Less-than-truckload provider Yellow Corp., formerly YRC Worldwide (NASDAQ: YRCW), made it official Thursday after the market close. The company will operate under the Yellow banner again. Yellow will begin trading on the NASDAQ under the ticker “YELL” on Monday.

The Overland Park, Kansas-based company reported a net loss of 37 cents per share, worse than the consensus call for a 24-cent per share loss but 9 cents better than the prior-year result.

Yellow is the holding company for LTL brands Holland, New Penn, Reddaway and YRC Freight along with HNRY Logistics. The entities will continue to operate under those respective names until the first half of 2022 when the transformation to a super-regional carrier has been completed.

“As we continue our transformation into a super-regional, LTL freight carrier, it is the right time to reintroduce the Yellow Corporation name and modernize the holding company brand,” CEO Darren Hawkins stated in a press release.

The company’s restructuring has included the streamlining of leadership, sales and technology onto the same network with one point of contact. The turnaround received a boost from a $700 million Treasury loan in July, which allowed the company to catch up on health care and pension benefits payments as well as providing capital to begin replacing its rolling fleet.

“Migrating to one Yellow technology platform and creating one Yellow network are the key enablers of our enterprise transformation strategy, which is to provide a superior customer experience under one Yellow brand,” Hawkins continued.

Fleet replacement accelerates

On a Thursday evening call with analysts, management said it had spent the bulk of the $75 million October draw it received from the $400 million second tranche of the loan. That tranche was allocated for equipment capital expenditures.

Yellow received $176 million in January, which should be exhausted on new equipment purchases — 1,100 tractors, 1,900 trailers and 250 containers — in the next couple of months. The remaining $149 million will be used in 2021 and will include buying out existing leases on equipment. Management guided to $450 million to $550 million in capital expenditures during 2021.

$274 million of tranche A, $300 million in total for the repayment of deferred benefits payments, has been used, with the remainder to be distributed in the first quarter.

Fourth-quarter miss

A full-year net loss of $53.5 million was roughly half of 2019’s $104 million loss, which included $11.2 million in costs associated with its term loan refinancing.

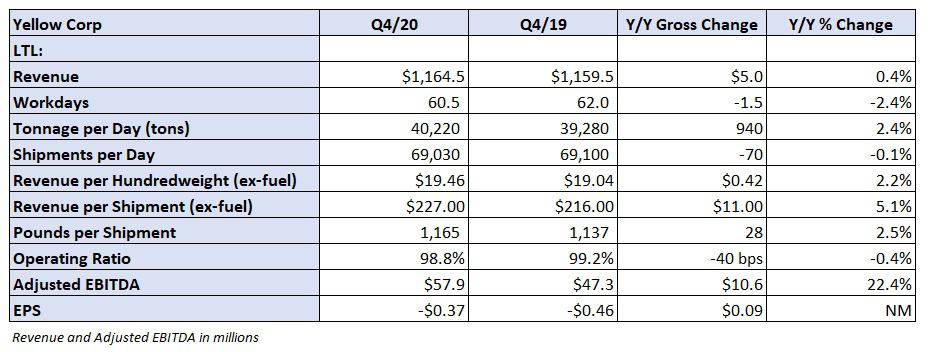

Tonnage per day improved 2.4% year-over-year and revenue per hundredweight, or yield, was up 2.2% excluding fuel surcharges. Revenue was flat as there were 1.5 fewer work days in the quarter and yield was down 0.7% including fuel. Contractual renewals came in 5.6% higher during the quarter.

In January, contract prices increased 6% and tonnage per day was up between 2% and 3% year-over-year. The company implemented a 5.9% general rate increase on Monday.

The fourth-quarter operating ratio improved 40 basis points to 98.8%. Increased purchased transportation, 430 basis points higher as a percentage of revenue, was cited as a significant headwind in the quarter.

A lack of available drivers continues to be a challenge. Yellow will add to its driver school network and plans to have 12 academies operating by March.

Adjusted earnings before interest, taxes, depreciation and amortization increased 22% year-over-year and full-year adjusted EBITDA was $191.9 million, well ahead of the upcoming $100 million covenant, which goes into effect in the fourth quarter.

YRC ended the year with liquidity of $440 million and total debt of $1.28 billion.

“During the fourth quarter, volume and pricing continued to improve in a tighter capacity environment. As the industrial and retail segments of the economy rebound, a shortage of drivers is keeping a lid on LTL capacity. Overall, the industry is stable and well positioned for a strong 2021,” Hawkins added.

Chris

Worst managed LTL ever. I cringe when they’re on our board for pickups because they never have room on their trailer for all of our freight. Hopefully they go under so our corporate office is forced to pay somebody reliable to pick up our freight.

Mike Dargis

There are at least five major LTL carriers that are doing quite well in today’s market and if one were to compare the attached numbers such as revenue per cwt and revenue per shipment the other carriers are head and shoulders better than these numbers. Their pricing structure is extremely low and irresponsible and their operating leaders are dinosaurs with a 50 year old operating plan. It’s to late for them to restructure and the $700 million will be gone within a year and then what?

Nancy S.

Yellow Freight is a JOKE!!

I had a shipment picked up in

Eau Claire, Wisconsin on December 18, 2020 to be delivered to Culpeper, VA. It finally arrived on December 30, 2020

That’s approx 1000 miles ….I could have had my shipment delivered by horse and buggy faster than Yellow Freight. I know Christmas was during my delivery but even allowing extra 2 days for the Holidays the horse and buggy would still have been faster.

I definitely would NOT recommend Yellow Freight for ANYTHING!!!

EDI

Nancy S. – You are the reason people hate their jobs.

Christine A

I totally agree with you. Roadway was the best. They took care of their employees. Yellow could give a rats ass about what happens to any of them.

Ron carlson

How is débt back to over billion dollars? For last 10yrs teamster workers gave back more tha 2 billion paid down debt to under 900 million now your back owing over a billion and a half along with over a billion in revenue.

William A Price

This company has been, and will continue to be the worst run LTL company out there! If it wasn’t for the govt bailing them out in September, they would’ve been out of business.

TMR

I was employed by Roadway Express for 30+ years before it was sold off to Yellow Freight. Bill Zollars did a super great job running Roadway Express deep into the grave. Over the following years, YRC was a joke from all directions examined. At one time “ Roadway” was the rolling 18 wheeler “ King of the Road”. It delivered the freight in ways no other trucking company could match. Ask any ex REX employee and they will tell you the same.

Christine

I totally agree with you. Today was the best. They took care of y their employees. Yellow could give a rats ass about what happens to any of them.

Christine Alvarado

What was meant to be said is that roadway was the best. It was a great company and they cared about their employees. Whereas yellow could give a rat’s ass about anyone. I have seen so many things go wrong with yellow and they just don’t get taken care of. I really pray that it becomes a better company because for the last few years they have not impressed me.

Gary L

I worked for Yellow when we merged with Roadway.

Roadways equipment was in terrible condition.

Many of the tractors, trailers, and forklifts needed extensive repairs. Quite a few pieces of equipment ended up being scrapped. The computer system we inherited from Roadway was also a joke. We used to know where all the equipment was located.

Thomas

What is the latest on MULTI EMPLOYEE PENSIONS HELP?