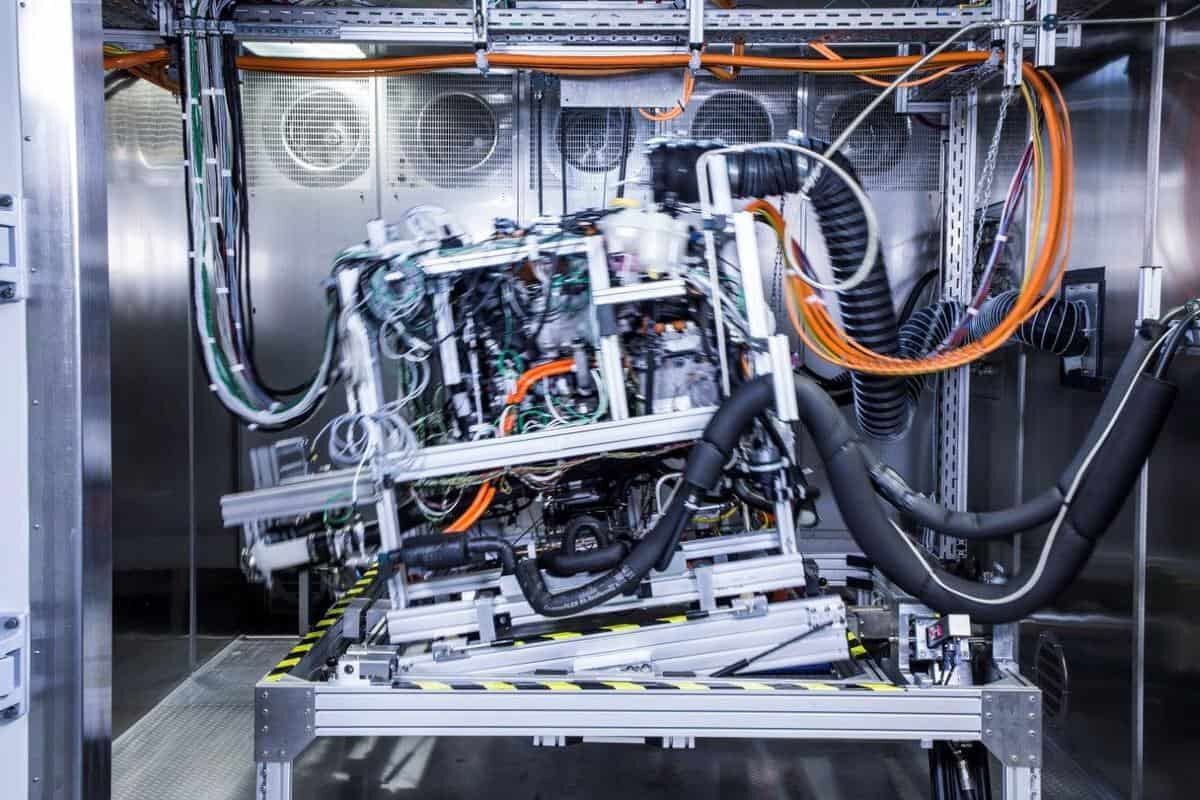

Daimler Trucks and Volvo Group are forming a joint venture to make fuel cell trucks for both companies after neither showed great enthusiasm for hydrogen-powered fuel cells. (Photo: Daimler)

Volvo will pay Daimler to use technology developed for buses and Mercedes-Benz cars

Daimler Trucks and Volvo Group will work together on hydrogen fuel cell technology for heavy-duty trucks, a pursuit both companies have previously shunned in favor of battery electric propulsion.

Daimler has decades of experience in fuel cell development for Mercedes-Benz cars and commercial buses. Yet as recently as a year ago, Daimler Trucks North America President Roger Nielsen claimed battery power would drive the future of trucking. Fuel cells, he said, were still far away and needed significant development.

By October 2019, Nielsen’s boss, Martin Daum, included fuel cells as one of the technologies that would help Daimler reach its corporate goal of carbon neutrality by 2039.

“This joint initiative with the Volvo Group is a milestone in bringing fuel cell-powered trucks and buses onto our roads,” said Daum, chairman of the Board of Management for Daimler Truck AG and a member of the Board of Management of Daimler AG.

