Shipping stocks are not considered “buy and hold” investments these days — for good reason. It’s all about timing. Case in point: Tanker stocks are now soaring after years mired in negative territory.

Fresh 52-week highs were hit Tuesday by Scorpio Tankers (NYSE: STNG), Ardmore Shipping (NYSE: ASC), Euronav (NYSE: EURN), DHT (NYSE: DHT), International Seaways (NYSE: INSW) and Teekay Tankers (NYSE: TNK).

Tankers stocks are up double digits year to date (YTD), in some cases triple digits. However, the rebirth of tanker stocks comes after two painful “bagholder” years. Anyone who bought and held a basket of tanker stocks since January 2020, pre-COVID, would have only recently broken even.

To gauge how shipping stocks have fared, American Shipper crunched the numbers by segment — tankers, dry bulk and containers — both YTD and across the COVID era.

The analysis also examined Greek-sponsored micro-cap shipping stocks in various segments involved in fully disclosed, dilutive sales of common equity and warrants facilitated by New York investment bank Maxim Group. “Maxim stocks” appear to attract retail investors looking to gamble on short-term price swings even though data confirms that these shipping stocks fare much worse than others over time.

Winners and losers YTD

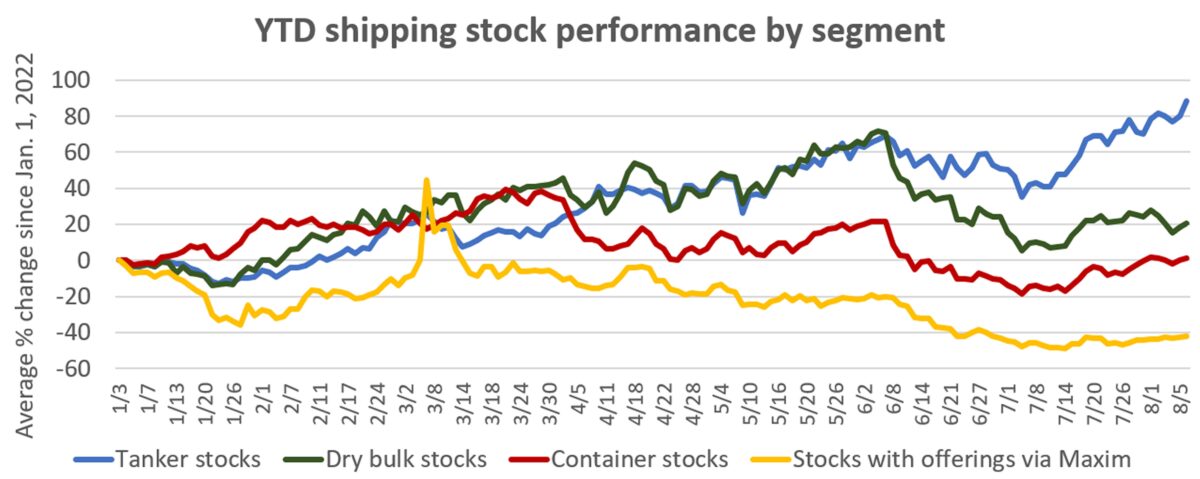

The pattern of winners and losers YTD is very different from the medium-term pattern over the course of the pandemic. From Jan. 1 to Monday’s close, tanker stocks were up 88%. Dry bulk stocks were up 21% and container shipping stocks just 1% (for methodology, see below).

In contrast, shares of shipping companies that have sold equity via Maxim-related deals were down 42% YTD.

This year has been a continual upward climb punctuated by a few brief pullbacks for tanker stocks. Dry bulk shares kept pace with tanker shares until June, after which lower spot rates and economic headwinds took their toll. Dry bulk shares have seen a small recovery since mid-July.

Container shipping shares maintained their winning streak until the end of March. Then they fell back, although, like dry bulk shares, they’ve regained some ground since mid-July.

The Maxim-linked shipping share average jumped briefly in March due to a fleeting spike in one equity, Imperial Petroleum (NASDAQ: IMPP), after which that stock and the overall average slid lower.

