Maersk, the world’s second largest liner operator, earned more money in 2021 than in any other year in its history: $24 billion. It now predicts 2022 will be just as strong, but take that with a grain of salt. Maersk has a proven track record of being way too low in its guidance.

During a conference call with analysts on Wednesday, Maersk executives revealed new details on the carrier’s burgeoning long-term contract business, guidance for 2022 and yet another logistics acquisition: U.S.-based Pilot Freight Services.

Long-term contract share rising to 70%

Ocean carriers have traditionally split business down the middle: around half short-term spot deals, half long-term contracts. Maersk continues to separate itself from the pack, focusing on more long-term contracts of ever-longer durations.

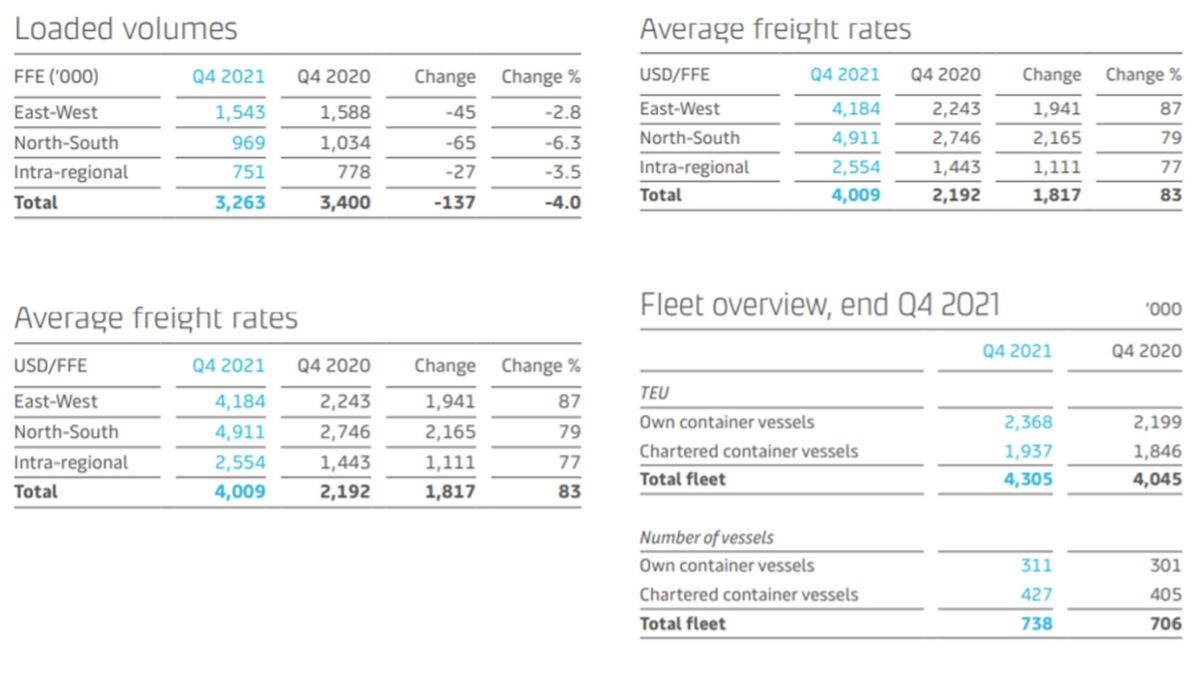

The proportion of Maersk’s long-haul volumes covered by long-term contracts jumped from 50% in 2020 to 65% in 2021. This year, the share will rise to 70%, or over 7 million forty-foot equivalent units.

On previous quarterly calls, A.P. Moller-Maersk CEO Soren Skou has referred to a rising share of multiyear contracts, for terms of up to three years. On Wednesday’s call, there was talk of contracts lasting up to a decade.

Maersk now expects 1.5 million-1.7 million FEUs of 2022 volume to be under multiyear contracts.

Vincent Clerc, CEO of Maersk’s ocean and logistics division, said that some of these multiyear contracts are at fixed rates for two years, but “the majority have durations of between three and 10 years and are adjusted based on market developments. They are mostly indexed to the CTS [Container Trade Statistics] index, so they will have a lag to the market and have a smaller adjustment compared to what you see on indexes like the SCFI [Shanghai Containerized Freight Index].”

The shift to long-term contract implies fewer slots available to freight forwarders, given that Maersk plans to keep its fleet size constant this year at 4.3 million twenty-foot equivalent units.

“As we increase the allocation we’re giving to our long-term customers, that means by default that we’re reducing the footprint we have with freight forwarders, to what in 2022 will be somewhere between 25-30% of what we’re doing,” said Clerc.

“The profitability [of freight forwarder deals] is obviously very high at the moment because they are principally the ones paying the short-term spot market rates today, but we’ve made the decision to forfeit some of the spot opportunities to really invest in long-term relationships.”

