The highlights from Friday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Lane to watch: LA to Atlanta

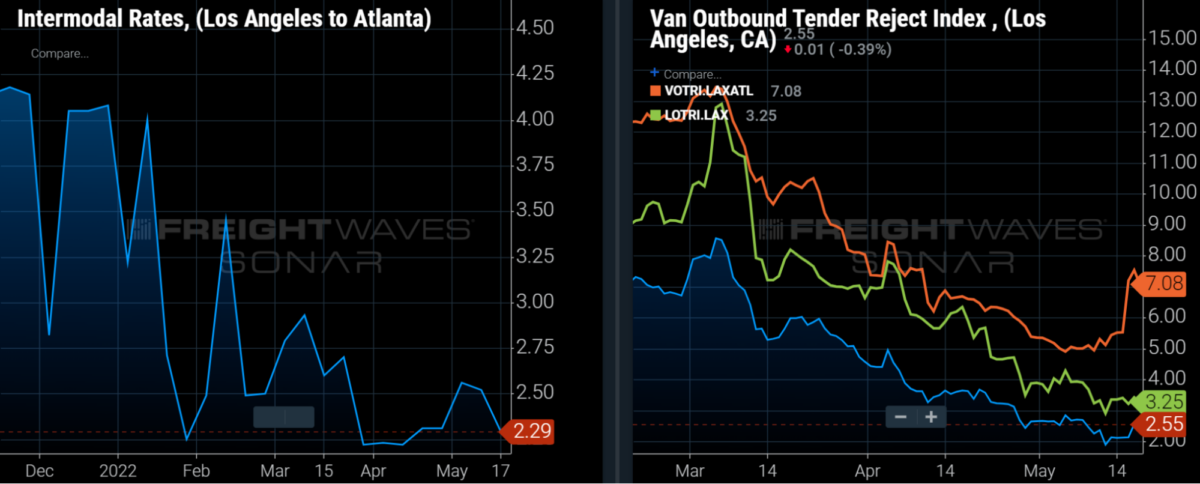

Overview: Capacity loosens across modes as intermodal spot rates fall 9% w/w.

Highlights:

- The intermodal spot rate to move 53-foot containers door to door declined 9.2% in the past week to $2.29 per mile, including fuel.

- That intermodal spot rate is 5.3% below the current dry van spot rate of $2.42/mile, including fuel. Dry van spot rates have declined sharply from $3.62/mile at the beginning of the year.

- Domestic intermodal volume averaged 311 units/day in the past week, which is more than 10% below the volume during certain weeks in November and December, suggesting that the railroads could handle more intermodal volume in the lane.

What does this mean for you?

Brokers: Capacity remains plentiful in LA so you can continue to negotiate aggressively with carriers. But keep in mind that tender rejection rates show that dry van carriers are less willing to accept loads to Atlanta than most other LA outbound lanes.

Carriers: Most carriers are very accepting of outbound LA loads as evidenced by the LA van outbound tender rejection rate of 2.6%. Van tender rejection rates in the LA-ATL lane are higher at 7.1%, which is still below the national van tender rejection rate. One advantage of heading to Atlanta is that it remains a headhaul market with a Van Headhaul Index of 46.

Shippers: Contractual intermodal shippers do not need to be as concerned with getting their loads covered as they had been in recent months. Current spot rates indicate that the railroads are less concerned with protecting capacity for contracted shippers. Plus, intermodal tender rejection rates have returned to less than 1% for outbound LA loads.

