The FreightWaves Research Institute was created to recognize the most innovative and disruptive companies in freight and logistics. From an original list of over 500 nominations, the institute first narrowed the original list to the Freight.Tech100, which was then winnowed to the Freight.Tech25. From those top 25 an independent panel of judges by accounting firm Katz, Sapper & Miller (KSM) oversaw the final ordering.

We would be hard pressed to find a more colorful and controversial company than Tesla [NASDAQ: TSLA], making it as high as number 3 on our Freight.Tech list. If you follow FreightWaves at all, you’ve probably seen that our coverage has trended a lot more bear than bull. There are plenty of good reasons to criticize many of the operational decisions and business dealings—not to mention the general inaccessibility of the company (we reached out to them for comment and were not surprised by the radio silence). But if you were to simply evaluate them on innovation and influence, they really are in the globally-sized big leagues.

No doubt much of the public’s fascination with Tesla originates with the personality attributed to it. In February of this year, we compared Elon Musk’s genius and travails to another automotive industry legend in Henry Ford. Whether by dint of ego, eccentricity, naivete, grand Machiavellian scheming, or some weird combination of all the above, there is never a dull moment when it comes to Musk. In fact, the media is so fascinated with the wizard behind the Tesla curtain that “Tesla news” has become a cottage industry. Within just the past 24 hours you can find updates on Tesla 3’s software updates, which include new climate controls and anti-theft features. You can find speculation about what kind of company town will be built around Tesla’s Gigafactories, and about the Solar Roof production ramping up at Gigafactory 2. When did the word Gigafactory become so popular?

In terms of innovation, we should clarify which companies are actually Tesla. The Hyperloop concept originates from a 2013 57-page Musk whitepaper, and there is a Hyperloop that remains a part of the Tesla brand, although the Virgin Hyperloop One seems more likely to break through first in meaningful application. The Solar Roof is also a Tesla company. Other companies that may easily be conflated with Tesla are not, like the Boring Company (laying down Hyperloop infrastructure), and SpaceX. Prodigious innovative talent is part of how we see Tesla as such an engine of innovation. At the same time, it’s easy to conflate the companies for the simple reason that they were all founded by Musk, and they share his vision.

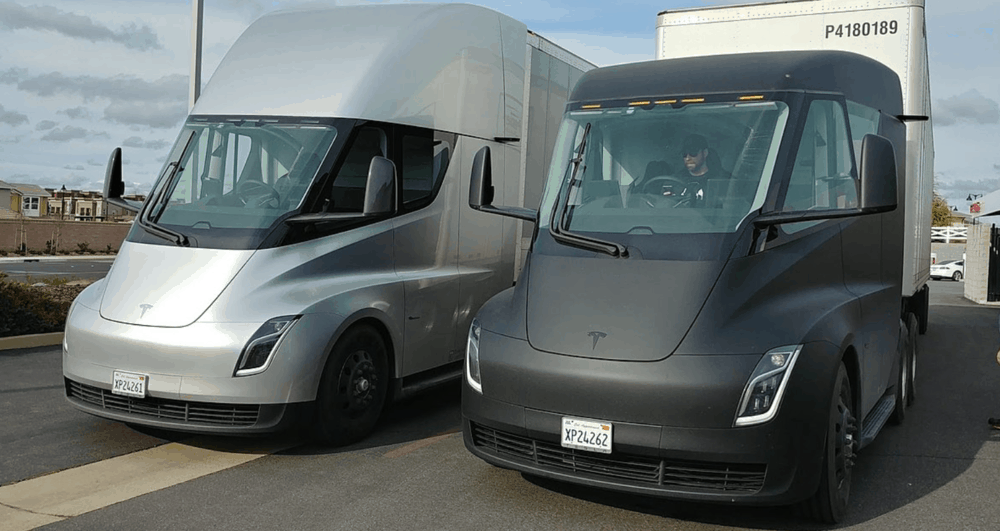

Criticize the business model, call it over-valued, speculate about the machinations of its founder, you must admit that Tesla has set much of the conversation around autonomous and electrification, and incumbents and OEMs across the globe are chasing them. As a case in point, only days after their Q3 earnings report, in which Musk did not discuss the Tesla’s Semi progress, James O’Leary, VP of NFI Industries fleet services said at a symposium, “Nobody in North America was talking about electric vehicles until your local news outlets picked up the rollout of the Tesla Semi. That led basically to what we call the Tesla effect. Now shippers are asking their carriers where you are with electric vehicles.” NFI is a major 3PL, and according to O’Leary, Tesla does in fact have plans to begin delivering the all-electric Semis by 2020. Not to be outdone, Daimler [NASDAQ: DDAIF] and Volvo (NASDAQ: VLVLY] are also tracking on similar timelines.

Indeed rumors of Tesla’s demise remain premature, although no doubt the rumors will persist for the foreseeable future. And the personality of Musk will continue to project the company’s image, even if he has been asked to step down as Chairman of the Tesla board (and yet does remain CEO).

No doubt, there have been plenty of ups and downs throughout the year and we—like the rest of the media—have charted it in endless fascination. The company’s shares fell sharply twice this year, the last time in May when it fell by over 8% in 24 hours, after Tesla’s Q2 earnings exceeded expectations in revenue growth by 26% YOY. The slump wasn’t attributed to the earnings call itself, but to another round of head-scratching statements by Musk who said he didn’t care about the desires of day traders, and asked them to sell his company’s stock—not buy it. He also said he would not answer “boring” questions asked by Tesla’s investors during that very same post-earnings conference call. Yet for all that Musk remained stridently optimistic about the prospects of Tesla, and went on to discuss the construction of a new Model Y factory, and confirmed that the location of the next Gigafactory would be in China.

Perhaps the saving grace for Tesla’s rising the innovative ranks of the Freight.Tech25 is that it did in fact have a breakthrough Q3 earnings report. We noted as much on October 25, writing: “If Tesla can keep generating cash ($881M in FCF this quarter), the company’s current debt load starts looking manageable ($230M in SolarCity convertible bonds due next quarter). In our view, Q3 2018 was Tesla’s best quarter in its 15 year history: the company managed to build cars at scale, control costs (redesigning production and laying off 9% of its workforce), and achieve meaningful profits. On a revenue basis, Tesla’s Model 3 is now the best-selling car in the United States.” While Model 3 gross margins are likely decline as the lower-specced $35K version enters production, Tesla’s cars are still highly desired by consumers and order deposits only decreased slightly to $906M.

Whether it’s the cost of sourcing Cobalt and Nickel, or the challenge of fighting off OEMs and industry incumbents, or how effective the battery innovation turns out, or challenges in the infrastructure to develop charging stations, there remain plenty of headwinds. To even call them headwinds is an understatement. At the same time, you might also say, to quote Frederick Douglas, “If there is no struggle, there is no progress.”