Sometimes stocks in all ocean shipping segments move up or down in unison. Now is not one of those times.

Shares of container lines and container-ship leasing companies are down double digits. Shares of ocean carrier Zim (NYSE: ZIM) have lost more than half their value year to date. In contrast, tanker stocks are up double and in some cases triple digits. Shares in product carrier owner Scorpio Tankers (NYSE: STNG) hit yet another 52-week high on Tuesday. This stock is up 257% year to date.

For perspective on what’s driving the divergence and on who’s investing in these stocks, American Shipper interviewed veteran analyst Omar Nokta. Nokta took over as head of maritime research at investment bank Jefferies in July. Prior to that, he covered shipping at Clarksons Platou Securities and Dahlman Rose, where he began in 2004.

This question-and-answer interview was edited for clarity and length.

Container line stocks plunge with spot rates

AMERICAN SHIPPER: Container shipping lines are still making billions per quarter. Spot rates have fallen sharply yet revenues per container have held up much better due to contract coverage. Despite still historically strong cash flows, liner stocks are way down. What are you hearing from investors?

NOKTA: “There’s definitely a lot of jittery fingers. I think most people anticipated freight rates would start to moderate through the year. In the first seven or eight months, I think the pace of the decline was probably surprising, because rates were coming off very slowly, which is unheard of. In my experience covering shipping and commodities, when markets reach a tipping point and start to correct, they nose-dive down.

“So, freight rates were easing very, very modestly. And in the earnings season for the second quarter, Maersk, Hapag-Lloyd and others were actually raising guidance. This got people thinking: ‘Well you know, we’ve still got congestion. Maybe this whole unwind of the market happens later than we thought, in late 2022 or 2023.’ I spoke to dozens of people in August who were sharpening their pencils and really looking at Zim and container lines more broadly as a value play. [Value investors pick stocks they believe are trading below their intrinsic value.]

“Then it was like the rug got pulled out. The pace of the rate declines really started to accelerate. Freight rates began correcting really harshly. And those people who were looking at container lines as value plays went to the sidelines.”

Leasing stocks don’t reflect contract coverage

AMERICAN SHIPPER: What about companies that lease ships to liners? It looks to me like the ship lessors are more insulated than liners against a cyclical downturn in 2023, but less insulated further on. Charter rates are falling, yet lessors have massive locked-in revenue streams from their existing charter portfolios. Then, in the years beyond that, with the flood of newbuilds to be delivered in 2023-2024, it looks to me like ship lessors are more vulnerable than liners, because liners can just let their charters expire over time, sell their older ships and reduce market exposure, whereas lessors are stuck. Would you agree?

NOKTA: “Lessors are in a stronger position now because their revenue backlogs have really jumped. Their backlogs today are probably the best they’ve been since 2007-2008. Their counterparty risk is very limited because liners are as strong as they’ve ever been going into a downturn. I think that presents a really good value opportunity, because these lessor stocks have really sold off. There’s a fear that maybe some of these contracts won’t hold up, which we don’t view as a real risk.

“But I do feel there is a risk with the orderbook — that when those ships are delivered, liners will return their existing [chartered] ships. Outdated narrow-beam Panamaxes [vessels designed to traverse the original smaller canal locks] will probably be returned to owners, who will have to figure out what to do with them.”

AMERICAN SHIPPER: Even if existing charters aren’t renewed because liners replace older chartered ships with owned or chartered newbuilds in 2023-2024, lessor companies still have huge backlogs right now, which do not seem to be reflected in the stock prices.

NOKTA: “When we look at valuations of Danaos [NYSE: DAC] or Global Ship Lease [NYSE: GSL], they’re not getting credit for the backlog they have. I don’t want to say these stocks are misvalued, because we don’t know what the future holds. But there’s a lot of pessimism at this point.”

Who’s buying container shipping stocks?

AMERICAN SHIPPER: Container shipping has clearly entered a downcycle for a potentially extended period. What’s the appeal of either a container liner or ship lessor stock at this stage of the cycle? Who’s interested in container stocks this year?

