It’s a tale of two oceans for U.S. container imports. Freight rates for Asian exports crossing the Pacific are reaching new heights even as fleet capacity rebounds. Rates for European exports crossing the Atlantic are sliding even as fleet capacity remains constrained.

Prior to the coronavirus, the secular shipping pendulum was swinging toward the East Coast ports. Now, the pendulum is swinging back — at least temporarily. The West Coast is seizing a bigger share of U.S. imports in the COVID era.

U.S. importers sourcing goods in Asia are opting for faster transits to California as opposed to the long route via the Panama Canal to ports on the Atlantic coast. Simultaneously, lower cargo flows from Europe are further curbing the East Coast share.

The East-West split has significant implications for land transport. The more cargo unloaded at the docks in the West, the better for rail and the worse for trucking, and vice versa.

Asian cargo unloaded in California and destined for Eastern states creates more rail volume eastward. Asian cargo unloaded in the East and destined for Eastern states leads to fewer rail miles eastward and more trucking miles westward.

What ocean rate data shows

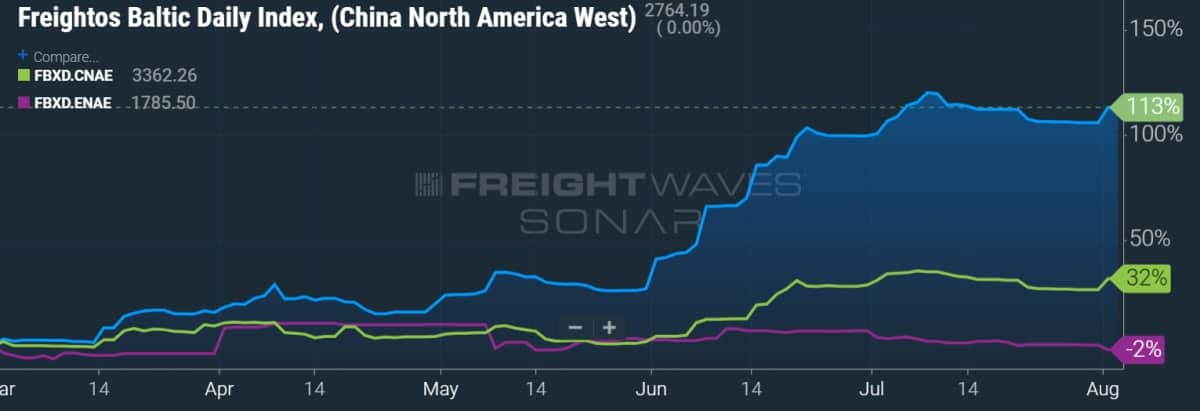

The Freightos Baltic Daily Index — which estimates the cost to ship a forty-foot equivalent unit (FEU) container — reveals how the markets are diverging.

Since the beginning of March, when freight markets were particularly weak, the cost per FEU to ship from Asia to the West Coast (SONAR: FBXD.CNAW) has more than doubled. The cost from Asia to the East Coast (SONAR: FBXD.CNAE) is up by a third. But the cost from Europe to the East Coast (SONAR: FBXD.ENEA) is down by 2%.

What customs and rail data reveal

This year’s swing to the West is clearly visible in data on the number of customs filings for maritime imports (each filing can be for any cargo volume).

Looking at the seven-day trailing average of daily filings since March 1, the number of customs forms has almost quadrupled in Long Beach, California (SONAR: ICSTM.USLGB). It has more than doubled in Los Angeles (SONAR: ICSTM.USLAX). But customs filings in New York/New Jersey (SONAR: ICSTM.USNYC) are flat and those in Savannah, Georgia (SONAR: ICSTM.USSAV) are down 2%.

The rail data tells the same story. Since March 1, 40-foot loaded containers on rail from Los Angeles to Chicago (SONAR: ORAIL40L.LAXCHI) are up 64%. Volumes from New Jersey to Chicago (SONAR: ORAIL40L.EWRCHI) are up only 6%.

Trouble on the Atlantic

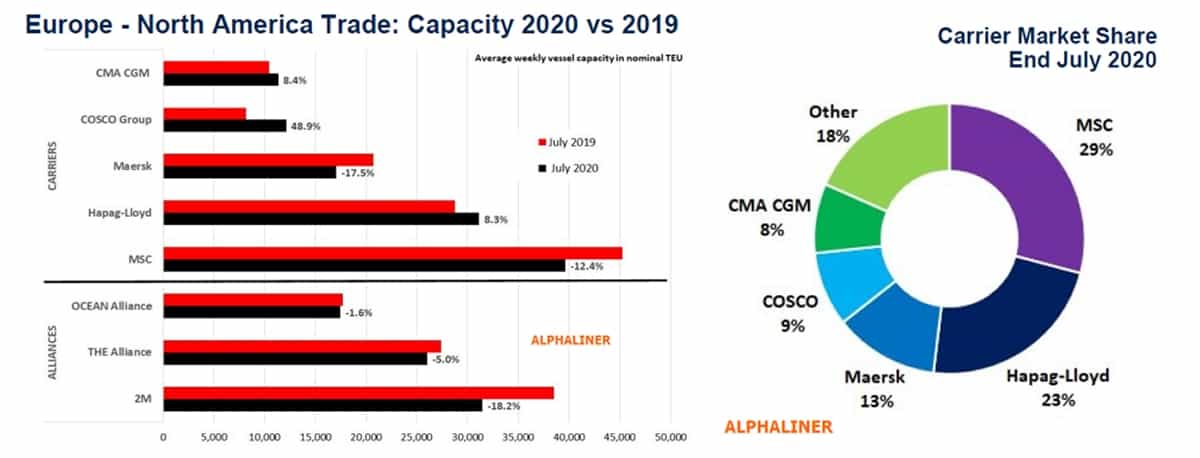

“The Europe-North America trade is not yet enjoying increased cargo demand,” said Alphaliner in its latest weekly newsletter. “Whereas most blanked [canceled] sailings have already been reinstated on the trans-Pacific … more void sailings have already been announced for the trans-Atlantic trade.”

