The economy lost some momentum in the first quarter of 2019, and freight movements were not spared from the softening. However, a rebounding retail sector moving into the second quarter offers some optimism for both the economy overall and the transportation industry.

FreightWaves CEO and Managing Director Craig Fuller and FreightWaves Chief Economist Ibrahiim Bayaan teamed up to discuss the first quarter of 2019 and what to expect moving forward in the April Market Update.

Fourth quarter 2018 growth in the U.S. gross domestic product (GDP) was revised downward in the last month to 2.2 percent. That is significantly slower than the growth seen in the middle of 2018. GDP refers to the total value of goods produced and services provided in the country during a one-year period.

Bayaan suspects that GDP growth in the first quarter of 2019 will come in at around the same pace.

“At first, I thought the first quarter might fall to the 1.5 range, but some better data coming out of retail and some better data, from a growth perspective, coming out of international trade has bulked that up a little bit,” Bayaan said. “I expect growth to stay around this 2 percent rate going forward. It’s not great growth, but it is positive growth.”

Retail activity numbers were low earlier this year, which Bayaan attributed partially to poor weather conditions across the country. Retail rebounded from a disappointing February in March, with the growth rate climbing from 2.2 percent to 3.6 percent year-over-year. It was one of the strongest rebounds seen in the retail sector since mid-2017.

Chart: FreightWaves’ SONAR

While retail activity growth is still well below the pace seen in the middle of last year, Bayaan expects retail to be a strong source of freight demand going forward.

Inventories that were stored in warehouses late in 2018 are expected to flow into the wider economy in the second and third quarters, also bolstering freight demand.

“We’ve talked a lot over the last couple of months about how imports surged at the end of 2018 and ended up being stored in inventory,” Bayaan said. “I still think there’s a good amount of that that is just sitting on the coast, waiting to get unleashed into the rest of the economy.”

Both imports and exports downshifted in the first quarter, and import growth was negative year-over-year for the first time since 2016. However, Bayaan expects to see increased import volumes during the second quarter, another positive sign for freight demand.

“There was a big surge in imports at the end of 2018 to try to avoid tariffs, so part of the weakness during the first quarter is payback for that,” Bayaan said. “As retail rebounds, you should see better import growth going forward.”

The export sector has struggled because of weak growth in both Europe and China, but the China stimulus has already begun and will likely boost some growth in the second and third quarters.

“There have been rumblings that a trade deal is forthcoming between the U.S. and China,” Bayaan said. “It is much more important that global growth picks up, but a resolution on tariffs would also move things in a positive direction.”

While a trade deal would likely move things along in the right direction, generally trade policy uncertainty could prove to be a weak point for the second quarter.

“There is still this overarching cloud of trade policy uncertainty that exists in the economy, which is weighing down a lot of business investment and slowing down economic activity in general,” Bayaan said.

Weak business investment overall could also take a toll on the upcoming quarter. Business investment slowed down considerably at the end of 2018 and into the beginning of 2019. Bayaan did not anticipate an improvement in the second quarter.

Trade and manufacturing did not see the same uptick as retail during the first quarter.

Manufacturing activity declined in the first quarter, with year-over-year growth falling to just 1 percent. In contrast, the manufacturing sector reported close to 4 percent growth year-over-year last September. Bayaan attributed the decrease to reduced business demand and a poor export environment.

Chart: FreightWaves’ SONAR

Durable goods orders have stalled since the third quarter of 2018. Nondurable manufacturing orders declined in the fourth quarter of 2018 but began to rebound in February.

Historically, there is a tight correlation between factory orders and factory shipments, with orders leading shipments by one to two months. Order data suggests a soft manufacturing environment, which is not conducive to growing freight demand.

The overall labor market seems to be holding strong. After a scare in February, job growth rebounded significantly in March. Hiring is still moving forward at a decent clip, and unemployment remains at near multi-decade lows, according to Bayaan.

Unlike the overall job market, the trucking industry saw a decline in job growth for the first time in nine months.

“A single month doesn’t really mean a whole lot, but I think a lot of the fundamentals are in place to say that you are not going to see the same amount of hiring going on in the industry that you did over the last year or so,” Bayaan said. “There is a sense that there is already enough capacity in the market, so there’s no real reason to keep adding drivers the way they did over the last year.”

Rates for long distance trucking declined for the third straight month in March. Year-over-year growth continued to decelerate, falling below 5 percent.

Chart: FreightWaves’ SONAR

Chart: FreightWaves’ SONAR

While freight volumes are expected to improve in the second quarter, loose capacity will continue to put downward pressure on rates.

Despite the softening some carriers may be feeling, national freight volumes are actually on par with April 2018 volumes so far this month.

“If you own trucks right now, particularly if you’re heavily exposed to the spot market, it feels very, very soft,” Fuller said. “In reality, volumes as a whole in the market have held up.”

East Coast volumes are lagging year-over-year, which Fuller said could be weather-related or could be a true indicator of the economy.

Some of the nation’s largest markets, including Atlanta, Georgia and Joliet, Illinois, are down year-over-year and struggling to get going. The West Coast markets and those with a port presence are continuing to drive the freight market, not unlike late 2018.

“Ports like Norfolk, Savannah, Los Angeles, Long Beach and Seattle are really what kept the latter part of 2018 alive,” Fuller said. “If you take the intermodal points of entry into the domestic trucking market out of the country and only focus on what is driven from the core part of the U.S., you don’t see a lot of activity. What drove the U.S. freight market last year was heavily related to ports, and we’re still seeing that as a factor in 2019.”

Convoy’s Market Supply Index shows that volume remains high in California, and capacity has remained loose following 2019’s high volume of truck order purchases.

Convoy’s data also shows that the refrigerated market has been tighter than the dry van market, which is likely related to national weather conditions.

“People always think of refrigerated as being refrigerated, but in reality, the proper term would be temperature-controlled,” Fuller said.

Convoy sponsored the April Market Update and contributed its data in order to add to the conversation surrounding market conditions.

While overall freight volume in the U.S. is up slightly year-over-year, intermodal is down about 2 percent. This suggests shippers are finding that the spot market is cheaper, according to Fuller. In a market where there is plenty of capacity, shippers tend to revert to the spot market.

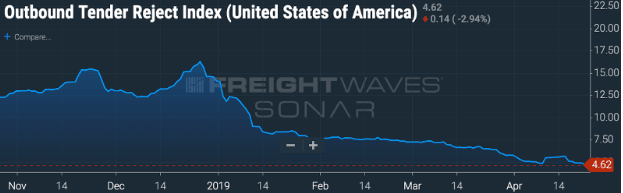

Tender rejections are an indicator of a carrier’s behavior and willingness to reject dedicated loads. Tender rejections remain historically low, and spot rates are trending back to a normalized pattern after surging throughout 2018.

Chart: FreightWaves’ SONAR

Chart: FreightWaves’ SONAR