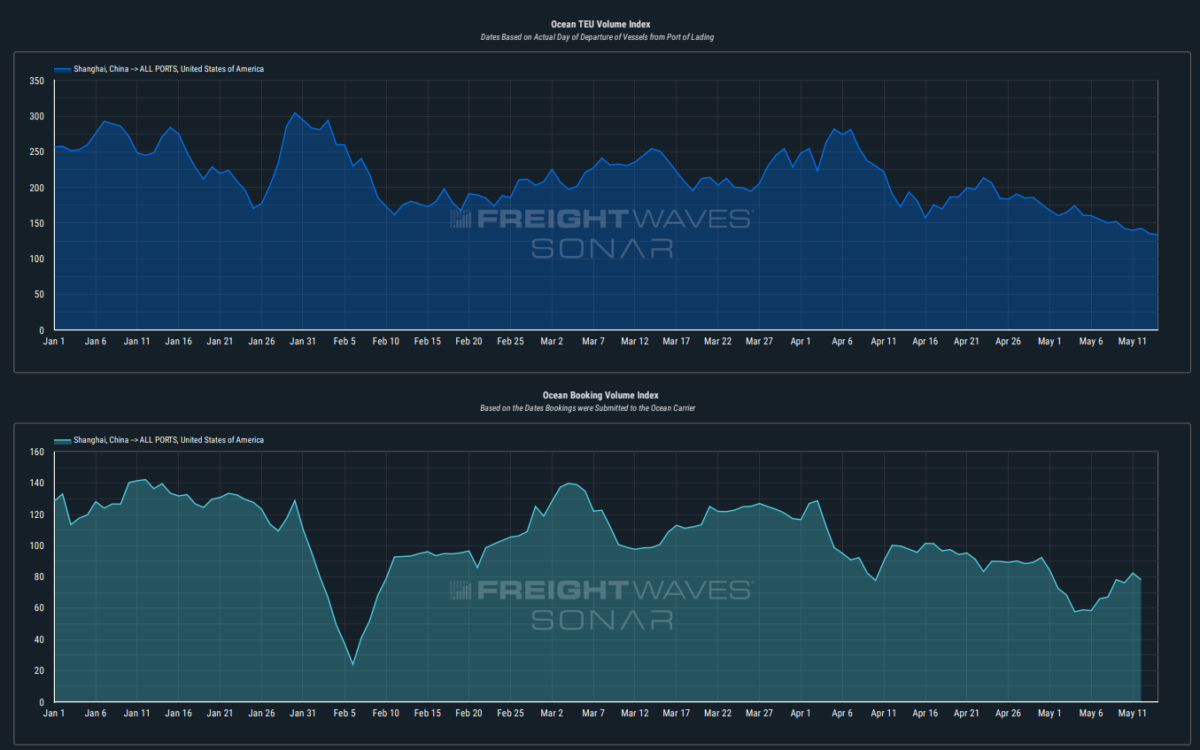

Watch: Carrier update

For the week ahead, many will be waiting to see if authorities in Shanghai truly begin easing COVID restrictions. While these authorities have said similar things in the past, we will not know exactly how seriously to take these most recent communications until next week. Since these lockdowns began, ocean container volumes out of Shanghai have dropped significantly, but that has not been attributed to the port and terminals throttling operations. In fact, they have remained fully operational, and ocean container dwell times for Shanghai exports are at some of their lowest levels ever. However, for the imports going through Shanghai, those container dwell times are at some of their highest levels ever, thereby showing the true impact the domestic side of these lockdowns is having. Trucking capacity has been affected significantly, unable to travel across districts, and so have Chinese factories with many workers mandated to stay at home. These actions have created a backlog of much-needed goods to be further upstream in the manufacturing process, so the impacts of these lockdowns have not truly been felt yet. That is why this new communication on potentially lifting restrictions is more important than ever. If these factories do not get back to producing orders in time for the ramping up of peak season, it is unforeseen just how many orders will be left. The University of Michigan’s Consumer Sentiment Index just plummeted, and between now and the last time the index reported, global stocks have experienced their worst week ever since the Great Financial Crisis in 2008. So with consumer demand sliding further, and liquidity “drying up” as the Federal Reserve maintains a hawkish stance (raising interest rates), we may truly be on the verge of a global freight recession. Just this past week, the communication from Hapag-Lloyd’s CFO was that “we have to accept that demand is going down” and he expects to see a “strong reduction” in spot rates through the third quarter, with, in some instances, short-term rates falling back below contract rates.