Volvo, which had no investment in fuel cells, took a sudden turn in agreeing to pay Daimler 600 million euros ($651 million) in a nonbinding agreement to participate in a joint venture expected to begin work in the third quarter.

Volvo and Daimler will be 50/50 partners in the venture, which will operate as an independent and autonomous entity.

“By forming this joint venture, we are clearly showing that we believe in hydrogen fuel cells for commercial vehicles,” said Martin Lundstedt, Volvo Group president and CEO. “But for this vision to become reality, other companies and institutions also need to support and contribute to this development,” especially in creating a hydrogen fueling infrastructure.

The timing of the announcement Tuesday was curious given the crash in the oil market and the roughly 20% decline in the price of diesel fuel that most trucks use. Fuel accounts for about one-third of the operating cost of a Class 8 truck.

“The absolute collapse in the price of oil only pushes out further the desire to move to a technology that will require the creation of an entirely new refueling infrastructure,” Mike Ramsey, vice president and analyst for Gartner’s CIO Research Group, told FreightWaves.

Fear of missing out

With other manufacturers, two of them working with Toyota Motor Corp. (NYSE: TM), pursuing hydrogen-powered fuel cell heavy-duty trucks, Daimler and Volvo may see the need to place bets on hydrogen. Toyota is working with Kenworth Truck Co. in the U.S. and with its subsidiary Hino Trucks in Japan on fuel cell trucks.

“Everybody is coming around and finally seeing the light for the long-haul application,” said Antti Lindstrom, a trucking industry analyst with IHS Markit. “I think maybe they are feeling that they don’t want to be left out of what’s happening. You see Hyundai is already pushing forward.”

Other partnerships

Hyundai Motor Co. revealed a fuel cell-powered concept truck at the North America Commercial Vehicle Show (NACV) in Atlanta in October 2019.

A month earlier, it signed a memorandum of understanding with engine maker Cummins Inc. (NYSE: CMI) to work on developing and commercializing electric and fuel cell powertrains and to make stationary backup power systems for data centers. Cummins also revealed a fuel cell concept truck at the NACV show.

“The hydrogen industry continues to mature as OEMs [original equipment manufacturers] and suppliers invest and look to develop economies of scale to achieve the technology cost reductions needed to accelerate the adoption of hydrogen,” Amy Adams, Cummins vice president of Fuel Cell & Hydrogen Technologies, told FreightWaves.

“It will take collaborations from across the industry to innovate and overcome the challenges associated with adoption, like hydrogen availability, to realize the full potential of hydrogen as a power source,” she said.

Honda Motor Co. and Japanese truck maker Isuzu Motors Ltd. also have announced a fuel cell heavy-duty truck partnership.

Pragmatic considerations

Volvo, which is leading a 16-partner effort in battery electric heavy-duty trucks in California and testing battery electric construction equipment in Europe, had no shown no particular interest in fuel cells.

“It makes sense that Volvo would want to jump into this sector and partner with a company like Daimler that has a significant amount of experience with fuel cells,” Sam Abuelsamid, principal analyst with Navigant Research, told FreightWaves.

“There are enough companies getting involved that it looks like there’s going to be a market for this,” he said. “Now it’s to the point where it’s starting to become realistic for the kind of vehicles that Volvo builds.”

Both Daimler and Volvo, as well as other truck manufacturers, face financial uncertainty as they measure the business impact of the coronavirus pandemic, which has shuttered plants and worsened an already gloomy market for new trucks.

“There is going to be a lot less to invest in future technologies,” Abuelsamid said. “Electrification is one area where they are not going to be able to back away. You’re going to see more and more partnerships to share technology when there’s not going to be a competitive advantage to have your own.”

The Nikola factor

Nikola Corp., the well-financed startup whose business model is to sell fuel cell trucks with seven years of maintenance and hydrogen fuel for a set price, is thrilled each time it sees a new fuel cell partnership because it lends credence to its plan to build hundreds of hydrogen fueling stations.

“For years Nikola has been pioneering the advancement of fuel-cell technology, and a common standard for hea

vy-duty hydrogen-fueling infrastructure,” Nikola President Mark Russell told FreightWaves.

“This announcement shows that industry leaders now also recognize what Nikola saw, years ago. We applaud such collaboration,” he said. “We will create a zero-emission future for the world, even in the very difficult case of heavy and long-haul transport.”