Uber Technologies, Inc. (NYSE: UBER) reported a net loss of $1.16 billion in the third quarter of 2019, ahead of the consensus expectation calling for a $1.5 billion loss. Excluding stock-based compensation expense, the loss was $761 million, better than the company’s second-quarter loss of approximately $1 billion, which excluded stock-based compensation and one-time driver awards.

Uber announced it will now report its financial performance through five reportable segments: Rides, Eats, Freight, Other Bets, and Advanced Technologies Group (ATG) and Other Technology Programs.

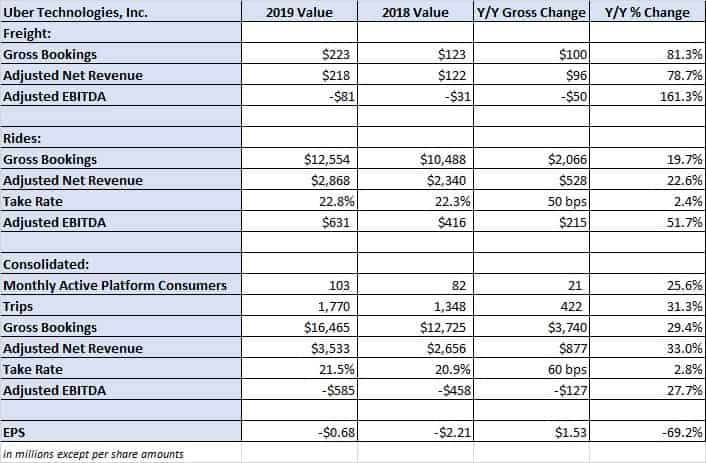

The company’s digital freight brokerage division, Uber Freight, reported a $100 million increase in gross bookings to $223 million. Loads in the freight division increased by more than 100% year-over-year, however the actual number of loads handled by Uber Freight was undisclosed.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was a loss of $81 million in the quarter, $50 million worse on a year-over-year basis. Previously, the company reported Uber Freight’s results through its Other Bets division, which saw a second-quarter 2019 net loss of $122 million.

The company reported that the freight division grew the network to more than 50,000 carriers and made reference to having some of the nation’s largest carriers as users of the app.

The press release noted that although the Uber Freight app is only 2 years old, more than 50,000 carriers have used it. “Several of the top-10 national carriers are already regular participants in our network and our shipper list includes several Fortune 50 customers.”

Prior to the third-quarter earnings report, revenue in Other Bets consisted primarily of Uber Freight. Other Bets generated $373 million in revenue during 2018.

On a consolidated basis, total revenue was up 30% year-over-year at $3.8 billion, compared to the consensus estimate of $3.68 billion. Gross bookings increased 29% year-over-year to $16.5 billion. Monthly active platform consumers increased 26% in the quarter to 103 million. Uber’s active users surpassed the 100 million threshold in July. Adjusted EBITDA was a loss of $585 million, $127 million worse than the same period last year but better than the $656 million EBITDA loss recorded in the second quarter of 2019.

Uber now expects an adjusted EBITDA loss of $2.8 billion to $2.9 billion in 2019. The company’s prior guidance called for a loss of $3.2 billion to $3 billion.

“Our results this quarter decisively demonstrate the growing profitability of our Rides segment. Rides Adjusted EBITDA is up 52% year-over-year and now more than covers our corporate overhead. Revenue growth and take rates in our Eats business also accelerated nicely. We’re pleased to see the impact that continued category leadership, greater financial discipline, and an industry-wide shift towards healthier growth are already having on our financial performance,” said Uber CEO Dara Khosrowshahi.

Most investors remain focused on the company’s lock-up period that ends Wednesday, Nov. 6. Lock-up periods prevent restricted shares, typically issued to the company’s executives and other interested parties, from being sold on public markets for a set period of time following the company’s initial public offering. Analysts have expressed concern that as much as 90% of the company’s outstanding shares will be eligible for trading on the public market once the lock-up period expires, potentially placing downward pressure on the stock if a large percentage of those shareholders look to liquidate their position.

