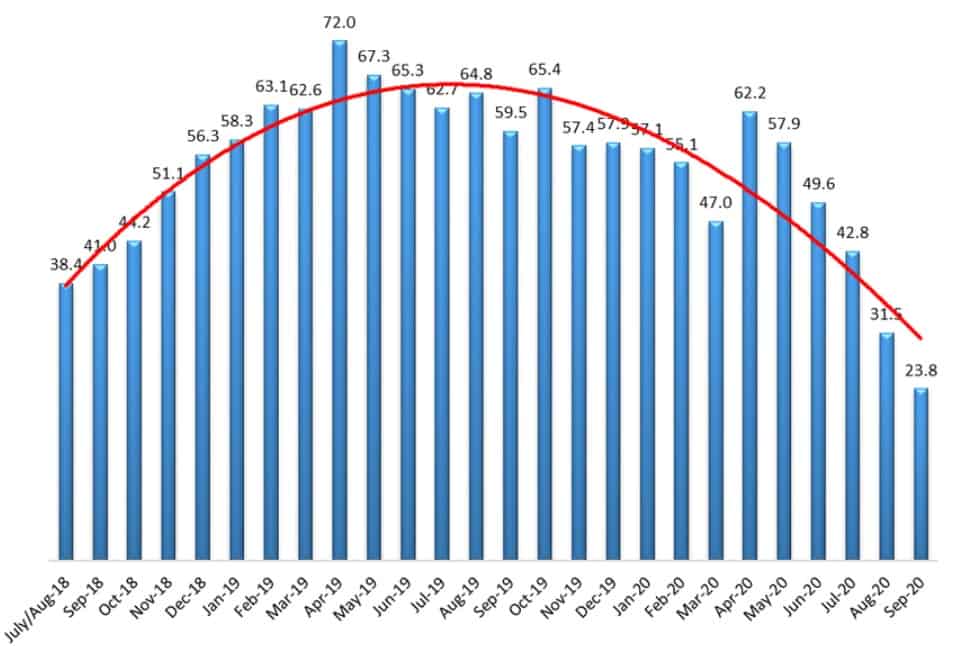

A September supply chain survey shows transportation capacity has reached new lows. The Logistics Managers’ Index (LMI), a survey of leading logistics executives, showed capacity fell to new lows, dipping another 770 basis points during the month to a 23.8% reading.

The LMI is a diffusion index, wherein a reading above 50% indicates expansion and a reading below 50% indicates contraction. The survey captures the rate of change in activity for key supply chain trends in areas like transportation, inventory and warehousing.

The September transportation capacity reading was the lowest level ever for any of the eight metrics the survey tracks. The capacity situation was even worse for “downstream firms,” or those closest to the consumer, at 16.3%.

“Clearly consumer-facing firms are struggling to find the capacity needed to meet the increasing consumer appetite for home delivery,” the report stated. “It is interesting that logistics capacity is already this pressed at the end of Q3. Traditionally Q4 is when we see peak logistics demand, so the fact that it’s already close to maximum utilization calls into question whether or not missed or late deliveries will become an issue through peak retail times in November and December.”

