PitchBook and FreightWaves have crunched the numbers and confirmed what most of us already know – the FreightTech sector, defined loosely as software companies that aid in the movement of freight, is on a tear. FreightTech growth has an analog in the broader transportation services category, with four of the five largest venture capital deals in the first quarter of 2019 going to companies that move people or stuff.

One of the most interesting FreightTech statistics is that the total amount of investment during the first quarter – $1.6 billion – is greater than the full year 2017 record of $1.3 billion and more than half of the $2.9 billion in venture capital invested for the full year 2018.

“The first quarter is already more than 50 percent greater than last year,” said Jenny Xu, FreightWaves’ chief strategy officer. That growth rate is expected to continue, said Xu, who sees FreightTech investment as potentially doubling this year.

Using the FinTech industry’s growth trajectory as a guide, Xu noted that investment in FinTech companies doubled in 2014 and 2015, after 2014 was six times the amount invested in 2010. FreightTech is already growing exponentially faster, having climbed from $118 million to almost $3 billion, or a multiple of 25 in five years.

Continuing a trend, the Softbank Vision Fund is driving the first quarter 2019 curve, as it led the $1 billion round in Flexport, boosting the online freight forwarding company’s valuation to an estimated $3.2 billion.

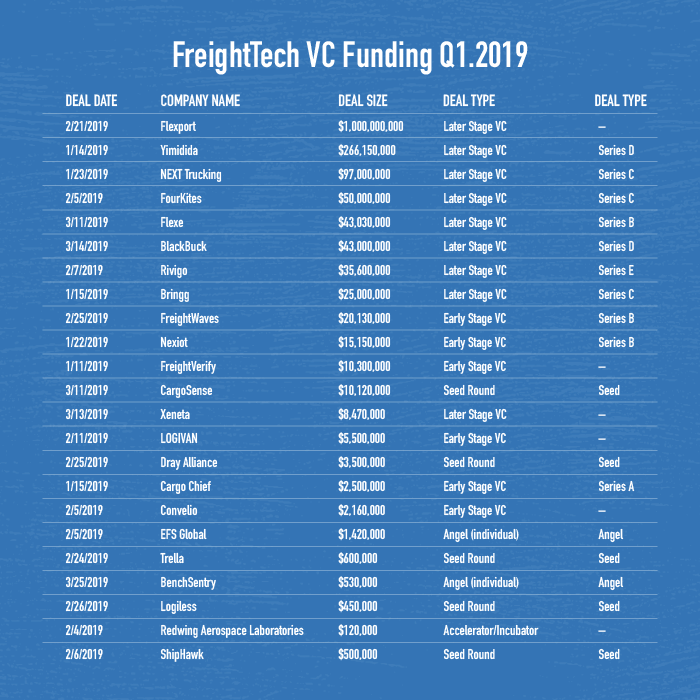

As was the case last year, capital continues to shift toward later stage rounds (Series B and above), Xu said. Out of the 23 recorded deals in the first quarter, 10 are growth stage. That translates into a more competitive funding environment for later stage companies, said Xu, while new companies trying to enter the space will confront a more limited seed and angel investment environment.

“The attention is moving to the bigger companies,” she said.

The size of the deals is also increasing. During the first quarter of 2018, there were 35 recorded FreightTech deals, but total investment dollars topped out at $191 million. Mega-deals like the Flexport round are also expected to increase, Xu said.

Here are the top five Q1 2019 FreightTech deals:

1. Flexport, developer of a freight-forwarding platform – $1 billion.

2. Yimidida, a cloud-based logistics platform and delivery services specializing in shipping to rural towns in China – $266 million in Series D.

3. NEXT Trucking, developer of a digital freight matching platform and app – $97 million in Series C

4. FourKites, developer of a predictive supply chain platform – $50 million in Series C

5. Flexe, developer of an online marketplace designed to provide warehousing spaces on-demand – $43 million in Series B

5. BlackBuck, developer of an online fleet management platform in India – $43 million in Series D