It’s still very expensive to ship containers full of goods across the oceans. Spot rates globally are still more than quadruple pre-pandemic levels. But rates are now materially lower than they were a few months ago — and falling by the week. The Shanghai Containerized Freight Index (SCFI) logged its 15th consecutive weekly loss on Friday.

In April, container shipping indicators were mixed. Some, like the SCFI, pointed lower. Others didn’t. As of mid-May, indicators are much more aligned: pointing down.

The question ahead is whether peak season volumes, the end of China lockdowns and possible port labor unrest will cause spot rates to spike yet again in the second half, or whether falling import demand due to inflation and the end of stimulus, combined with unwinding port congestion, will pull ocean spot rates lower still — perhaps even lower than annual contract rates.

Container shipping rates off highs

Weakness in the Asia-West Coast trade is now showing up in the Freightos Baltic Daily Index (FBX). This mirrors the trend previously shown by the weekly Drewry World Container Index.

Between May 2 and May 11, the FBX Asia-West Coast assessment — which includes premium charges — sank 25% to $12,217 per FEU. It subsequently rose to $13,806 per FEU as of Friday. But even so, Friday’s rate was down 33% from the lane’s all-time high in late September.

The Drewry Shanghai-Los Angeles assessment, which doesn’t include premiums, was down to $8,666 per FEU as of last week.

That’s 23% below levels in the third week of January and 30% below the index’s late-September record.

Asia-East Coast routes show the same directional trend: down. The FBX Asia-East Coast rate assessment fell 15% from $18,711 per TEU on May 2 to $15,982 per FEU on Friday. The index was down 28% from the record high in late September.

The Drewry Shanghai-New York rate assessment was $10,926 per FEU last week, down 22% from mid-January and 32% from the all-time high in mid-September.

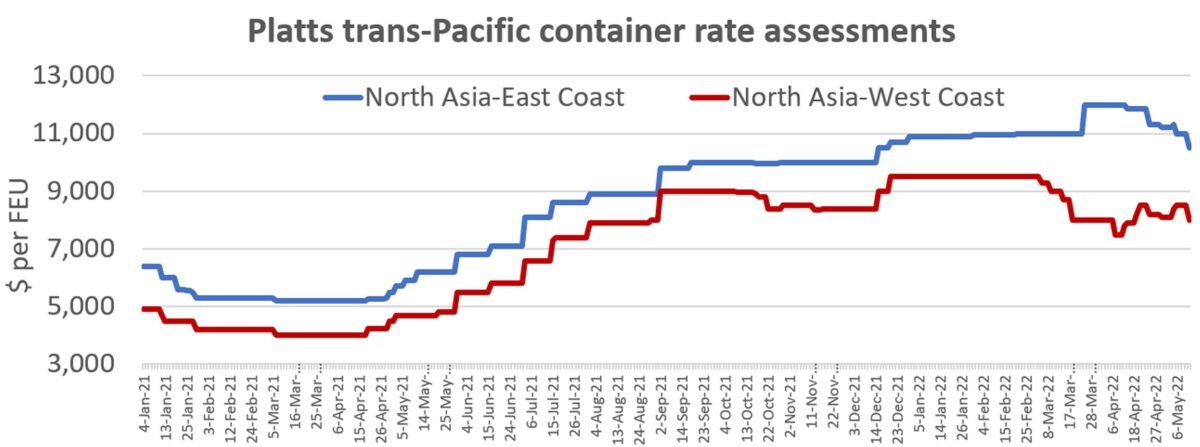

The Platts Container Rate Index previously showed a different pattern than several other indexes, with its Asia-East Coast spot rates still rising. Now, Platts is also showing declines. It put Asia-East Coast spot rates at $10,500 per FEU as of Friday, down 11% from the all-time high of $11,850 in mid- to late April.

Platts’ Asia-West Coast assessment declined to $8,000 per FEU, 16% below the index’s all-time high in February.

Platts, which is a part of S&P Global Commodities, said Monday that “persistent weak demand and a bearish sentiment over the market pressured rates to multi-month lows.” Spot rates are now “edging closer to contracted term rates,” it added.

Blank sailings for Asia export services

The three alliances — 2M, Ocean Alliance and THE Alliance — “blanked” (canceled) sailings during the initial Q2 2020 lockdowns due to falling import demand. Blank sailings artificially reduced sailing capacity to prop up rates. During the height of congestion in late 2021 and early 2022, carriers blanked sailing for a different reason: There were too many ships stuck waiting at export ports to pick up imports on the other side of the ocean.

Now, it appears carriers are blanking sailings for a mixture of reasons: congestion, reduced exports out of China, as well as reduced import demand.

“Shipowners have continued announcing blanked [canceled] sailings and port omissions as volumes wane, in a bid to prop up freight rates,” said Platts.

One U.S. freight forwarder source told Platts that it has seen “drastic volume declines for the past six weeks. It’s all the blank sailings now. That’s going to stabilize rates, in my opinion.”

Simon Sundboell, founder of eeSea, believes China lockdowns are playing a role in blank sailings. “During the early stage of lockdowns, carriers might have accepted a slightly lower utilization to keep the vessels and equipment conveyor belt moving,” he told American Shipper. “But below a certain utilization, it does make sense to blank the vessel instead.”

According to project44, the 2M Alliance will blank 39% of its sailings globally between April 25 and June 12 “due to a drop in [vessel] demand caused by the situation in China.” The Ocean Alliance will blank 37%, THE Alliance 33%.

Last week, Xeneta CEO Peter Berglund said that 63 sailings with capacity of 517,300 twenty-foot equivalent units had been blanked from the Asia-West Coast lane over the prior five weeks.

Berglund attributed the move to “both a softening of the demand picture as well as a strengthening of carrier resolve to protect the healthy spot rates which have served them so well.”

US port congestion off its highs

Blank sailings can reduce ship queues at ports, due to reduced arrivals.

In February and March, Sea-Intelligence predicted that the ship queue off Los Angeles/Long Beach “would grow again” as liners added services following the Lunar New Year holiday. Sea-Intelligence also predicted heightened pressure on East Coast ports, based on liner schedules showing much higher calls.

It hasn’t turned out as predicted, whether due to blank sailings or other reasons.

The queue off Los Angeles/Long Beach fell to 29 container ships on Thursday, according to the Marine Exchange of Southern California. That’s the lowest level since early August 2021.

And while there has indeed been more congestion off East and Gulf Coast ports this year, the total number of waiting ships is down from earlier highs.

There were around 70 container ships waiting off these coasts in late February. On Monday, ship-position data from MarineTraffic showed only 45 ships waiting offshore.

Almost all of the East and Gulf Coast port queues have declined since February, with the exception of the one off New York/New Jersey, where an unusually high 20 ships were waiting on Monday.

Click for more articles by Greg Miller

Related articles:

- Has the peak of container shipping’s epic boom already passed?

- China lockdowns are not causing shipping chaos, say liner CEOs

- Demand for shipping containers is falling. Transitory or turning point?

- Despite rising risks, shipping lines on track for another record year

- Shanghai lockdown is not causing global supply chain chaos (yet)

- Container shipping at the crossroads: The big unwind or party on?

- How invasion of Ukraine could ease shipping logjam off US ports