18 “in light of various near-miss incidents faced by MSC in the past months, all of which could have led to dramatic consequences for our crew, our ships and the environment.”

Meanwhile, more container ships plying heavy seas with decks stacked to the limit with boxes coincide with more containers falling overboard. Such accidents have enormous financial and legal consequences due to the value of the lost goods.

The ONE Apus lost 1,816 containers overboard in November 2020; the value of lost cargo was estimated at over $200 million.

The Maersk Essen lost 750 boxes overboard in January 2021, the Maersk Eindhoven lost 260 the following month, with another 65 damaged. The Zim Kingston lost 109 in October 2021 (then caught on fire). Maersk’s Dyros lost 90 overboard this March, with another 100 containers damaged.

In 2017-2019, an average of 779 containers fell overboard per year worldwide, according to the World Shipping Council. Losses over recent years far exceed that average.

“There is definitely an issue here,” affirmed Khanna. He believes the rising number of container-overboard accidents could be driven by something more than increased trade volume.

“There is a lot of work going on behind the scenes trying to figure out whether this is a phenomenon related to the increased size of container vessels,” he said. Researchers are looking at parametric rolling, beam issues, forces on container lashings and the relationship to vessel size.

Ports get a lot more crowded

The COVID-era shipping boom has also brought big changes to ports and the waters offshore. Terminals are busier and anchorages are much more crowded.

Anchorages were full of tankers employed for floating storage in 2020. Anchorages were full of bulkers off China’s ports in 2021 due to pandemic protocols. Container ship queues in the U.S. and China have been high for the past year and a half.

“With ships waiting, it obviously becomes more dangerous for navigation. Especially if there is weather and anchors are dragging,” said Khanna. “But mariners know how to deal with this. It has some impact, but I don’t think it’s a massive impact on safety.”

He noted that ships have always anchored in large numbers off Singapore, where weather and sea conditions are relatively benign. In contrast, waters off Southern California, where ships were anchored or loitering in record numbers last year, are more prone to rough weather.

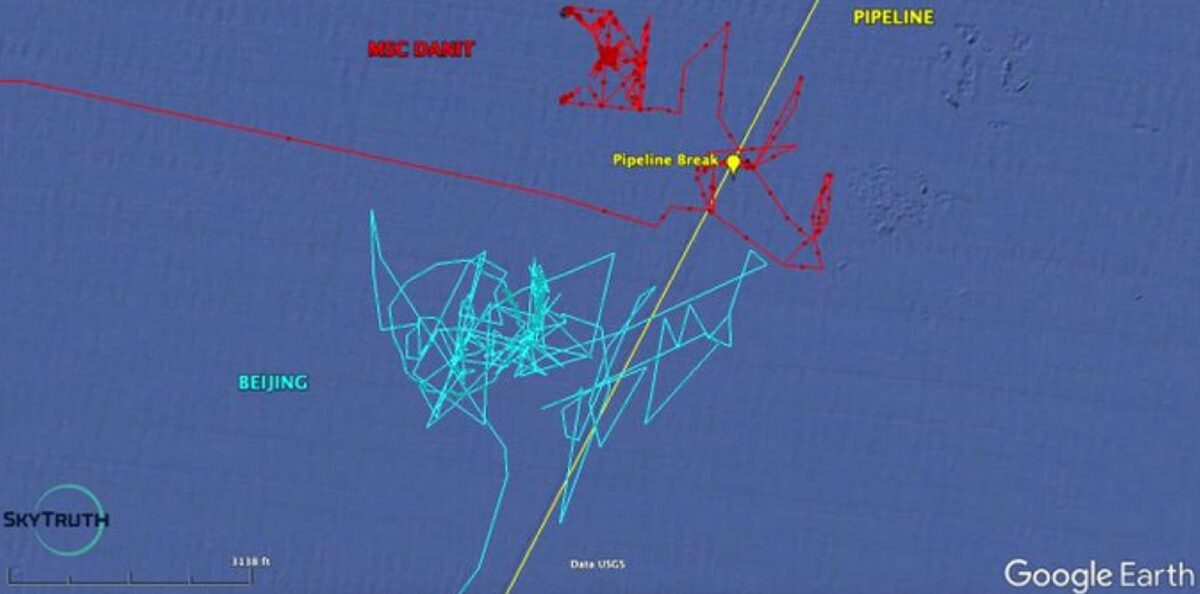

In October, an oil spill hit California’s Huntington Beach after a pipeline operated by Amplify Energy ruptured. U.S. Coast Guard investigators believe the rupture occurred months after the pipeline was struck by a ship anchor.

Ship-position data showed that two of the container ships waiting in the queue — the MSC Danit and the COSCO Beijing — dragged anchor over the area of the pipeline during a storm on Jan. 25, 2021. The Coast Guard has yet to release a final accident report but extensive details on the incident are filed in court documents.

In February, Amplify, which is itself being sued by California businesses, filed suit against MSC, the operator of the MSC Danit, and Costamare (NYSE: CMRE), the owner of the COSCO Beijing, among other shipping parties, alleging that the vessels should have left the anchorage area during the storm, as other ships did (court filing here).