Product tankers trump crude tankers in 2022

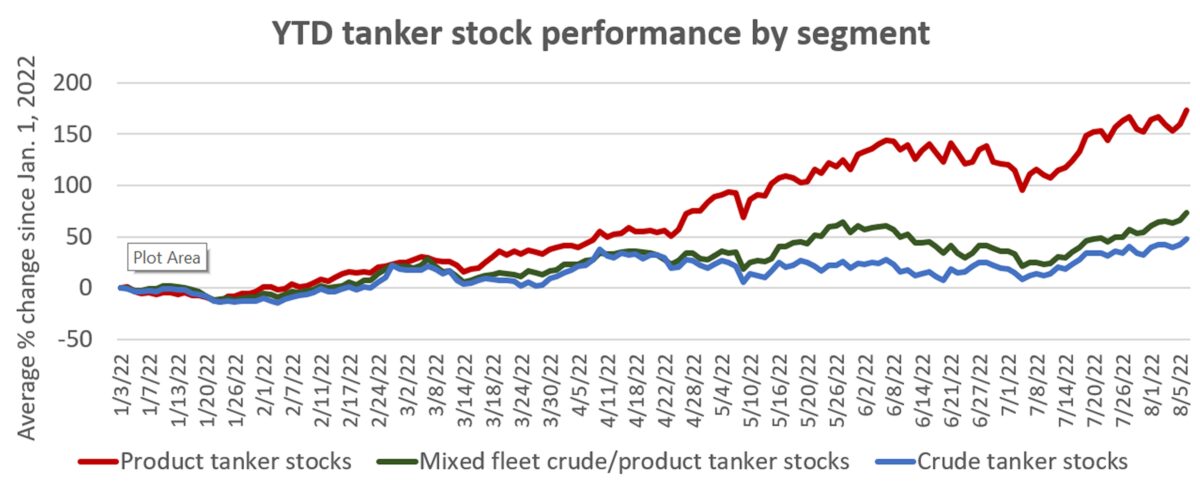

Tanker stock performance has diverged based on tanker type this year. Shares of pure product-tanker owners are far outperforming the rest, up by an average of 173% year to date. Mixed fleet owners — with both crude and product tankers — are up 73%. Pure crude-tanker owners are up 47% (an impressive gain considering that crude tanker owners are still reporting losses).

COVID-era shipping stock performance

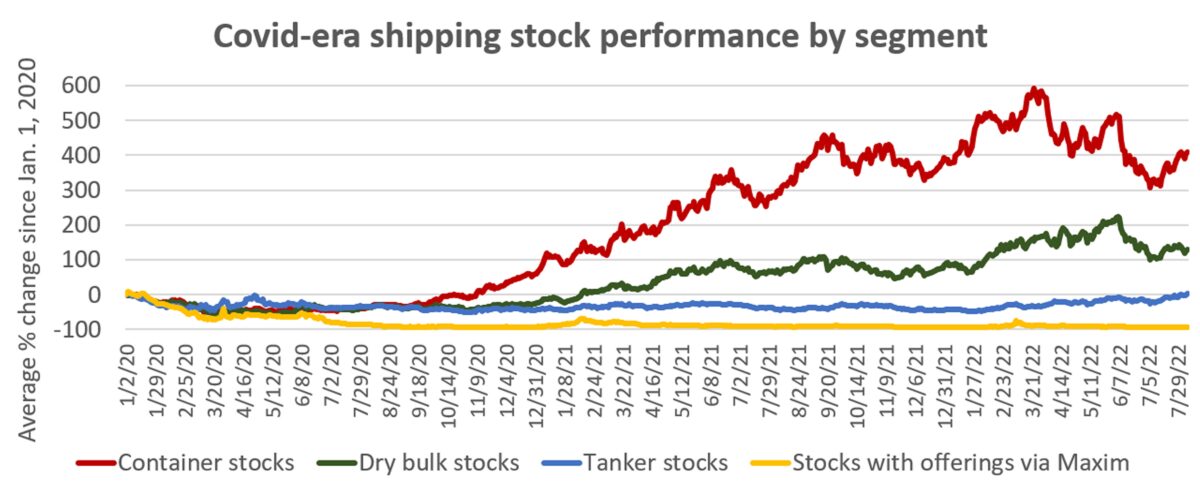

Over the course of the pandemic, container shipping stocks have been by far the biggest winner. As a group, they’re still up 409% on average since Jan. 1, 2020, despite flat performance in 2022 YTD.

Dry bulk shares have been the second-biggest winner. Even with this year’s retrenchment, they’re up 129% since January 2020. In contrast, tanker stocks — which are more in the spotlight this year — are essentially flat versus January 2020 (up 3% as of Monday’s close).

