Editor’s note: CORRECTS 2022 production goal to 500 trucks instead of 250 trucks as written

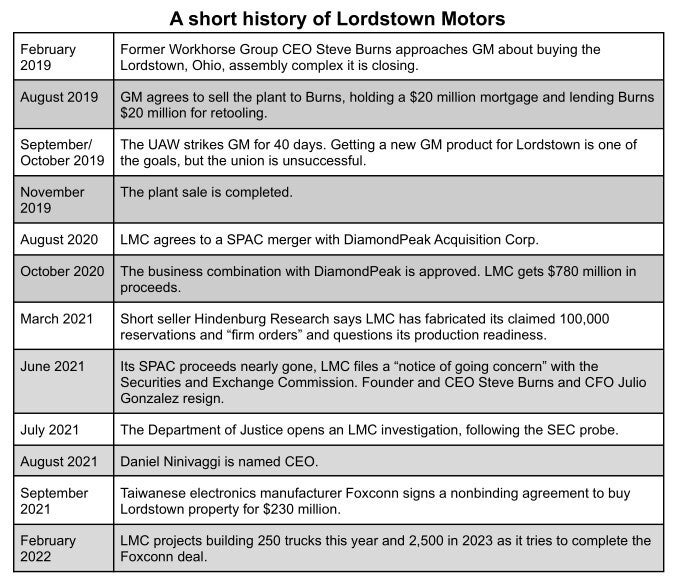

Beleaguered startup Lordstown Motors Corp., facing federal investigations and production costs for a commercial electric pickup truck that exceed the price it can get for the vehicle, is gamely showing up at industry events focused on the future rather than its ignominious past.

Despite more setbacks than successes, including an ousted founder in the crosshairs of Securities and Exchange Commission and Justice Department probes and financial challenges that led the company to officially question its survival, Lordstown (NASDAQ: RIDE) is focusing on a fresh start that hinges on a Taiwanese manufacturer of cellular phones.

In a corner of the Indianapolis Convention Center packed with snowplows, dump trucks, cranes and all manner of last-mile and regional haul vans, Lordstown executives and marketers last week cheerily talked about their battery-electric Endurance targeted at commercial fleets of all sizes. Production is expected in Q3.

This is about two years later than LMC founder Steve Burns originally estimated as he took over an idled 6.2 million-square-foot General Motors assembly complex covering 640 acres in northeast Ohio.

GM practically gave Burns the property to secure a future — any future — as GM sought to mollify President Donald Trump and the United Auto Workers union, incensed about the March 2019 closing of the plant that GM had operated since 1966.

Burns raised $780 million in a SPAC merger with DiamondPeak Acquisition Corp. He thought he had all the money LMC would need to get the pickup truck to production. But relative inexperience led to a heavy cash burn along with allegations of inflated orders for the truck. Burns and Julio Rodriguez, his chief financial officer, resigned last June.

In the same month, Lordstown filed a “notice of going concern” with the SEC, suggesting it might run out of money by this May. That could still happen if a deal with Taiwan’s Foxconn is not finalized.

Foxconn last fall agreed to pay $230 million for the Lordstown plant that LMC bought for $20 million from GM in November 2019 with GM holding a mortgage and lending LMC $20 million for retooling. GM invested an additional $25 million in cash before selling its stake in Q4 last year.

As part of the purchase, Foxconn wants to be the contract manufacturer for the Endurance along with a small electric vehicle program from Fisker Inc. and maybe other EV projects and components.

A fresh start

With all this as a backdrop, veteran automotive executive Ed Hightower took over as president last November. A senior executive at three automakers — Ford, BMW and General Motors — Hightower agreed to trade his consulting role for the No. 2 job to CEO Daniel Ninivaggi, who spent a decade working for activist investor Carl Icahn.

Ninivaggi didn’t really know Hightower, who also worked for turnaround specialist Alix Partners, but he took a pay cut to clear money to bring Hightower in at a $625,000 annual salary with a bonus that could double that. Hightower also gets 500,000 shares of Lordstown stock and options to purchase 500,000 more.

