A reduction in operating expenses helped Western U.S. railroad BNSF achieve a 4% increase in fourth-quarter net profit and a 5% increase in annual net profit despite lower revenues on both a quarterly and annual basis.

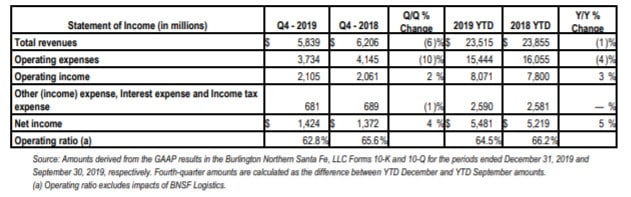

Fourth-quarter net income totaled $1.42 billion, compared with $1.37 billion for the fourth quarter of 2019, BNSF said Monday. On an annual basis, BNSF reported a net profit of $5.48 billion in 2019, a 5% increase from $5.22 billion in 2018 as lower operating expenses offset a 1.4% decline in revenues.

BNSF is a subsidiary of Berkshire Hathaway (NYSE: BRK).

Total revenue in the fourth quarter fell 6% to $5.84 billion amid a 6% drop in unit volumes, but a 1% increase in average revenue per car/unit helped offset the revenue decline, BNSF said.

On an annual basis, BNSF’s revenue totaled $23.5 billion in 2019, compared with $23.9 billion in 2018. Average revenue per car/unit rose 3.6% year-over-year amid increased rates per car/unit and a favorable outcome for an arbitration hearing, according to Berkshire Hathaway’s 2019 annual report released on Saturday. Factors that negatively affected revenues were severe winter weather and flooding on parts of BNSF’s network.

Breaking down the revenues by segment, consumer products revenue slipped 4% to nearly $2 billion in the fourth quarter as volume fell 5% on lower intermodal volumes. But on an annual basis, consumer products revenue slipped only 0.5% to $7.9 billion amid higher average revenue per car/unit and volume decreases of 4.6%. Looser truck capacity and lower imports along the West Coast contributed to volume decreases in 2019.

Industrial products revenue fell 8% to $1.43 billion in the fourth quarter of 2019. But on an annual basis, industrial products revenue rose 1.7% to $6.1 billion, again amid higher average revenue per car/unit and lower volumes. “Overall softness” in the industrial sector, lower frac sand volumes and adverse weather conditions contributed to a 3% decrease in volumes. But higher demand for petroleum products and liquefied petroleum gas helped offset the decline in industrial volumes.

Agricultural products revenue in the fourth quarter declined 1% to $1.2 billion compared with the same period in 2018. But agricultural products revenue was roughly flat for 2019, slipping 0.3% to $4.7 billion, amid a 5.1% decline in volumes due to competitive global markets for non-U.S. goods, international trade policies and challenging weather conditions.

Coal revenue experienced the largest decline on both a quarterly and annual basis. Coal revenue slipped 11% to $967 million in the fourth quarter. On a yearly level, coal revenue fell 7.4% to $3.7 billion amid adverse weather conditions and lower prices for natural gas, a competing generating fuel for power plants.

Meanwhile, fourth-quarter operating expenses were $3.73 billion, a 10% drop from the same period in 2018. Annual operating expenses fell 4% to $15.4 billion amid lower volume-related costs and fuel surcharges, as well as cost-control initiatives, and a retirement plan curtailment again helped offset costs due to adverse weather conditions.

Among the operating expenses, fuel expenses fell 18% in the fourth quarter to $733 million, and 12% for the year to $2.9 billion.

Purchased services expenses also slipped 18% in the fourth quarter to $613 million, while on an annual basis, purchased services expenses fell 5.9% to $2.7 billion amid lower purchased transportation costs of BNSF’s logistics services business, lower drayage and lower service expenses, and higher insurance recoveries, the company said.

BNSF’s operating ratio, defined as the ratio of operating expenses to revenue, was 62.8% in the fourth quarter of 2019, compared with 65.6% in the same period of 2018. For 2019, BNSF’s operating ratio was 64.5%, compared with 66.2% for 2018.

Annual carloads fell by 4.5% to 10.2 million cars/units in 2019 from 10.7 million cars/units in 2018. In 2019, consumer products constituted approximately 35% of BNSF’s freight revenues, while 27% were from industrial products, 21% were from agricultural products and 17% were from coal.

Looking ahead to 2020

BNSF expects to spend $3.4 billion on capital improvements in 2020, compared with $3.6 billion allocated toward capital expenditures in 2019.

Of this, the railroad expects to spend $2.55 billion on maintenance and replacement, including replacing and upgrading rail, rail ties and ballast and maintaining rolling stock.

BNSF also plans to spend $581 million on expansion and efficiency projects, including projects that support capacity and performance improvements on BNSF’s Southern Transcon route, routes to and from Texas, and intermodal facilities. The railroad also expects to spend approximately $270 million on equipment acquisitions.