Management from flatbed truckload provider Daseke said “capacity is booked solid” on a call discussing third-quarter results with analysts on Wednesday.

More than one-quarter of the freight the carrier hauls in its specialized segment was described as “noncyclical.” CEO Jonathan Shepko said calls are coming in from customers to “confirm capacity availability” for infrastructure-related projects and that the initial 2023 outlook for the manufacturing, construction and agricultural markets remains constructive.

Daseke also has the ability to move brokerage loads to company-owned trucks on slow days, which stabilizes equipment utilization rates.

Shepko noted a recent slowdown in shipments of steel, lumber and building materials but said only 5% to 6% of the company’s overall revenue is tied to residential housing, where activity has slowed as interest rates have risen.

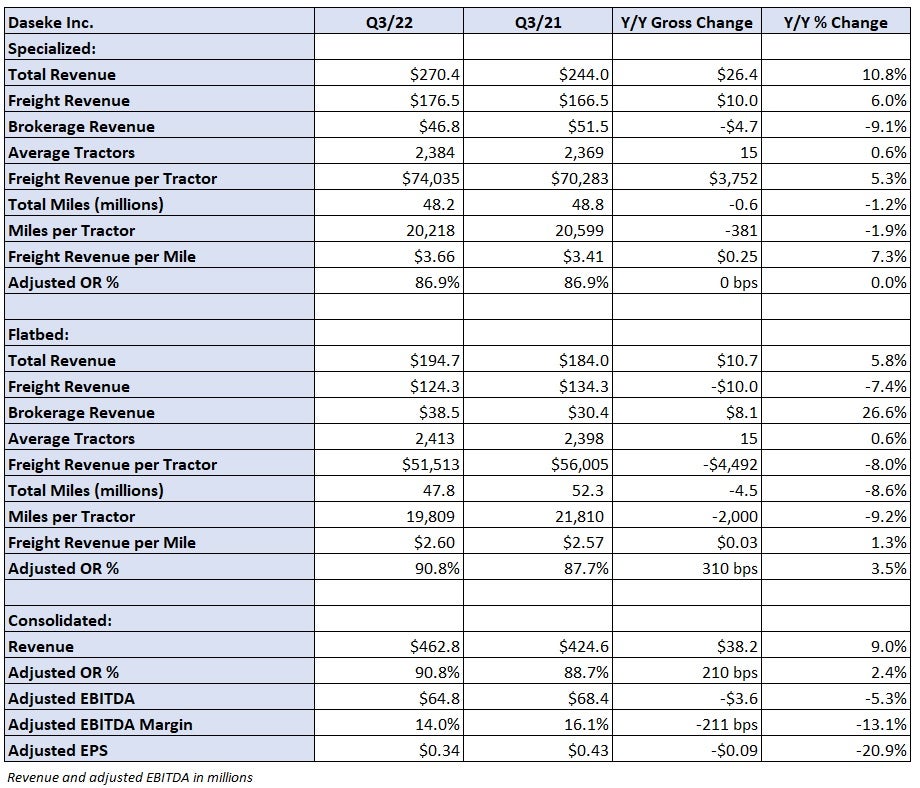

Daseke (NASDAQ: DSKE) reported third-quarter adjusted earnings per share of 34 cents, a penny ahead of the consensus estimate but 9 cents lower year over year (y/y). The quarter was negatively impacted by $4 million due to “an unusually large, single-event insurance claim.”

Consolidated revenue was 9% higher y/y at $463 million, but adjusted earnings before interest, taxes, depreciation and amortization declined 5% y/y to $65 million due to the increase in claims activity. Higher fuel surcharges and a 4% increase in brokerage revenue drove the top-line increase. Excluding fuel, revenue was up 2% y/y in the quarter.

An adjusted operating ratio of 90.8% deteriorated 210 basis points y/y. Stripping fuel revenue out of the equation, the OR was 89.3%, 160 bps worse.

Freight revenue per mile was up 7% y/y in the specialized segment and 1% higher in the general flatbed division.

