Driver detention has been causing headaches and lost wages for years, but the ELD mandate has shone a spotlight on the issue like never before. For the first time, carriers have the data to back up what they have always known.

Spireon hosted a webinar in collaboration with FreightWaves to delve into the issue further and examine just how much detention time costs.

The webinar, “Time is Money: Managing Detention More Profitably,” featured FreightWaves Market Analyst Zach Strickland and David Heller, Truckload Carriers Association vice president of government affairs.

John Coppens, Maverick Transportation vice president of operations, also spoke during the webinar. Coppens focused on the driver side of detention, and his portion of the webinar will be covered in its own story later this week.

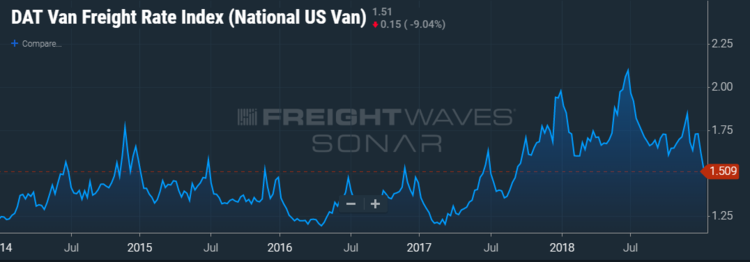

Strickland looked at freight trends over the last decade and the impact the current state of the market has on detention rates.

Freight volume is the highest it has been since 2007, with the Cass Freight Index showing a volume swing of 30% in 16 months.

“You can see very clearly that the recession occurred in 2009. When we recovered from that, we went into this real normal, stable pattern of shipping volume and seasonality,” Strickland said. “A lot of that changed over the last couple of years. In 2017, the January slowdown was actually as high as July, and then it continued to increase significantly over the next few months. We all lived 2018, and it was a pretty wild rollercoaster ride throughout.”

(CHART: FreightWaves’ SONAR)

When volume surges into the market so quickly, shippers lose leverage because capacity tightens and there simply are not enough trucks to cover available loads. This results in increased costs.

The Cass Freight Expenditure Index was up 31% in 20 months. This number includes fuel costs, which explain about 26% of the increase, but the remainder of the increase can be attributed to increasing demand.

Capacity was so tight in 2018, spot market rates were up 20-30% more than contract rates during peak. While this seems like a win for carriers, Strickland noted that detention rates do not pay on the same scale, so it is important for carriers to be moving as much as possible during peak.

(CHART: FreightWaves’ SONAR)

“When you see rates increase, detention rates do not increase with them at the same level, especially in the spot market,” Strickland said. “The spot market won’t have an extra 15-20% on the detention rate, normally.”

Carriers tend to be inflexible by nature and adapt slowly to wild market fluctuations like those seen in 2018, according to Strickland. This is largely because they cannot acquire 30 new trucks and 30 new drivers overnight to meet market demands.

Operating ratios start coming down when carriers start adapting to new market conditions, and several carriers saw improved ORs in 2018, with some even dipping into the 80s.

Strickland calculated the opportunity cost for carriers during periods of surging volume, and the cost of detention became evident.

The average load paid $2.03/mile at peak, and the average length of haul clocked in at around 550 miles or one day of transit.

“According to TCA data, the average was 3.73 loads per truck per week in 2018,” Strickland’s webinar slide read. “There is room for at least 1.27 more loads per week or another 698.5 miles at $2.03/mile, adding up to an extra $1,417 per week. A 10% increase in utilization would lead to an additional $141 per truck per week.”

In addition to the cost of detention, Heller looked at how excessive detention times can get and their impact on safety. He used several examples from drivers collected through a March 2018 FreightWaves survey.

“It took 14 hours to pick up a load of underwear,” one driver said. “My appointment to load was at 3 p.m., so I arrived an hour early to make sure I was ready. At 5 a.m. the next day, I finally signed the paperwork.”

While 14 hours seems like a long time to wait for a load of underwear, it wasn’t even the longest number of the bunch.

“It once took two days to load frozen chickens at a plant in Arkansas,” another driver said.

Heller cited a J.B. Hunt white paper from several years ago that estimates, on a good day, the average driver spent 108 minutes of their 14-hour, or 840-minute, day at shipping facilities.

This, combined with things like personal time, prep time and time for things like parking, knock the day’s actual driving time down to around 7.3 hours. This number was calculated prior to July 2013 HOS changes, and J.B. Hunt estimates it is now around 6.5 hours of active driver time.

“Detention time has some safety ramifications,” Heller said. “There is a strong correlation between safety incidents and driver detention time.”

Drivers having loads with longer-than-expected load times were associated with more driver fatigue, according to Heller. In 2001, the Federal Motor Carrier Safety Administration recognized a “strong positive relationship” between the percentage of time drivers spend loading and unloading and crash involvement.

A full 10 years after the FMCSA’s inaugural study, the Government Accountability Office found 80% of carriers reported detention time impacts their ability to comply with hours of service regulations and 65% reported major lost revenue due to improper facilities, inefficient staff and unprepared shipments.

Heller also cited a 2014 Virginia Tech study, “Driver Detention Times in Commercial Motor Vehicle Operations,” that found drivers experience detention at one in 10 stops. It also found that truckload drivers are far more likely to be detained than less-than-truckload drivers, and medium carriers are twice as likely to suffer than large carriers.

The most recent report Heller cited, a 2018 Office of Inspector General report, concluded that detention increases crash risk, and a 15-minute increase in average dwell time increases the average expected crash rate by 6.2%.

When looking at truckload specifically, the report found detention accounted for up to a $1.1 to $1.3 billion reduction in earnings annually. It can reduce the net income for carriers $250.6 to $302.9 million annually.

Heller thinks conquering detention time could have a large impact on the industry’s chief complaint: the driver shortage.

“Can you imagine how well we would retain drivers if they weren’t detained all the time?,” he said.

When it comes to fixing the problem, Heller thinks several factors will play a role, including more flexible HOS regulations, better utilization of ELD data and infrastructure fixes.

FreightWaves and Truckload Indexes will take a look at the driver-specific impact of detention time later this week.