Transportation prices fell in February at the fastest rate recorded in the six-and-a-half-year history of a monthly survey of supply chain executives.

The Logistics Managers’ Index (LMI) registered a reading of 36.1 for transportation costs in February, 5.9 percentage points lower than in January and below the prior record, which was established in December.

A level below 50 indicates contraction while one above signals expansion.

The report said the rate declines were “a little more pronounced in the later portions of the month than in the beginning of the month.”

“February is generally a low point seasonally due to the consumer spending hangover from the holidays in the U.S. combined with slowness in imports due to Chinese New Year, and that was certainly reflected this year,” the report stated.

It also acknowledged the large sequential decline from January was likely tied to severe winter storms in December, which pushed shipments into January, providing a bump in demand and the rate index.

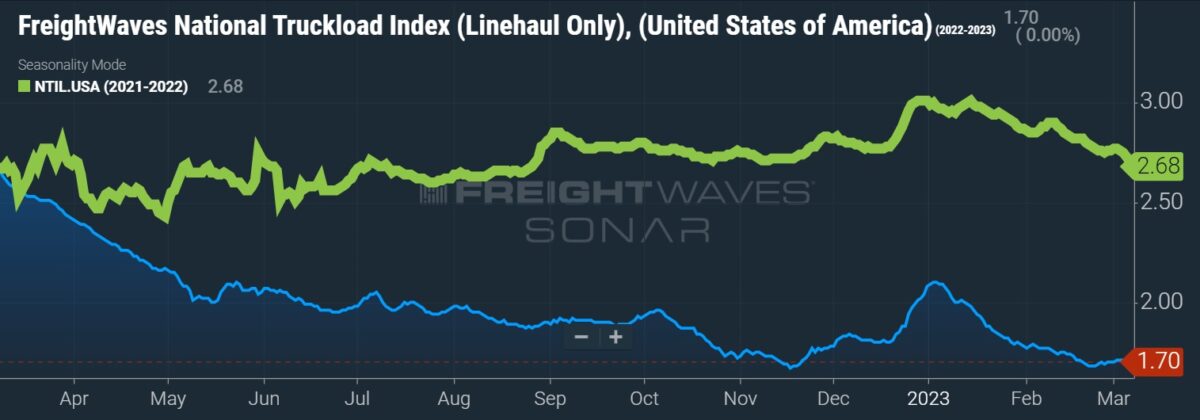

The rate commentary in the report was similar to the movements seen in FreightWaves’ spot truckload rates. Spot rates stepped notably higher in late December and early January but declined through February.

Transportation capacity (70.4) expanded at a high rate again in February, hovering near the all-time high of 73.1 recorded in October.

Transportation utilization (51.9) remained in growth territory, albeit 5.1 points lower than in January. Downstream respondents, mostly retailers that are closer to the consumer, registered a utilization reading of 59.5, while those upstream at the wholesale level returned a reading of 45.1.

Downstream supply chain operators also provided a higher reading for transportation prices (44.9) than those upstream (30.6).

“Downstream respondents are much more bullish on future growth across transportation metrics than their Upstream counterparts,” the report said. “If those future predictions were to bear out, we may find ourselves in a situation similar to 2019, where the transportation market is down due to weakness in B2B freight, but the overall economy and some elements of the logistics industry are buoyed by strong consumer spending.”

The report pointed to recent less-than-truckload intraquarter updates, suggesting shipments have stabilized, as reason to believe the cycle may be nearing a recovery.

“While the freight recovery has not yet begun, it does seem that we may have hit, or at least gotten close to, the bottom of the market,” the report said.

When asked about transportation prices over the next 12 months, respondents returned a neutral level of 50. However, those downstream (61.5) were expecting meaningful increases while those upstream (44.4) expect rates to contract.

Inventory levels (62.4) expanded at a similar rate to January, “lending further credence to the idea that firms are continuing to rebuild inventories after running them down through much of the back half of 2022.”

Inventory costs (70.9) still grew at a fast pace but the subindex was down 3.3 points sequentially.

Warehousing capacity (56.6), up 10.2 points sequentially, moved into expansion territory for the first time after 30 months of contraction. However, warehousing utilization (70.3) continued to climb, up 3.2 points during the month, and warehousing prices (73.3) remained elevated but 13.1 points lower than a year ago when inventories peaked.

“A lack of supply has been the primary driver behind inflation over the last year; this includes the lack of the necessary supply of warehousing,” the report stated. “As warehousing becomes more available, supply chains will become more efficient, and the costs of holding and moving goods will decrease — something that should have a significant impact on inflation.”

Overall, the LMI stood at 54.7 in February, down 2.9 points from January.

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.

More FreightWaves articles by Todd Maiden

- ArcBest’s Q1 update shows impact of dynamic pricing model

- Old Dominion says shipments ‘have largely stabilized’

- Saia’s tonnage declines carry into Q1

Adrian D. Morgan

Buz is exactly right. Flying the moronic flag of ” out of control spending “, exhibits the lack of responsibility to truckers and us as citizens of the United States. Government is the only entity that can cause inflation.

Buz Apodaca

The main reason for inflation is out of control government spending. They make a big deal of having to raise interest rates. The government, evil morons out of control IS THE REASON OF INFLATION.

I DON’T CARE IF U EXHIBIT MY NAME OR EMAIL.

BUZ ALFRED LEE APODACA