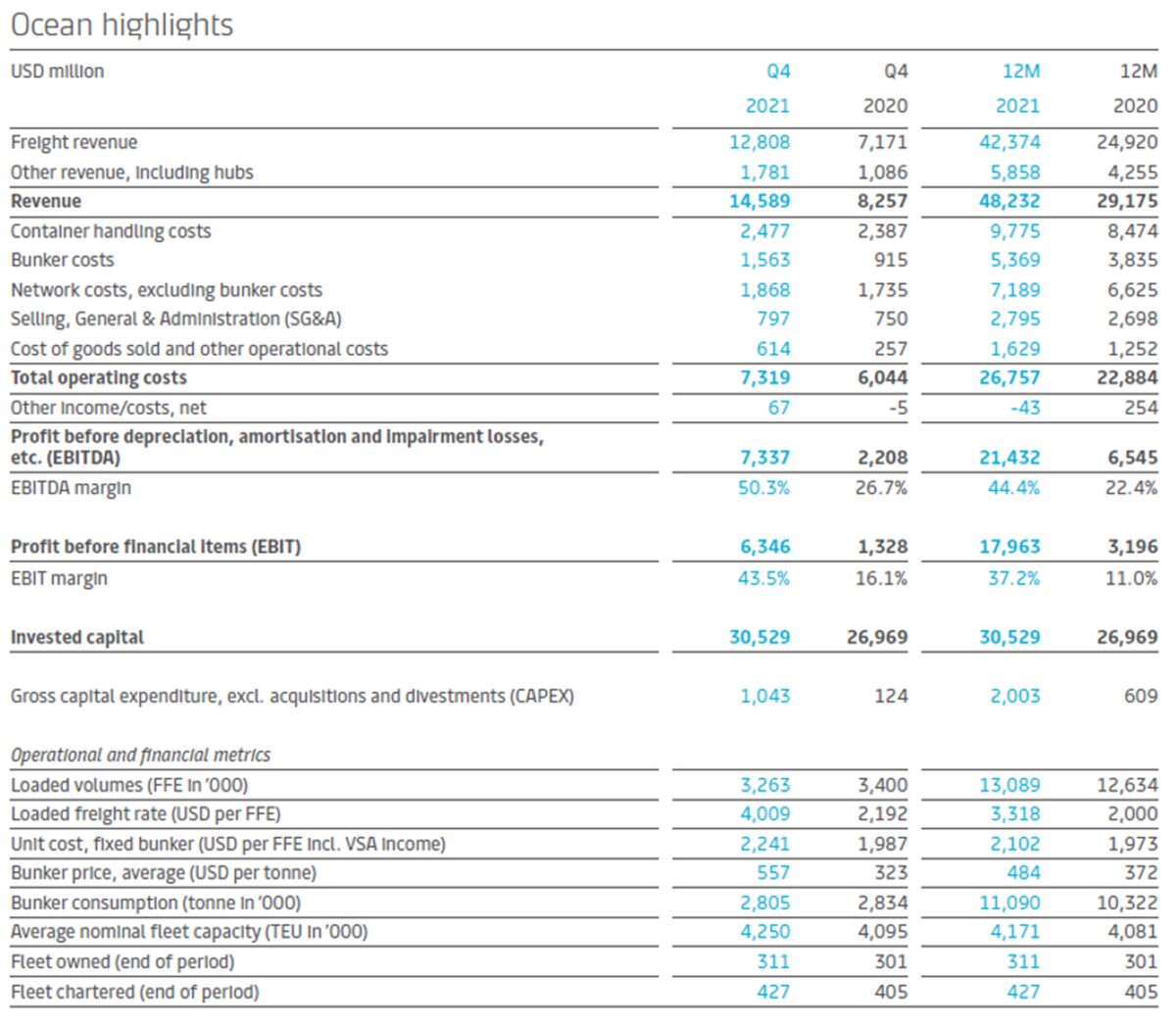

Skou said that average rates for Maersk’s long-term contracts increased to around $3,000 per FEU in 2021, up 50% from the pre-COVID level of $2,000 per FEU in 2019-20. He said long-term rates should increase a further $800 per FEU this year.

Skou also noted that “the normal seasonality of contract renewals is out the window. A lot of things have been renegotiated early or enlarged, where customers say, ‘Look, we need more capacity and we already have this contract.’ Then we end up doing a new contract out of the normal cycle and adding more volume.”

Commenting on rate gains in Q4 2021, Maersk CFO Patrick Jany explained, “As in the previous quarter, the positive development came from the upselling of volumes to existing long-term contracts, the effect of early renegotiations of long-term contracts and the implementation of higher bunker adjustment clauses due to the increase in bunker [marine fuel] price.”

Guidance: Not high enough?

