In an appearance at an investor conference on Wednesday, management from J.B. Hunt Transport Services (NASDAQ: JBHT) said the recent stretch of inclement weather is likely to hit first-quarter operating income by $15 million to $20 million.

The company reported operating income of $155 million in the first quarter of 2020 and $208 million during the fourth quarter as a comparison.

John Kuhlow, J.B. Hunt’s CFO, said the winter storms produced “probably one of the hardest winters that we’ve ever seen and it’s spread throughout the U.S.” He described the event as much more compressed than past harsh winters but noted that the company is “still climbing out of that.”

The financial impact was most notable in J.B. Hunt’s intermodal segment as drayage operations and rail ramp closures impacted roughly 20,000 to 25,000 loads in the period. By comparison, the company moved nearly 500,000 intermodal loads in the first quarter of 2020. Management believes some of the affected loads will be moved this month.

Total intermodal traffic as reported by the Class I railroads was up 11% year-over-year in the fourth quarter. Weather has slowed the growth rate to roughly 7% so far in the first quarter.

Brad Delco, J.B. Hunt’s VP of investor relations, said, “Congestion is still pretty bad on the West Coast.”

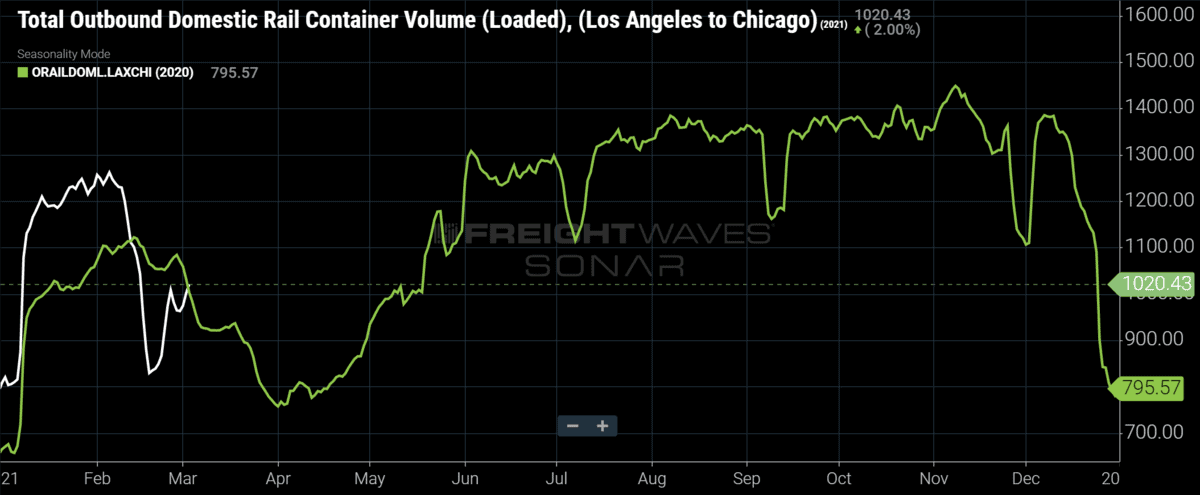

J.B. Hunt’s densest lane is Los Angeles to Chicago, which has bounced back somewhat from the storms. Delco said the company had been making headway on service inefficiencies in its Western intermodal network, which weighed on 2020 results, prior to the storms.

He said it would be another week or two before the network sees normal fluidity again.

Longer term, management views intermodal prospects favorably. They see roughly 7 million to 11 million road-to-rail freight conversion opportunities in the market currently. They have identified 160,000 such loads on digital freight platform Marketplace for J.B. Hunt 360, but capacity headwinds have kept those loads in the incumbent mode. Management believes small to midsized customers that are still working with small brokers are a prime target for conversion.

The bulk of the conversion is expected to be seen in the East as the shorter lengths of haul make rail more comparable to truck service. Rising fuel prices, tight truck capacity and increasing truck rates as driver costs move higher are all tailwinds to the thesis.

Delco also sees a broader adoption and focus on corporate environmental, social and governance (ESG) initiatives as a plus. “The carbon footprint of intermodal is a lot better than truck,” he said. Intermodal’s inclusion into ESG plans is still a newer concept for most, but he noted most European shippers are already focused on the mode as a means to hit carbon reduction targets.

What’s not in the early stages is intermodal pricing. Spot rates continue to step higher, eclipsing year-ago levels by more than double on some of the nation’s 10 largest lanes. Management’s 2021 intermodal pricing guidance calls for high-single-digit to low-double-digit rate increases.

The topic of long-term intermodal margins, which the company said may need to be reduced on its fourth-quarter call, weren’t addressed specifically. Management previously said that this year’s bid season will go a long way in determining future targets at investor conference in mid- February. However, they did indicate Wednesday that absent the poor weather, demand and pricing have been trending ahead of their initial expectations.