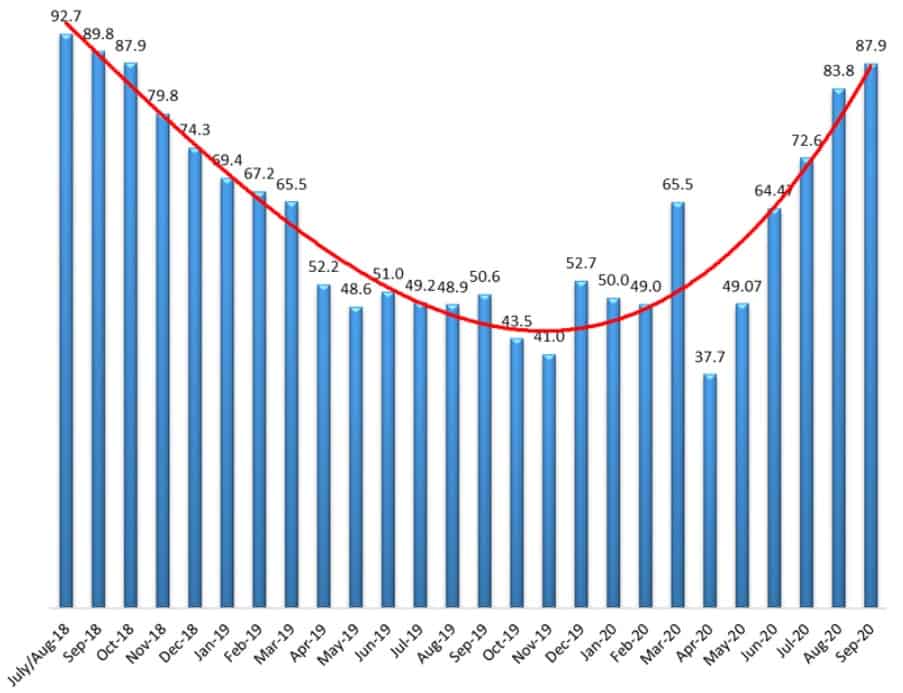

The lack of available capacity was also “reflected in the premium firms are paying.” The transportation pricing subindex increased 410 basis points in the month to 87.9%, the highest reading since October 2018. “Observing the last two years of transportation prices shows a U-shaped trend, with September’s rate of growth representing a return to the heady days of mid-to-late 2018,” the report stated.

The overall index increased 450 basis points from August to 70.5% in September, the first reading north of 70% since October 2018 and only the sixth time the index has breached 70% since its inception in 2016. The index bottomed during the depths of the pandemic-induced shutdowns in April at 51.3%.

“Growth rates in the logistics industry are roaring” because of e-commerce, the report said.

“Digital-heavy retail methods allow concerned shoppers to avoid in-person stores but are also more logistics resource intensive. Logistics-intensive commerce becoming a more significant proportion of retail activity explains why the metrics tracked in the LMI are increasing at rates not seen since mid-2018, in spite of the relatively modest overall economic growth,” it said.

Capacity declines to moderate, pricing to remain high

The survey captures 12-month forward-looking expectations as well. Respondents indicated that they expect capacity to continue to contract over the next year but at a more subdued pace. The future indication for capacity registered at 48.1%, still in contraction territory, but up significantly from the August prediction of 31.7%.

However, increases in transportation pricing show no signs of letting up. Survey respondents registered an 85.8% reading for the index one year from now, implying that the current high rate at which transportation pricing is increasing is expected to continue. “Respondents clearly expect the continued tightness in the freight market to result in increasing costs – with no relief in sight.”

Inventory and warehousing

The rate of inventory growth moved higher, up 330 basis points to a 61.4% reading during the month. Inventories have remained in expansion territory since March. “Bustling port activity as firms move to replenish the inventory from international suppliers that they were unable to procure early in the summer” was listed as the primary reason. Additionally, the costs to hold inventory remain on an upward trajectory, up 110 basis points at 65.8%

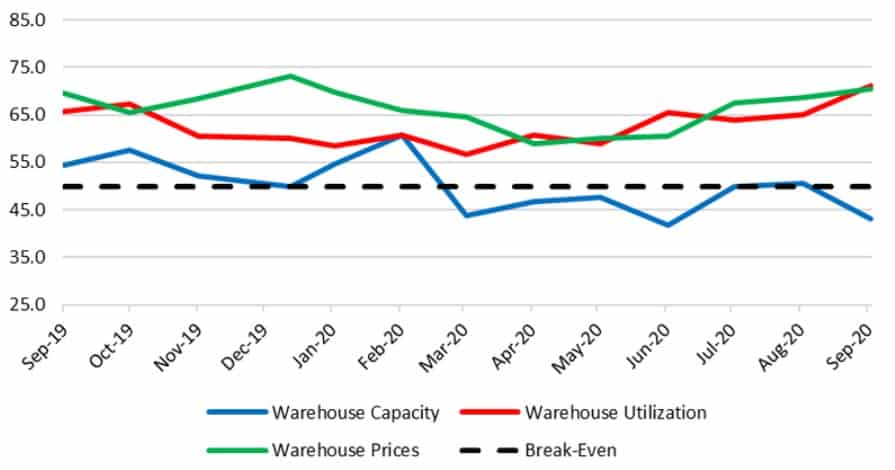

All of the warehousing metrics – capacity, utilization and prices – continued to show tightening in the logistics real estate market. Capacity declined 740 basis points to contraction territory at 43.1%, with utilization increasing 590 basis points to 71.1%. The warehousing prices component increased 190 basis points to 70.5%.

“At this point it seems likely that these high rates of growth will continue even if the overall economy is slow in Q4. The dramatic reliance on logistics services due to the pandemic may insulate the industry from moderate economic downturns in the near future.”

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.