NOKTA: “There has been a lot of institutional investor interest. I’ve been surprised. In my experience as a shipping analyst, there haven’t been a lot of institutional investors who’ve cared about container shipping, at least in the U.S. They’ve tended to be more focused on tankers and dry bulk. I would say the most actively talked-about sector in my coverage, especially since I joined Jefferies, is container shipping. It’s the value players who are looking at it.

“Investors typically leave when spot rates decline. Nobody wants to catch a falling knife. And historically, even when rates bottom in tankers and dry bulk, that is not a trigger for people to decide to go long. They still need to see a recovery and believe in a recovery.

“My sense when talking to investors is that it’s a bit different in this cycle for container shipping. Investors don’t want to be involved right now as freight rates are still declining. But the moment we start to see some stability in freight rates, I think buyers are going to be flocking into this sector because of the value these stocks hold. People are really chomping at the bit to buy these stocks the moment there’s stability in freight rates.”

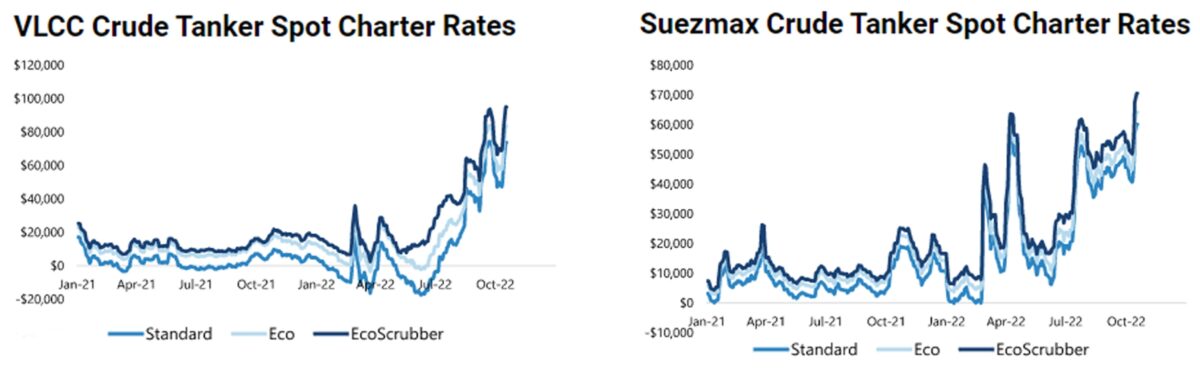

Tanker stocks on rise but face recession risk

AMERICAN SHIPPER: Tanker stocks are in many ways the mirror opposite of container stocks. Tanker rates were at record lows when container rates were at record highs. As container rates peaked and started falling, tanker rates headed up. And while container-ship capacity on order is historically high, the tanker orderbook is historically low. Crude and product tanker rates and asset prices are now very strong. To play devil’s advocate, though, the sustainability of the tanker market comes down to demand — and there are widespread predictions of a global recession in 2023. How big of a risk do you think this is?

NOKTA: “It depends on the magnitude of the recession. Looking at the past two recessions, in 2009 versus 2008 coming out of the financial crisis, oil demand fell about 1% for 12 months and went back up starting 2010. In 2002 versus 2001, you actually still had oil demand growth. We see [recession risk] as a short-term headwind within a broader upcycle that will last the next three-plus years.”

AMERICAN SHIPPER: There’s also the war factor. There has already been a huge effect on tankers from the Russia-Ukraine war, particularly on product tankers and smaller and midsize crude tankers. The EU ban on crude imports from Russia and the G7 price cap begin on Dec. 5, which is practically tomorrow from an oil sourcing point of view. How do you see this affecting tanker rates?

NOKTA: “The biggest thing we see is that the EU ban is going to cause a real rerouting of vessels, which can’t happen overnight. That will cause charterers to start booking ships much further ahead of time. It will also create new trading patterns, which in my experience take a year and a half to two years to smooth out. There will be logistical problems. All of which usually means higher freight rates.”

Who’s investing in tanker stocks?

