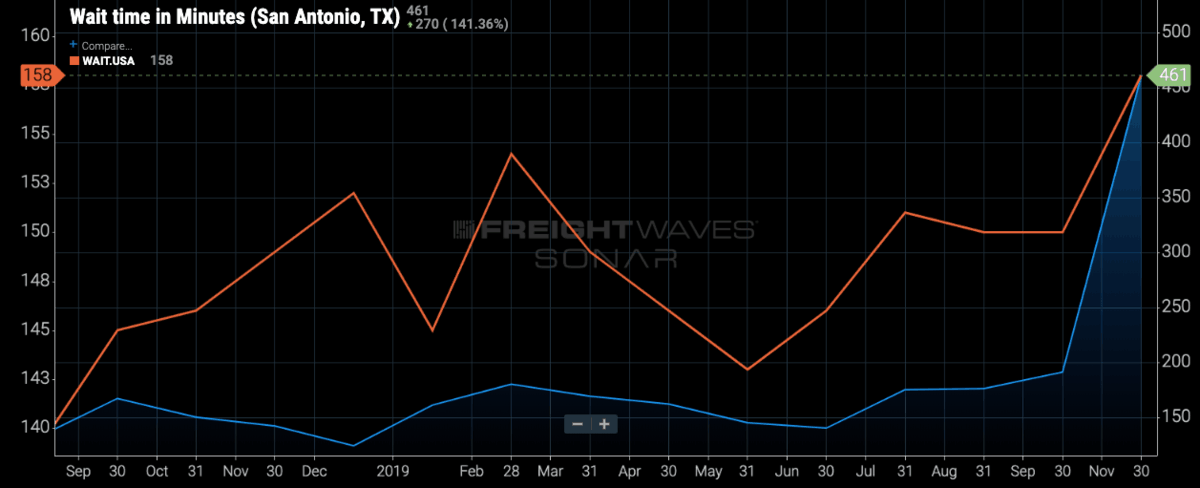

San Antonio was at the top of the list for wait times for truckers in November and early December, increasing to as much as 7.7 hours, according to FreightWaves SONAR data.

Normally El Paso and Laredo, Texas, are the worst offenders on or near the U.S.-Mexico border for trucker wait times.

Logistics professionals said the increase in San Antonio could be a mix of factors, including large volumes of shipments moving across the South Texas region, as well as carriers that service Mexico using San Antonio as a distribution point.

“A ton of carriers that service Mexico use San Antonio for a yard location instead of Laredo,” Matt Silver, CEO of Chicago-based Forager, told FreightWaves. “I think there’s also more facilities being built there as a distribution point out of Mexico instead of Laredo or Dallas because of how congested those cities are becoming.”

Forager is a freight tech company focusing on freight from Mexico and Canada. Silver said one of Forager’s customers has a facility in San Antonio that it used as a distribution point.

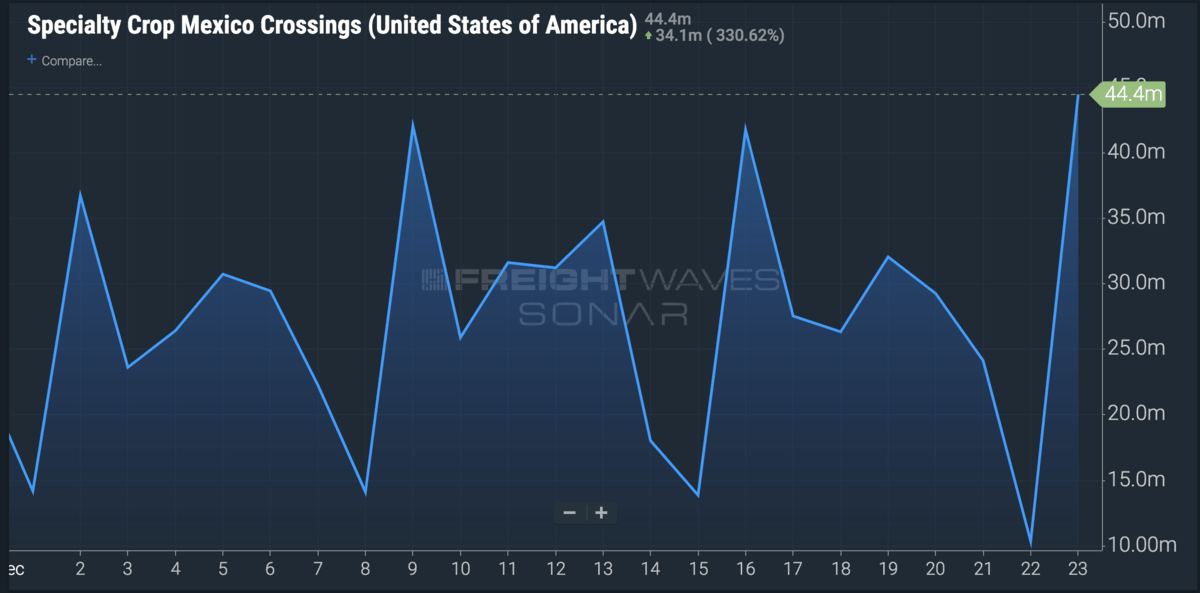

The produce season in Mexico is currently in full swing, with imports including avocados, tomatoes, bell peppers, and onions moving across the border. Other produce that the U.S. imports from Mexico includes squash, limes, lettuce, celery, broccoli, strawberries and cucumbers.

The average weight of specialty crop crossings from Mexico — the daily total pounds of truckload movement of non-grain crops entering the U.S. at one of the Mexican border crossings — jumped 32% from the third quarter to the fourth, according to FreightWaves SONAR data.

Gerardo Alanis Barrios of Laredo-based Cold Chain Solutions said San Antonio has always had a number of distribution centers.

Cold Chain Solutions is a refrigerated carrier and refrigerated cross-dock operation servicing the refrigerated and frozen industry in Mexico, Canada and the U.S.

“Some companies with San Antonio distribution centers that come to mind are H-E-B and Pure Hothouse Foods,” Barrios said.

San Antonio-based H-E-B is the sixth largest grocery chain in the U.S., with 350 stores in Texas and northern Mexico.

Pure Hothouse Foods Inc., a Leamington, Ontario-based company, has had a presence in San Antonio since 2011. In 2015, Pure Hothouse opened a 60,000-square-foot distribution center in San Antonio.

“Bottom line, In the refrigerated industry, I would say Dallas is still leading,” Barrios said. “If I had to guess, I would say one of the reasons Dallas is so attractive is rates. Congestion tends to have a negative effect on rates. As a carrier, I can tell you rates coming out of Dallas are very low.”

Ben day hoe

Going to the bathroom in the driver’s seat for the next driver to sit in you pody

Judi Girard

Hours of service for these truckers, all truckers, needs new revisions on standby times.

Landon Hartline

Charge more and it will stop. It’s all about $$$$$$$$