On Jan. 14, Maersk preannounced 2021 earnings before interest, taxes, depreciation and amortization of $24 billion. That was more than double the guidance Maersk gave at this time last year ($8.5 billion-$10.5 billion). The company had to hike its guidance three times last year — and it still came up short.

On Wednesday, Maersk announced 2022 EBITDA guidance of $24 billion, i.e., flat versus 2021. The consensus was for $24.4 billion, with one big outlier: Deutsche Bank’s Andy Chu predicting Maersk 2022 EBITDA of $34.1 billion.

“We are not surprised that management has put out conservative guidance. We saw this last year,” wrote Chu. “Given that there are no real signs of the supply chain issues getting resolved quickly, we think our forecasts remain realistic.”

Skou himself highlighted a big caveat to Maersk’s guidance, acknowledging, “We don’t frankly have a lot of experience coming out of a pandemic, which is a challenge when we have to provide guidance.” All Maersk can do, he said, is provide more color on the assumptions underlying its guidance.

The positive assumptions detailed by Maersk execs: The rise in long-term contract coverage and long-term rates will add around $6 billion in earnings for the year; Q1 2022 results will be on par with Q4 2021; the first half overall will be “very strong”; and full-year demand will rise 2-4%.

The negative assumptions: The higher mix of long-term versus spot business will be a headwind to average rates (given that spot rates are higher than long-term rates), spot rates will “normalize” starting early in the second half; and unit costs will continue to rise due to inflation, with bunker prices remaining very high.

The biggest variable appears to be when and to what extent spot rates fall. When asked about how this could play out, Skou admitted: “We don’t know.” From what executives said on the call, the Q3 2022 guesstimate on the rate-drop timing appears to have been chosen because Maersk has no spot bookings visibility that far out.

“Near-term spot rates have stabilized at a very high level,” said Skou. “Everything we see now looks very strong but we have to assume that at some point, people come back to work, the bottlenecks will debottleneck, things will start to return to normal, and this will release capacity into the market, including the ships sitting off of LA right now,” said Skou.

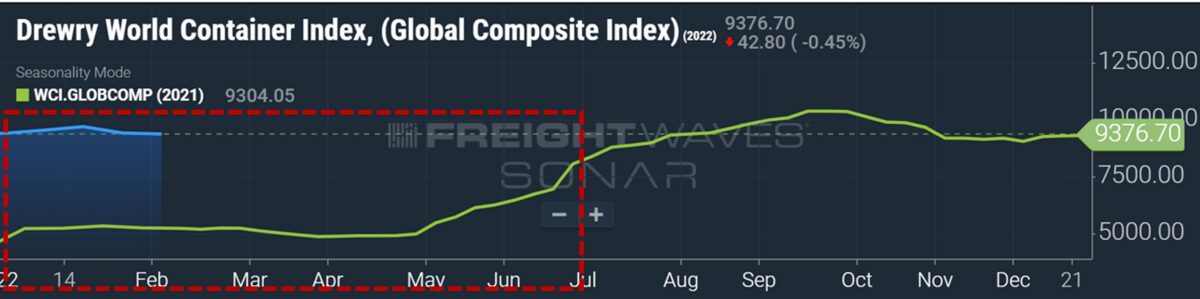

Supporting the argument that Maersk’s guidance is too conservative: Today’s spot rates are much higher than they were a year ago — and stable. The Drewry World Container Index is currently up 79% year on year. Spot rates have plateaued at a very high level. As of now, first-half comps appear fairly easy to beat.

If full-year contract earnings top last year’s — which is virtually guaranteed — and first-half spot earnings exceed last year’s, which at the moment seems a strong possibility, then second-half spot earnings would have to plunge for Maersk EBITDA to end 2022 flat with 2021.

“Our guidance implies a significant reduction in short-term [rates] as soon as normalization happens, and our assumption is that it happens early in the second half of 2022,” said Jany.

Chu of Deutsche Bank predicted that Maersk’s “conservative guidance … will need to be materially upgraded through the year, as it was in 2021.” The ocean carrier’s current forecast, he said, “requires profits to collapse in the second half, which we do not see.”

According to Frode Mørkedal, shipping analyst at Clarksons Platou Securities, “We believe the fact that they guided annual EBITDA at the same level as last year indicates that their normalization scenario must mean a huge drop off in spot rates back to before-2019 levels, higher costs notwithstanding. We are struggling to model such low rates.”

Maersk key performance indicators:

Click for more articles by Greg Miller

Related articles:

- Container shipping has greatest quarter ever — with more to come

- Cartel? Liner competition increased as trans-Pacific rates spiked

- ‘Tricky time’ for shipping stocks: Course corrections ahead?

- Inside container shipping’s COVID-era money-printing machine

- Shipping giant Maersk continues buying spree after best quarter ever

- How high can container shipping profits go? Will 2022 top 2021?