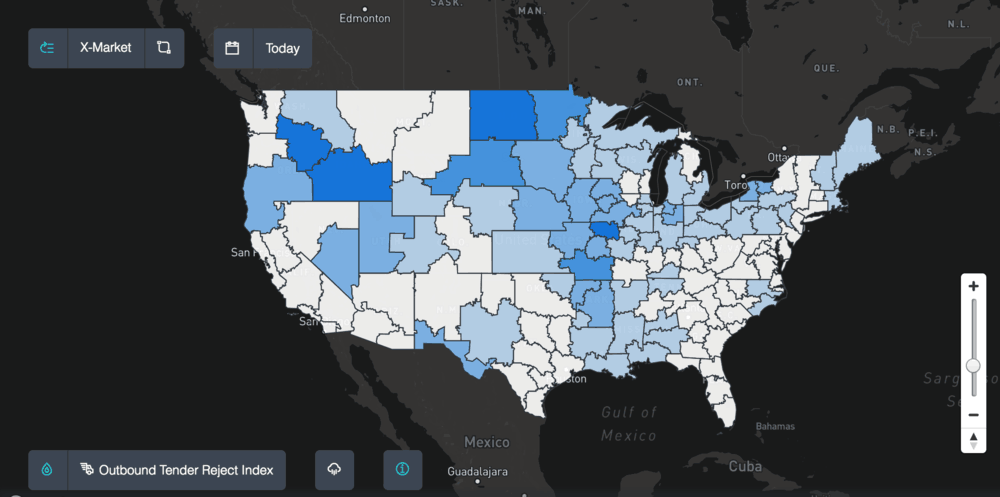

Back-to-back major snowstorms in the Midwest have tightened freight markets in the region as trucking capacity flows South in search of more favorable conditions. In the past week and a half, carrier sentiment started changing and rates into the Southeast fell significantly. Retail freight in Southern California and cross-border lanes is still pulling capacity away from northern markets, driving up turndowns and compressing broker margins.

This week, another winter storm threatens to drop ice and snow on a broad swath of the country from Oklahoma City through Missouri, Kentucky, and Virginia. We’ll be watching to see if bad road conditions continue pushing capacity into the Southeast, which is already becoming an oversupplied market.

Aside from capacity distortions in the Pacific Northwest and Midwest, much of the country has stabilized, with regional volumes for the most part matching expected seasonal trends.

“For us, in the final week of November, we had record high volumes. What’s interesting is we’re seeing things settle back down,” said Duke Begy, EVP of Customer Sales at Arrive Logistics, in a phone conversation.

“The Midwest is the tightest market for us right now,” Begy continued. “Freight out of the Southeast and Texas has been fairly easy. California has opened up. Most of the country is in a normal pattern, historically speaking.”

Indeed, volume outbound from Los Angeles (OTVI.LAX) dropped 5.7% since November 30 while capacity (TRUK.LAX) has remained stable. Spot rates from Los Angeles to Dallas (DATVF.LAXDAL) plummeted 20% since Thanksgiving weekend, down to $2.01/mile.

Meanwhile, it’s getting harder to move loads in Midwestern markets. Carriers are rejecting 28% of loads outbound from Omaha (OTRI.OMA) and Kansas City (OTRI.MCI); turndowns are up to 39% in Joplin (OTRI.JLN).

Capacity in the Southeast, however, has loosened and it’s become much easier for brokers to find trucks.

“We have seen capacity loosen up drastically in the last seven days,” Carter Garrett, VP of Sales at Trident Transport, wrote to FreightWaves by email. Garrett wrote that regional moves in the Southeast have become much less expensive—the examples he gave were from Tampa to Orlando, Chattanooga to Birmingham, and Fairfax, Virginia to Jessup, Maryland. “All have seen a 15-20% drop in rates for us,” Garrett wrote.

According to DAT’s RateView tool, spot rates for dry vans from Atlanta to Tallahassee fell in the past week to $2.46/mile net of fuel from $2.60 in November.

“On the van side, there’s a lot of difficulty in the Pacific Northwest,” Jason Roberts, Director of Business Development at Avenger Logistics, told us by phone. “There’s still a lot of retail stuff pulling capacity out of the Pacific Northwest down to the south,” Roberts said. “Laredo specifically has been wide open; capacity is very loose over there. Houston has loosened up a bit.”

Roberts said that Avenger has not had any trouble covering regional moves within the Southeast, and that his team has benefited from falling rates. He added that volumes have dropped coming out of California, making it easier to service his customers. Avenger’s biggest challenge, Roberts emphasized, was in the Pacific Northwest—he tries to push his regional carriers up into the market to position them for the region’s peak, “where the money is. Typically going south to north up there is really expensive, but we’ve been trying to get aggressive on those rates and hold on to them.”

“The money isn’t the problem—the rates are there, it’s just getting the people up there. In the PNW and California volume stays up until the fifteenth or so of this month and then it’s gone,” Roberts said.

“For the first quarter, we’ve tried to strategically balance our van and our flatbed business. When one goes away, the other one rises. We have customers doing dredging and beachside work, so we do shore piping and work when people aren’t on the beaches. There’s a lot of good freight in that Gulf area for us to snatch up,” Roberts said.