Alphaliner reported that weekly Europe-North America capacity was down 4.8% in July versus the same month last year. “MSC and Maersk have made the biggest efforts to reduce capacity,” said Alphaliner, referring to the partners in the 2M alliance, which has temporarily halted one of its four North Europe-East Coast loops.

Copenhagen-based eeSea.com provides FreightWaves with data on carrier blank sailings based on U.S. arrival date. The latest data shows that sailing cancellations remain relatively high on the Europe-U.S. westbound route, averaging 7.3% in the third quarter versus 9.3% in the second quarter.

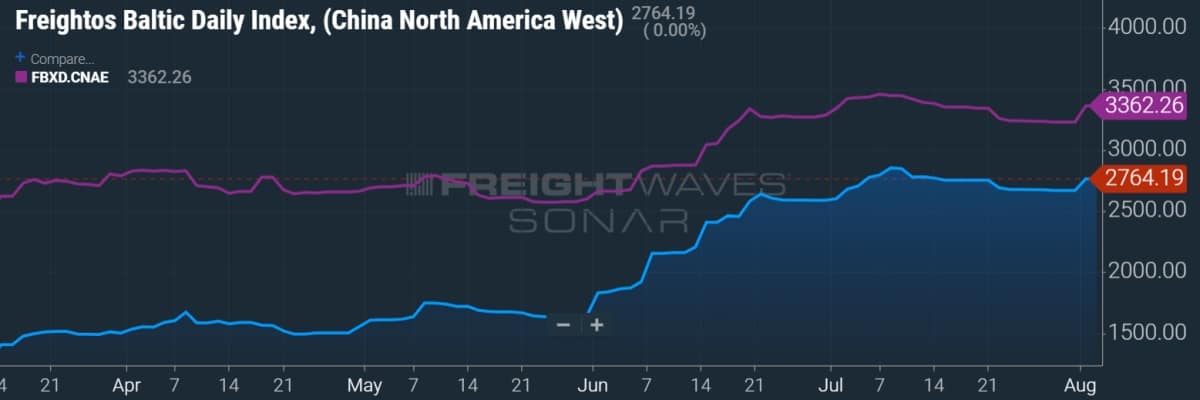

The Europe-U.S. rate had fallen to $1,785 per FEU on Tuesday, down 8% from the COVID-era high on June 7, according to Freightos data. The fact that trans-Atlantic rates are sliding at the same time ship capacity remains tempered underscores that transport demand is falling.

“The crisis on the westbound trans-Atlantic is getting worse,” warned Steve Ferreira, founder and CEO of Ocean Audit.

“Shipments of wine are always one of the bellwethers of westbound trans-Atlantic trade health,” he told FreightWaves. Imports of wine from Italy, France Spain and Portugal were down 24% in May-July versus the same period last year, he said. Overall container volumes were down 18%.

“The wine drop is especially alarming considering the pandemic and the increase in alcohol sales, meaning the consumer is shifting to other types of alcoholic beverages. As for auto parts [shipped trans-Atlantic] – forget it,” said Ferreira, noting that auto-parts volumes in May-July were just a third of levels seen a year ago.

Booming rates on trans-Pacific

The contrast with the other ocean trade is stark.

In the trans-Pacific, carriers have brought back much more of the capacity that they previously blanked. The eeSea.com data shows that carriers have blanked 5% of third-quarter Asia-U.S. eastbound sailings versus 14.7% in the second quarter.

Despite the quarter-on-quarter increase in ship capacity, rates are rising.

Rates climbed through June and the first week of July, then pulled back slightly through the rest of the month. Then they bounced up again in the first few days of August, following the fourth general rate increase (GRI) since early June.

Asia-West Coast rates had risen to $2,764 per FEU as of Tuesday, according to Freightos.

“These elevated rates are quite surprising,” said Freightos Chief Marketing Officer Eytan Buchman. Rates “point to how unprecedented the current environment is for ocean freight,” he said.

“The rebound in demand that started in June continues to keep rates up,” continued Buchman. Carriers are charging premiums to prevent rolled cargoes. Ships sailing from China are “very full.”

According to Buchman, “Some industry insiders are predicting that this year’s version of peak season will last only through September and will focus on stay-at-home goods like furniture, kitchenware and electronics.” In other words, current trans-Pacific demand could, to some extent, be borrowing from the future. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINER SHIPPING: Are trans-Pacific carriers guilty of price gouging? See story here. A look at recent trans-Pacific trade trends: see story here. For an in-depth Q&A on blank sailings with Sea-Intelligence CEO Alan Murphy, see story here.