“When the deal with Foxconn was announced, I really saw that as a great opportunity for Lordstown’s future,” Hightower told FreightWaves during an interview at the Work Truck Week event. “And when they reached out to me to consider the role, that’s what made me really interested.”

The Endurance faces enormous competition in electric pickup trucks from startup Rivian, EV leader Tesla, and legacy automakers Ford, GM and Stellantis.

Neither Ninivaggi nor Hightower is sure the deal with Foxconn will be completed — “constructive” and “ongoing” was how Ninivaggi described the talks during the Q4 earnings call on Feb. 28. Lordstown could look for other ways to raise money but its options are limited. Its shares currently trade slightly above $2 compared to a high of $29.

It already has begun to draw on a $400 million equity line of credit, issuing shares to an investment fund managed by Yorkville Advisors Global in exchange for cash. Startup electric truck maker Nikola Corp. has two similar arrangements with Tumim Stone Capital.

A joint venture with Foxconn?

Foxconn’s limited experience in making electric vehicles raises questions.

“They have a real interest and desire to enter or to build capabilities in the electric vehicle space,” Hightower said. “They’ve had some joint ventures in Asia that they’ve been working toward in place in the EV space. We think their ambitions in that space align with where we’re looking to go.”

That could mean a collaboration extending beyond the plant sale and contract manufacturing of the Endurance to a joint venture to make other EVs using Foxconn’s mobility-in-harmony platform.

“This is an important part of the deal, because in our view, LMC would greatly benefit over the long term from a scalable vehicle development platform for future vehicles that will allow us to compete with much larger vertically integrated OEMs,” Ninivaggi said on the earnings call.

First things first

Having led major automotive programs like GM’s global crossovers business, Hightower said resolving remaining design and engineering issues with the Endurance is proceeding, though he declined to give a percentage estimate of launch readiness. The company disappointed analysts on the call when it forecast just 500 trucks this year and 2,500 in 2023.

Nor did Hightower discuss the state of the order backlog. Burns’ claims that LMC had 100,000 reservations turned out to be an exaggeration and was a key allegation in a March 2021 report by short seller Hindenburg Research that led to the pending and costly federal investigations. LMC has spent millions in attorneys’ fees and cannot predict the outcomes.

“I’m not really focused on that,” Hightower said. “At this phase, it’s noses to the grindstone.”

LMC is methodically working through three rounds of pre-production vehicles. One of the first pre-production units was displayed in Indianapolis. The next round is for certification and then a set for customer trials it hopes will lead to orders.

“Building a vehicle is a very, very complex process. Automobiles, in my opinion, are the most complex consumer product someone can buy,” Hightower said.

“So, disciplines in terms of engineering and testing vehicle builds, management of the supply chain, execution of the testing, and doing things to a certain timeline, are the areas that I’ve been focusing on and building on what the company had in place.”

Reducing the cost of the bill of materials for the Endurance is critical because LMC cannot charge as much as it costs to make the vehicles. Moving to production from prototype parts will help. So would the purchasing power of Foxconn if a deal is finalized.

Wheel hub motors

Lordstown’s use of an electric hub motor in each of the truck’s four wheels also has been questioned.

“It gives you the flexibility to do some very interesting things,” said Sam Abuelsamid, a mechanical engineer and principal analyst at Guidehouse Insights.

“The downside is now you’ve got the mass of that motor at that corner assembly. And the wheel is something that has to be able to move up and down. When you add a bunch of mass at the wheel, that has negative impacts on handling and ride quality.”

Usually static high-voltage wiring that runs from the battery or power electronics undergoes a lot of motion as the wheel moves up and down, which could lead to durability issues, he said.

Hightower said he has heard the complaints but sees using hub motors as part of the transition to electrification.

“They will deliver on that lower cost of ownership for the customers versus [internal combustion engine] vehicles, and the power and the torque is going to be something that our customers will appreciate. Also, the handling and the maneuverability that’s enabled by the wheel hub motors is going to be something that our customers do like quite a bit.”

Related articles:

Lordstown Motors faces multiple hurdles to produce electric pickup

Lordstown Motors may sell its plant to Foxconn for $230M