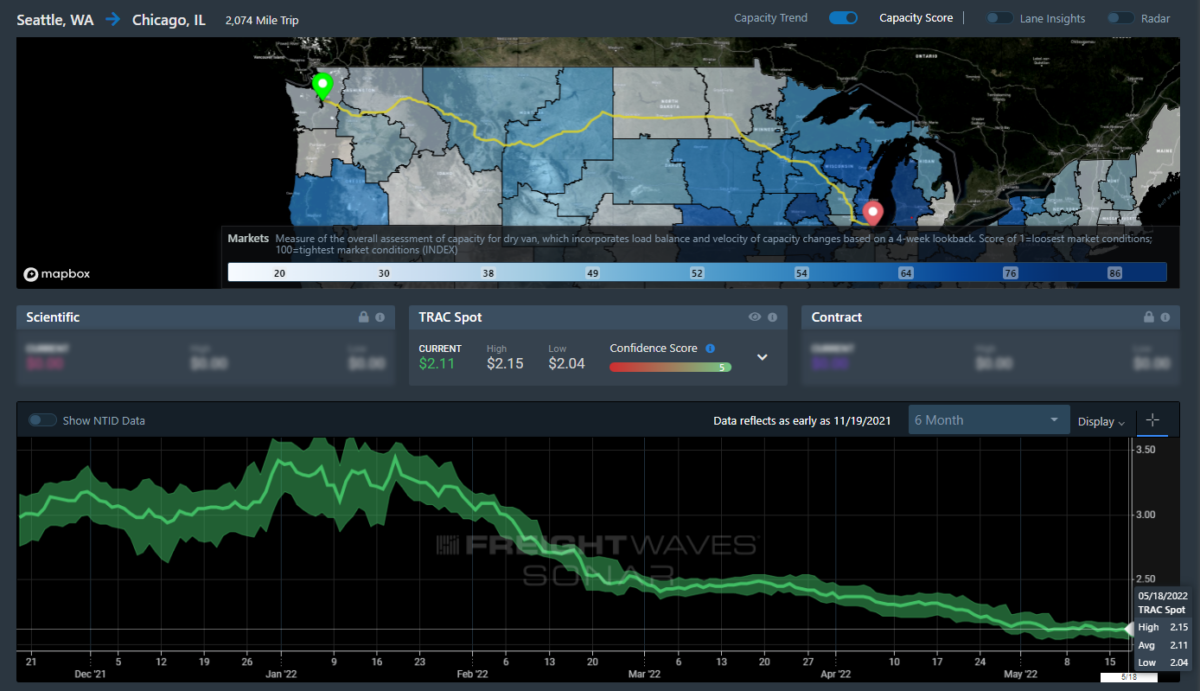

Lane to watch: Seattle to Chicago

Overview: There is upward pressure on spot rates as the Headhaul Index increases 12% w/w.

Highlights:

- Outbound tender volumes are up 12% w/w, indicating that demand for outbound capacity is increasing.

- The Headhaul Index in Seattle is up 13% w/w, signaling that there is a growing imbalance between inbound and outbound capacity.

- Outbound tender rejections are down 137 bps but are likely to increase in the days ahead as the demand for outbound capacity increases as well.

What does this mean for you?

Brokers: The Seattle truckload market is likely to tighten in the days ahead from a 12% increase w/w in outbound tender volumes and a 13% increase in the Headhaul Index w/w. Outbound rejections may be down 137 bps w/w, but that trend is likely to reverse in the days ahead, so be sure to prioritize this lane and let your team know that there is major upward pressure on spot rates.

Carriers: Stay firm on your rates, as you are likely to see pricing power shift further into your favor in the days ahead. Even though spot rates have been on the decline over recent weeks, the growing imbalance in volumes and increasing tender rejections should make Seattle’s outbound spot rates more favorable towards carriers.

Shippers: Your shipper cohorts currently have tender lead times at 2.1 days, but that is not likely to be sufficient for the increase in demand that is expected in the weeks ahead. In the tightest markets historically, shippers in Seattle have increased lead times to between 3.5 and four days to help offset tightening conditions.