An outlook for rates was not provided, but Shepko said flatbed capacity is leaving the market as small carriers fail to capture the rates needed to outpace mounting cost pressures.

“A lot of those smaller carriers were undercapitalized or were thinly capitalized going into this market and really do live month to month,” Shepko said.

Shepko estimates roughly 90% of the market is comprised of fleets operating just a few trucks.

“They’re the incremental provider of capacity in the space,” he said. “They’re having to drop rates to fund the given week’s payables and driver pay. That wave is about to crest.”

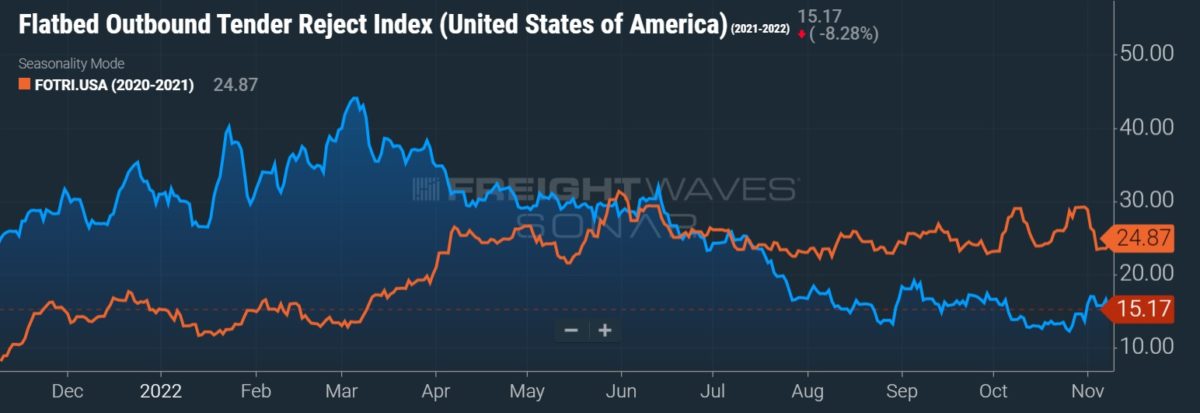

Between 80% and 85% of Daseke’s business is under contract, which insulates it from short-term fluctuations in spot rates to a degree. Throughout the flatbed industry, tender rejections have slowed to roughly 15%. While that’s a drop from the 25% rejection rate seen a year ago, it’s a much firmer level than the sub-5% mark the dry van market is currently maintaining.

Shepko said recent rate conversations with customers have been “balanced.”

“If you’re not wanting to pay a fair market rate, really build a relationship with us, then we’re just not interested,” he said.

The company reaffirmed full-year 2022 guidance, which calls for revenue to increase between 12% and 15% y/y with adjusted EBITDA climbing by 5% to 10%.

Shepko said Daseke should exit 2023 generating annual EBITDA at least $25 million higher than the $235 million it did for the trailing 12-month period ended Sept. 30. Planned reductions in fixed costs, improved asset utilization and an overhaul that moved all of its separate operating companies onto the same technology platform are the catalysts.

Responding to a question about the low valuation multiples placed on the company’s stock, Shepko said investors will likely want to see Daseke “go through some kind of tougher period” to gain comfort that the turnaround and other initiatives have worked. He believes companies with perceived high-debt leverage are being penalized in what is a “risk-off” market.

To counteract the low share price, Daseke recently implemented a $40 million share repurchase, following an activist investor’s encouragement to do so. Last year, it repurchased a little more than $20 million in stock.

Daseke had $188 million in cash and $312 million in total liquidity at quarter end. Net debt of $450 million stood at 1.9x trailing EBITDA.

Shares of DSKE were 5.9% higher at 2:01 p.m. EST on Wednesday compared to the S&P 500, which was down 1.6%.

More FreightWaves articles by Todd Maiden

- Werner acquires ReedTMS Logistics in $112M deal

- Broker Echo ups global freight forwarding game in latest deal

- Werner ready to navigate a downturn