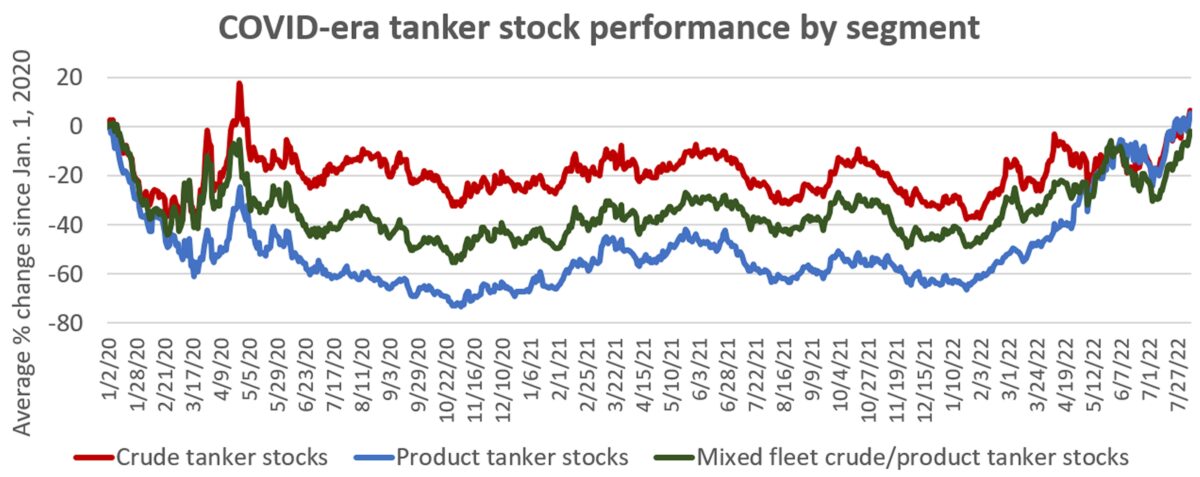

Highlighting the importance of stock-trade timing, the performance of different tanker segments over the medium term was the reverse of 2022 YTD performance. Since Jan. 1, 2020, product tanker stocks fared the worst, mixed-fleet stocks were in the middle, and crude tankers fared best.

‘Maxim stocks’ down over 90% vs. pre-pandemic

The performance of the Maxim-linked shipping equities over the medium term highlights just how important it is to get in and out of such equity bets very quickly.

Keeping in mind that the maximum loss is 100%, the share values of Top Ships (NASDAQ: TOPS) and Globus Maritime (NASDAQ: GLBS) were both down 98% at Monday’s close versus Jan. 1, 2020. Over the same time frame, shares of Seanergy (NASDAQ: SHIP) and Castor Maritime (NASDAQ: CTRM) were both down 91%.

Shares of Imperial Petroleum — a spinoff of StealthGas (NASDAQ: GASS) that Maxim has supported — have lost 95% of their value since the stock began trading in early December. Shares of OceanPal (NASDAQ: OP) — a spinoff of Diana Shipping (NYSE: DSX) that conducted an offering with Maxim as sole bookrunner — have lost 91% of their value since they began trading in late November.

A new shipping equity doing Maxim-placed offerings emerged last month. Seanergy spun off United Maritime Corp. (NASDAQ: USEA) into a separate listing that began trading on July 7.

In just one month, United Maritime’s shares shed 71% of their value.

Methodology for shipping stock averages:

Averages use adjusted closing price data of U.S.-listed shipping stocks from Yahoo Finance. Segment averages were not weighted by market cap.

Only large “pure” owners in each segment were included in averages. For the pure product-tanker average: Scorpio Tankers and Ardmore Shipping. Crude tankers: Euronav, DHT and Nordic American Tankers (NYSE: NAT). Mixed-fleet operators: Teekay Tankers, Frontline (NYSE: FRO) and International Seaways. Tanker owners with significant holdings in non-crude/product segments, such as Navios Partners (NYSE: NMM) and Tsakos Energy Navigation (NYSE: TNP), were excluded.

The dry bulk average was made up of the four largest U.S.-listed pure bulker owners by market cap: Star Bulk (NASDAQ: SBLK), Golden Ocean (NASDAQ: GOGL), Genco Shipping & Trading (NYSE: GNK) and Eagle Bulk (NASDAQ: EGLE).

The container shipping average comprises liner operators Zim (NYSE: ZIM) and Matson (NYSE: MATX), as well as pure container-ship lessors Danaos (NYSE: DAC), Global Ship Lease (NYSE: GSL) and Euroseas (NASDAQ: ESEA). Costamare (NYSE: CMRE), Atlas (NYSE: ATCO) and Navios Partners were excluded due to significant noncontainer holdings.

The Maxim stocks average comprises Top Ships, Seanergy, Castor Maritime, Globus Maritime, Imperial Petroleum and OceanPal. Due to the recency of its listing, share pricing of United Maritime was excluded.

Click for more articles by Greg Miller

Related articles:

- Shipowners with shares worth pennies rake in millions

- Shipping’s Wall Street saga: Rags to riches to rags to occasional riches

- War effect on crude trade: Long-lasting and just beginning

- Batten down the hatches: Shipping stocks ‘unable to escape the torrent’

- Gimme shelter: Shipping stocks still rising amid Wall Street storm

- Shipping on Wall Street: Is it better to be a pure play or jack-of-all-trades?

- COVID-era shipping stocks: The (super) good, the bad and the ugly