Shares of Uber and its ride-hailing competitor Lyft (NASDAQ: LYFT) have been under pressure since the passage of California’s Employee and Independent Contractors bill, otherwise known as AB5, which goes into effect next year. AB5 essentially lowers the threshold for classifying a worker as an employee versus an independent contractor and threatens the wage-and-benefit cost structure of service providers using a contractor model in the state. Uber and Lyft are seeking to put a ballot proposal in front of California voters in efforts to upend the new legislation.

Lyft beat analyst forecasts last week, losing more than $460 million in the third quarter, more than half of which was related to stock-based compensation and payroll tax implications. Lyft expects to post positive EBITDA by the end of 2021, a year ahead of analyst expectations.

Uber expects to see full-year EBITDA profitability in 2021.

Noble1

I’m starting to look into this UBER and I like what I see , a lot .

Take for example their growth in freight load volume during a soft market . It’s quite impressive . This will be something to keep an eye on from quarter to quarter .

If I look at what one carrier in Canada had to say according to another article on freightwaves , UBER is quite efficient .

The article I’m referring to is titled :

“Today’s Pickup: Canadian carrier sees Uber Freight as a “game-changer””

Quote:

“Montreal-based Transport DSquare got an early taste of the platform on a Mississauga-Montreal haul and sees good things for the Canadian freight market.

The core haul involved a food shipment from the Toronto suburb of Mississauga to Montreal, with a backhaul to Bolton, Ontario. A local haul from nearby Brampton to Mississauga got tacked onto the start.

“Normally you don’t see that,” Darbyson said of the local move incorporated into the backhaul.

“Uber gives us access to clients that we otherwise couldn’t get,” Darbyson said. “Now we can compete with the larger carriers on service. That to me is a game-changer.”

And from 2012 to 2018, Uber’s net revenue per quarter rose from $1.4M to $2.97B.

And by the way , I’m a BIG TIME contrarian , it’s in my nature . So according to the “negative sentiment” I see posted here , I’m “feeling” very comfortable , LOL ! To give you an example , look at what occurred since my “positive comment ” on 11/06/2019 at 6:40 am , the stock opened with a gap down and has been closing hire than its open since then . (wink)

However , I’m going to refrain from calling this one publicly as I did with CH Robinson lately . I want to prevent potentially attracting followers , LOL ! That means , hmm I don’t know , perhaps UBER’s price will collapse tomorrow , perhaps not . LOL !

And for the record , I don’t BS . You can view my “call” on CH Robinson on freightwaves under the article titled :

“Freight recession catches up to C.H. Robinson, causing earnings miss”

Best of luck to you !

In my humble opinion ………..

Noble1

WOW Uber is growing rapidly !

Quote:

“Uber CEO Dara Khosrowshahi predicted Monday the money-losing ride-hailing company will achieve an adjusted-earnings profit in 2021.”

On another note :

Quote:

February 1, 2018

” It took Amazon 14 years to make as much in net profit as it did last quarter”

“Amazon CEO Jeff Bezos has long maintained that investing in future growth is more important than hitting quarterly earnings targets, much to Wall Street’s chagrin.”

End quote .

In the process of not making a profit while investing in the GROWTH of the business , eventually the wind started to change and Jeff Bezos became the first publicly reported Centi-Billionaire ! Apparently he had the last laugh ! I’m willing to wager that Uber eventually will as well .

Quote:

Amazon’s epic 20-year run as a public company, explained in five charts

Quote ”

” On May 15, 1997, a money-losing online bookstore went public on the Nasdaq in an IPO that valued it at a modest $438 million.

Twenty years later, that little startup — called Amazon.com — is worth nearly $460 billion, with a B.

To get there, the Seattle-based giant has pumped nearly all of the cash it generates into huge new investment areas, like Amazon Prime, Amazon Web Services and, most recently, the Alexa voice computing platform.

With a focus on growth over net income, Jeff Bezos’s company has penetrated industry after industry at a pace perhaps unmatched in modern history.”