AMERICAN SHIPPER: You talked before about tanker investors not going all in at a perceived bottom but instead waiting until they believe in a recovery. Tanker rates are now far above the bottom. But there’s this recession risk and war uncertainty. Where are tanker stock buyers on the spectrum of believing in a sustainable recovery? And who’s buying these tanker stocks?

NOKTA: “You typically have three buckets of tanker investors. There’s the hedge funds. You can always count on them to be involved. Then there’s the long-only investors, which you get when the stocks start to screen better, report good earnings, year-over-year increases in earnings and forecasts for higher earnings.

“Tanker owners haven’t actually reported any positive earnings yet, especially on the crude side. But some will in the third quarter and definitely in the fourth quarter. So, we’re now starting to attract this second batch of investors, the long-only investors.

“I don’t think we’ve broached the third batch of investors yet: the dividend income funds and dividend-oriented retail investors. Those start to come in when you see actual dividends. And that’s when we think the valuation gets the highest, because these people start to pay up for the [dividend] yield.

“This group is really crucial and we’ve been missing it since the financial crisis. You haven’t really had the divided-income investors in tankers because anytime since 2008 that a tanker company has been able to declare a dividend, it has only lasted one to three quarters until it went back down. We think this time around dividends are going to be sustainable, with meaningful payouts.”

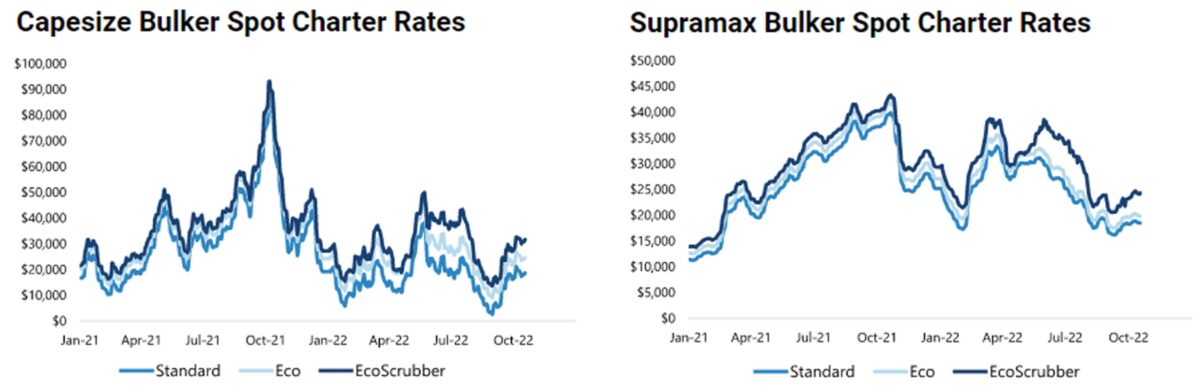

Dry bulk’s surprise collapse

AMERICAN SHIPPER: The dry bulk sector had an exceptionally good year in 2021. Many dry bulk stocks were up triple digits last year. In some cases, they did better than container stocks. A year ago, sentiment was sky high. Since then, dry bulk sentiment has completely collapsed. Rates are down sharply. This surprised a lot of people. What happened to dry bulk?

NOKTA: “Dry bulk had its best year in a long time in 2021. What drove that was really the minor bulks [dry cargoes excluding iron ore, coal and grains]. Minor bulks such as forestry products, cement, fertilizer and sugar make up 40% of dry bulk and are the most in line with GDP trends.

“We also had the steel market doing very well, both in China and outside of China [steel drives iron-ore and coal imports] and a resurgence of coal [for fuel use].

“That was in the first half of 2021. In the second half, China basically backed away from the steel market and we saw a real slowdown of iron-ore imports into China. However, steel production outside of China continued to grow very aggressively in the second half of 2021.

“In 2022, the minor bulk trades that were carrying the market last year suddenly started to ease. But the biggest problem, I would say, was that steel output outside of China came down. It’s been down 10% year over year in each month since March. Capesizes [larger bulkers that carry iron ore and coal] have not seen enough iron-ore cargo demand, which has really masked a phenomenally strong coal trade.”