Amplify also sued the Marine Exchange of Southern California, which runs the Vessel Traffic Service (VTS) in San Pedro Bay, alleging it should have told Amplify that the two ships had dragged anchors over the pipeline.

Six weeks after the Huntington spill and three and a half months before it was sued by Amplify, the Marine Exchange — together with terminal and carrier groups — implemented a new safety-oriented queuing system for container ships waiting for berths in Los Angeles/Long Beach. Since then, the vast majority of all container ships bound for Los Angeles/Long Beach wait outside the so-called Safety and Air Quality Area (SAQA), which extends 150 miles to the west of the ports and 50 miles to the north and south.

“My VTS watch standers are giddy with the safety increase we get with every ship that is not loitering in our crowded waters,” wrote Kip Louttit, executive director of the Marine Exchange, two weeks after the SAQA debuted.

Ships keep getting older

Another trend that affects ship safety — particularly given all the incidents related to machinery failure — is rising ship age.

According to the International Union of Marine Insurance (IUMI), the age of the global fleet averaged 21.75 years as of last August. It has increased every year since 2013, when the global average was around 18.5 years.

More recently, container ship age has risen because of skyrocketing container freight rates, which has rendered even 25-plus-year-old container ships exceptionally valuable. Owners are scrapping very few older container ships.

In the tanker sector, older vessels that normally would be scrapped are being used in clandestine trading of sanctioned Iranian and Venezuelan oil. In the tanker and bulker segments, ordering of newbuilds — which would lower average age — has been depressed by uncertainty over future environmental rules as well as yard slots being filled with orders for new ships in other sectors (container ships and liquefied natural gas carriers).

Commenting on the use of older ships in container shipping, Khanna explained, “This is a cyclical phenomenon that happens in the shipping industry over the years. When freight rates are very high, owners maximize the output of these vessels, which means they won’t scrap them. We saw this prior to the 2008 crash.

“Then the market turns the other way and we see a massive amount of scrappings and even 10-year-old vessels are sent to scrap.” (This explains why average age was pushed down to lows in 2012-2013 in the wake of the financial crisis.)

Khanna agreed that machinery damage incidents are related to ship age. “Yes, this is an issue. Machinery damage does jump because of increased overall age of vessels. Unfortunately, the mindset of at least part of the ship-owning industry is to maximize earnings capacity … and leave no stone unturned to get as much time laden,” which limits maintenance.

Unprecedented pressures on seafarers

But the most important factor in ship safety is the crew itself. Khanna noted that as much as 85% of shipping accident causes involve a human element. Seafarers are “at the heart of any safety discussion.”

And seafarers have been under intense pressure. At one point in 2020, 400,000 crew were unable to go home at the end of employment contracts due to COVID travel restrictions. While this situation has dramatically improved, there were still 4.5% of crew onboard beyond the expirations of their contracts as of this month.

An example of safety fallout: In July 2020, the bulk carrier Wakashio went aground and broke up off Mauritius, creating a fuel oil spill that devastated the pristine surrounding environment. The captain said he brought the ship close to shore to get cellphone network access so his crew could contact their families.

The Ukraine-Russia war has created a whole new set of complications for crew. The International Chamber of Shipping (ICS) estimates that 10.5% of the world’s crew are Russian, including 71,652 officers, and 4% are Ukrainian, including 47,058 officers.

“If even half of the Russian and Ukrainian crew is taken out of service, there’s a serious question mark on how we’re going to manage that,” said Khanna. “We’re looking at a shortage.”

Lars Barstad, CEO of tanker company Frontline (NYSE: FRO), said during a conference call Tuesday that his company employs seafarers “that are Ukrainian and Russian nationals, in some instances working together on the same ship.”

Two thousand seafarers of 27 nationalities were stuck on ships at Ukrainian ports in the Black Sea and Sea of Azov when Russia invaded, according to the ICS. As of early May, 1,500 had been evacuated and 500 were still stranded aboard 109 vessels.

According to Khanna, “The hardship the crew faced during COVID should never have happened. A lot of good quality talent has been drained from the industry and a lot of people have said they’re not coming back.” The Ukraine-Russia war is tacking on more attrition after COVID.

“Once that talent goes, it takes time to replace. And we are now looking at new vessel [designs] and new fuels, which means we need even more talented people onboard. But there’s going to be a talent shortage. That will definitely have an impact on safety.”

Click for more articles by Greg Miller

Related articles:

- Ever Forward finally moves on

- Car carrier — and Bentleys, Porsches and Lamborghinis — sinks

- Russia’s isolation deepens as shipping lines make final port calls

- Container shipping heads to court: Who’s suing whom?

- Import boom side effect: More container-ship accidents in Pacific

- Ocean container losses topple annual average in 2 months

- Ship at anchor off California ports may have caused major oil spill

- Shipping suffers wave of spills, fires, collisions and lives lost