“But isn’t a business’s goal to turn a profit? Not at Amazon, at least in the traditional sense. Jeff Bezos knows that operating cash flow gives the company the money it needs to invest in all the things that keep it ahead of its competitors”

“It took Amazon 18 years as a public company to catch Walmart in market cap, but only two more years to double it.”

In my humble opinion ……….

Eric Trudeau

Please don’t ever compare Uber Freight to Amazon.

* Lior is no Jeff Bezos. Lior joined Uber as part of the ethically corrupt Otto acquisition. Jeff built his company from scratch.

* Amazon was cash flow positive very early. Uber Freight sells each dollar for 60 cents with a plan to make it up in volume!

Noble1

LOL , I laugh because I just went to check out what the CEO has been saying . To my surprise he’s pitching that Uber is going to be the Amazon of transportation . What a coincidence . Whether he’s whacked or not , My feeling is this Co. is going to surprise many positively . It may take awhile , however, my gut feeling suggests to keep an eye on this one, a very close one . I don’t follow it per say , apart from the technical side . That being said , I firmly believe that the fundamentals will surprise many with time .

I get your point though .

For now it’s a good trading stock .

In my humble opinion …….

Jack Porter

I’m trying to do the math on Uber Freight Results? The increases in Revenue of 100%, and a 163% Increase in their Earnings Loss. So not sure how you report that, but, I would say the earnings was a negative (163%)! Thus the results was an increased Net Revenue over last year $96M generating an increased loss of $50M? This is all we need in this very tough industry, a Nucklehead Group generating additional income of $96M at a cost of $146M! If you are one of these Carriers in their fleet – Beware this is not sustainable, and the growth strategy will have to come from the Carrier, lower prices, delayed pay, discounts, and chargebacks. My Grandfather used to say “When your in a hole, Quit Digging!”.

Joe Leuman

I totally agree with David, It’s easy to grow if you have an open check book and never have to make money.

Miguel Yolo

Wow! Sounds like a great business to invest in! Time to cash out my 401K and load up….

sw

after all these digital brokers go down, then coyote is next one that should be put out of misery

Jeff Romer

Uber Freight is going to collapse. It’s just the jokers from Coyote pretending to be innovators.

David Tildern

Agreed, It’s easy to pretend when your boss doesn’t care if you make any money. Just imagine how great WE could all be if we were allowed to lose unlimited amounts of cash on each load we moved.

Their day of reckoning is surely coming and the fall will be mighty.

David Tildern

I would imagine that most brokers reading this article know that they can also grow a business to $1B in annual gross bookings if they were allowed to price the product way below market cost in order to drive sales with zero regard for making any profit at all.

However, a reasonable business owner would think more long term and consider ACTUAL profits to be the goal.

ANYONE can grow a business (and I mean ANYONE) if they were allowed to price their product or service way under cost – and there was no requirement to generate a profit.

Rest assured – this will end badly for everyone. Eventually, many Uber Freight staff will lose their jobs, their customers will lose a cheap (losing) capacity source, stock holders will see their holdings plummet (they already have by almost 50%). All of these money losing digital freight brokers (well, let’s face it they are just regular freight brokers really) will go under. Then, maybe rates will rise and carriers will once again be able to make a fair living.

Uber Freight, Convoy, Transfix, Loadsmart, Shipwell, Next Trucking, Colane, and the rest I read about here are all bleeding cash so fast – all with questionable business models at best – that I’m surprised they can sleep at night. In the case of Uber Freight, my guess, seemingly shared by stock holders, is that it won’t end well for anyone.

Jared Moore

You nailed it, David! These companies are also bleeding the smaller carriers and mid-sized asset based companies dry because their invalid and unsustainable pricing has caused ALL carriers and brokers are having to drop prices. Most of those decreases are well below profitability for asset-based companies, who are also seeing much higher costs in insurance premiums and driver pay.

I would even argue against a freight recession and point the finger at these price-gouging tactics as the root of the 2019 trucking problems. Maybe I am just being old-fashioned…