AMERICAN SHIPPER: You mentioned the correlation between minor bulks and GDP. Dry bulk in general, particularly given its exposure to China, seems very exposed to the risk of a global recession, which again, many economists are talking about. If this is a big demand risk on the tanker side, I’d assume it’s an even bigger demand risk on the dry bulk side.

NOKTA: “Theoretically, in a recession, oil consumption is more inelastic. So, you shouldn’t have a severe correction [with tankers]. But in dry bulk, the fear of course is that if we’re in a recession, projects get put on hold, there isn’t as much construction and you’d get a substantial decline in dry bulk volumes.”

AMERICAN SHIPPER: On the positive side for rates and stocks, the dry bulk orderbook is almost as small as the tanker orderbook. But going back again to your comment on commodity shipping investors needing to believe in a recovery, first, we can’t even be sure we’ve hit bottom yet in dry bulk. Second, we’ve just had a surprise rate collapse within the past year, so it seems even less likely for investors to have faith in a future recovery. What’s the investment thesis for buying a dry bulk stock at this point?

NOKTA: “To be honest, I’ve been a little bit surprised because there’s more interest than I would have thought. It’s on the premise of Chinese economic activity being stimulated and the resultant impact on dry bulk. The people I’ve spoken with are looking to invest on the premise that the Chinese are set to start pumping money into the system.

“At least dry bulk has finally got its [vessel] supply side figured out, and I think stimulus in China would definitely be helpful. But I don’t actually think that’s going to be enough. I think it’s going to take other steel-producing countries to start recovering as well. And I think this is more of a 2023 story. Whether that’s the first half or the second is the big question.”

Bigger is better for shipping equities

AMERICAN SHIPPER: Finally, I wanted to ask a more general question about investor interest in shipping stocks. Shipping stocks burned a lot of investors in the decade since the financial crisis. How does that affect their interest now? Also, a lot of the larger-cap shipping stocks went private in the past few years, winnowing the field. Are the remaining equities big enough to provide the trading liquidity institutional investors look for?

NOKTA: “The 2000s were an amazing ride and a lot of people made a lot of money. Since then it has been a tough slide and shipping definitely left investors with a bad taste in their mouth. That was really because private equity caused the downcycle to last much longer than it should have. The overbuild that started in 2006-2008 was exacerbated by the overbuild that took place in 2011-13 on the part of private equity.

“Dry bulk did not earn its cost of capital any year from the financial crisis until 2021. Container stocks didn’t earn their costs of capital until midway through 2020. Tankers did in only one year, in 2015. It was just a massive oversupply of ships that took a decade to work through.

“But this year we’ve seen a real outperformance on the part of tanker and LNG shipping stocks relative to the S&P. Even dry bulk, though it has had a tough year relative to 2021, has outperformed the S&P.

“[As far as the scale of public companies] I think we’re getting there. It has been a long-term process. The biggest shipping companies today are bigger than they were in 2006-2007.

“If the Frontline [NYSE: FRO]-Euronav [NYSE: EURN] deal concludes, we’ll have a $5 billion-$6 billion market cap company in the shipping space.

“In dry bulk, even though it isn’t doing that fantastically, you still have Star Bulk [NASDAQ: SBLK] with a market cap of over $2 billion and Golden Ocean [NASDAQ: GOGL] at $1.8 billion. Dry bulk investors are primarily asking about Star Bulk and tanker investors are primarily asking about Frontline or Euronav or Scorpio Tankers. So, size does matter and size will continue to be a big factor.”

Click for more articles by Greg Miller

Related articles:

- Global trade at the crossroads: Risks from geopolitics, inflation loom

- Shipping lines still raking in billions despite sinking cargo demand

- Tidal wave of new container ships: 2023-24 deliveries to break

- Fall in container spot rates ‘much steeper,’ ‘less orderly’ than expected

- Shipping’s China syndrome: Demand sinks across multiple cargo markets

- Container shipping lines suddenly a lot less interested in renting ships

- Five years on Wall Street: Shipping’s exits, arrivals, whales and minnows

- The plunge in dry bulk shipping: Ominous signal on China’s economy?