The biggest takeaway from Schneider National’s (NYSE: SNDR) third-quarter report may have been the announcement of a $2-per-share special dividend, which at least temporarily answered the questions around how the company would deploy its sizable cash position.

The $355 million special dividend represents less than half of the $769 million in cash on the balance sheet. Even after the Nov. 19 payment, the company will have ample cash to pursue other initiatives, including acquisitions. Management’s target is to retain $250 million in available cash.

However, that announcement was mostly overlooked on the Thursday earnings call with analysts. Most of the questions centered on relative softness in fundamentals — declines in revenue per truck and lower operating income in the company’s intermodal and brokerage divisions — during a bull market for trucking.

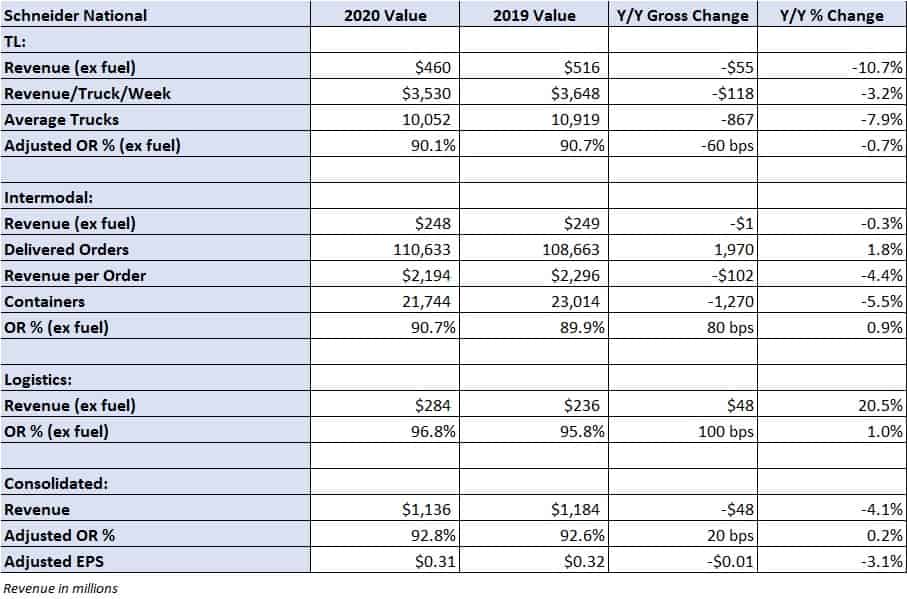

The Green Bay, Wisconsin-based truckload (TL) carrier reported adjusted third-quarter earnings per share (EPS) of 31 cents, in line with the consensus estimate but 1 cent lower than the 2019 third quarter. The result excluded a $13.1 million pretax charge for an adverse excise tax ruling on glider kits. The matter is being appealed and impacts tax years 2011 through 2013.

Several catalysts for future improvement

On the call, management said that a few more quarters of COVID conditions are likely. That means a sustained period of inventory restocking for its client base primarily composed of retail consumables and food and beverage providers. Elevated demand and tight capacity are likely to keep the current supply-demand balance in place for “multiple quarters.”

Schneider CEO and President Mark Rourke described the headwinds facing driver recruitment and retention as the “most difficult” he has seen in his more than 30 years in the industry. An aging driver demographic, the Drug & Alcohol Clearinghouse, low driver school enrollment and procedural delays at government permitting agencies are the main headwinds limiting recruitment.

Schneider has also had difficulty retaining non-family team drivers during the pandemic and has lost some owner-operator drivers, who have chosen to venture off on their own to take advantage of higher rates in the spot market.

On pricing, management expects contractual rates to increase in the near term and throughout 2021. Currently, they are moving as much capacity as possible to the spot market. The network, or one-way, TL segment has low-double-digit spot exposure currently, a metric that can be as low as mid-single digits in softer markets. Management’s conviction about the positive pricing forecast is rooted in the lack of available drivers and the fact that new truck capacity isn’t entering the market at an advanced rate like it did during 2018 when spot fundamentals surged.

Management narrowed the 2020 adjusted EPS guidance range to $1.18 to $1.22, from $1.10 to $1.25. The current consensus estimate is $1.22.

While the bullish commentary suggests improvement on the horizon, these conditions weren’t really apparent in the company’s third-quarter results.

Truckload sags on capacity issues

The TL division reported an 11% year-over-year decline in revenue excluding fuel surcharges. A lack of available capacity and the closure of the final-mile division were the reasons. Average tractor count declined 8% with revenue per truck dipping 3%. Pricing in the network segment improved throughout the quarter, up mid-single digits in September. The carrier is looking to raise rates on a couple of key out-of-cycle contract renewals in the fourth quarter but noted that the last quarter of the year isn’t traditionally a large renewal period for them.

Increased exposure to the spot market drove 60 basis points of operating ratio (OR) improvement, excluding third-quarter 2019 losses in the final-mile unit, at 90.1%.

Consolidated adjusted operating income fell 3% as expenses as a percentage of revenue increased 200 basis points in aggregate for the compensation and purchased transportation lines. The company recorded $16 million in accruals related to incentive compensation during the quarter.

Management said the margin target for TL is in the 10% to 12% range (OR of 90% to 88%), a level the company should achieve in 2021.

Intermodal struggling with congestion

Schneider’s intermodal segment reported a 2% year-over-year increase in delivered orders, which was in line with container volumes on the U.S. Class I railroads, according to the Association of American Railroads. Schneider’s rail partner in the West, BNSF Railway (Berkshire Hathaway Inc. NYSE: BRK.A) reported a 1% decline, with Eastern rail partner CSX Corp. (NASDAQ: CSX) seeing a 6% increase.

Revenue excluding fuel was flat year-over-year with network congestion on the railroads, drayage capacity constraints and delays unloading containers at customer facilities, presenting both revenue and cost headwinds. Management said they “would be comfortable” adding capacity to the drayage fleet as well as incremental containers moving forward.

The division reported 80 basis points of deterioration at a 90.7% OR, but 430 basis points better than the second quarter. Sequential margin improvement is expected in the fourth quarter as the company expects to capture rate increases in the current period and throughout 2021. The long-term margin goal of 10% to 12% for the division was reiterated.

Logistics sees modest decline

Logistics revenue increased 21% year-over-year on higher brokerage loads and revenue per load, but operating income was constrained by increased capacity costs. The 100-basis-point decline in margin to 96.8% was better than that reported by many asset-based brokerage operations in the quarter. Schneider has low contractual brokerage exposure, allowing it to more quickly pass through increases in capacity costs.

The company announced a strategic investment in Mastery Logistics Systems, a provider of cloud-based transportation management systems designed for large transportation companies, in July. The Mastery system will first be implemented in the logistics group.

Still ample cash to deploy

The company is still forecasting 2020 to close with $425 million of cash on the books. That includes the special dividend payment and a back-half weighting of equipment purchasing due to COVID-related shutdowns at the original equipment manufacturers.

Total net capital expenditures in 2020 will be approximately $250 million, but the company expects to see total investment move “quite a bit higher” in 2021. Growth capital for the dedicated operation appears to be a primary source of investment. Management wants its dedicated segment to account for 50% of TL instead of its current share of 39%. The company is also looking to improve the driver experience through tractor technology and will likely add equipment to intermodal.

Shares of SNDR were off more than 1% in midday trading compared to the S&P 500, which is up nearly 2%.