ArcBest updated long-term financial targets Tuesday in conjunction with the release of its fourth-quarter earnings report. The company expects to grow revenue to $7 billion to $8 billion by 2025. Hitting the high end of the range would double its top line from the $3.98 billion it recorded in 2021.

The guidance also included margin targets. The asset-based segment, which includes less-than-truckload operations, is expected to see operating margins in the 10% to 15% range, which is higher than the prior target calling for a high-single-digit margin. Asset-light margins are expected to be in the 4% to 6% range, excluding results from maintenance and repair unit FleetNet.

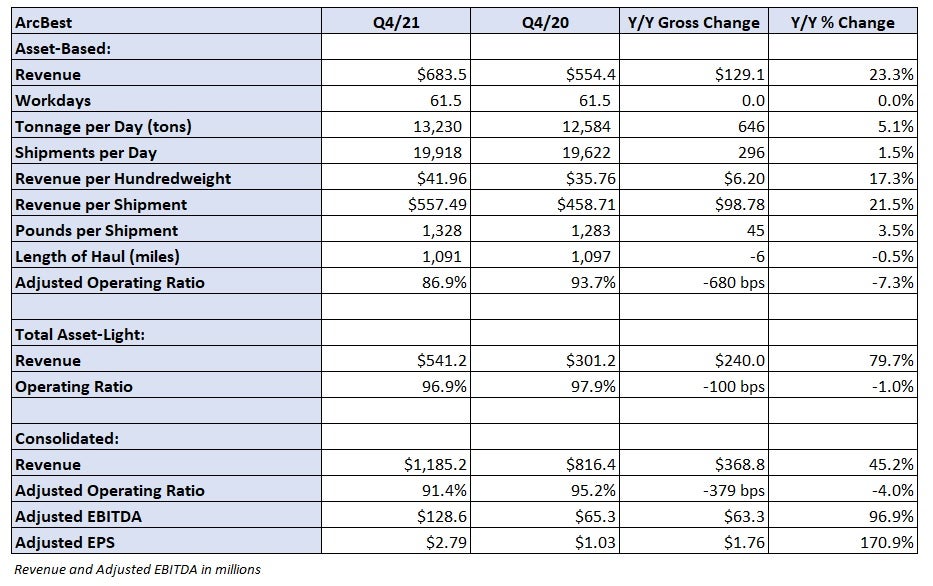

Before the market opened Tuesday, ArcBest (NASDAQ: ARCB) reported fourth-quarter adjusted earnings per share of $2.79, 52 cents ahead of consensus expectations and nearly three times higher than the year-ago level.

During the fourth quarter, ArcBest posted an 86.9% adjusted operating ratio (13.1% operating margin) in the asset-based unit, which was 680 basis points better year-over-year. The full-year OR for the division was 88.8%. Asset-based revenue increased 23.3% year-over-year to $684 million as tonnage increased 5.1% and revenue per hundredweight, or yield, jumped 17.3%.

Pricing remains strong across the industry as capacity is stretched. Additionally, carriers continue to address higher costs through price hikes. ArcBest implemented a 6.9% general rate increase (GRI) in mid-November, ahead of the normal first-quarter implementation and 95 bps higher than the one it installed in early 2021.

Rates on contract renewals and deferred pricing agreements were 10.2% higher on average in the fourth quarter, which was the highest percentage increase on record for any quarter. LTL yields increased by a double-digit percentage excluding fuel.

Management from ArcBest said the strong pricing trends have carried through January. Yield was up 20% year-over-year for the month with tonnage inching 2% higher. The 22% revenue growth rate in January was only a slight deceleration from the 24.4% year-over-year increase logged in December (up 25.4% in November and up 20.4% in October).

The asset-based unit normally sees 250 bps of margin erosion from the fourth to first quarters. The sequential change this year will also contend with the company’s record fourth-quarter performance and the GRI, which was ahead of schedule.

The asset-light segment saw revenue jump 80% year-over-year to $541 million. The increase included $120 million in new revenue from the acquisition of truckload brokerage MoLo Solutions, which closed at the beginning of November. Excluding MoLo, the segment saw revenue increase in the 40% range during each month of the quarter.

The addition of MoLo, as well as the growth trajectory in the legacy asset-light operations, will be key drivers of management’s new revenue target.

The asset-light division posted a 96.9% OR (3.1% operating margin) in the quarter, 100 bps better year-over-year.

Asset-light revenue in January was 135% higher year-over-year. MoLo is expected to operate at breakeven margin levels for the bulk of 2022, becoming accretive to earnings (excluding deal costs) during the 2022 fourth quarter.

Net capital expenditures totaled $104 million in 2021 but will jump to a range of $270 million to $290 million in 2022. The change will be largely driven by an increase in equipment capex, which was curtailed in 2021 as manufacturers struggled with parts shortages and production headwinds. ArcBest also plans to invest between $45 million and $55 million in real estate projects to support what it hopes will be a mid-single-digit shipment growth rate by the end of the year.

ArcBest completed a $100 million accelerated share repurchase in January. It will continue to repurchase stock through an open authorization, which has $42 million remaining.

Shares of ArcBest were trading 5% higher at 11:17 a.m. Tuesday compared to the S&P 500, which was up 0.1% at the time.

The FREIGHTWAVES TOP 500 For-Hire Carriers list includes ArcBest (No. 26).

Click for more FreightWaves articles by Todd Maiden.

- J.B. Hunt acquires furniture hauler from Bassett in $87M deal

- Another quarter, another record at Landstar

- Knight-Swift sees big Q4, expects hypergrowth to moderate in 2022