The help wanted signs are up at warehouses and for gig drivers, and for August at least, it looks like they got solid responses.

In the Bureau of Labor Statistics report released Friday, covering August data, the categories of warehouses and storage and couriers and messengers each rose by more than 20,000 jobs from July on a seasonally adjusted basis.

To put that in perspective, with a disappointing overall gain of just 235,000 jobs for the U.S. as a whole, those two categories combined accounted for a net 17.1% of August job gains.

The increase in warehouse and storage jobs is the largest since a run of tremendous increases at the end of 2020, when the industry was snapping back from a colossal loss of 106,100 jobs in April 2020 as the pandemic was kicking in. By the end of 2020, the warehouse sector had about 90,000 more jobs than when the pandemic began, after monthly gains that went as high as 68,700 jobs.

The 20,200 jobs gained in warehouses for August edged out the gain of 20,100 recorded in June. But there was a three-month period earlier this year when the warehouse sector posted small job declines.

With three months of gains between June and August of this year that totaled 55,200 jobs, the number of workers in the warehouse and storage sector is now 48,500 higher than it was at the end of 2020.

The gain of 20,000 jobs in the couriers and messengers category is the largest since an increase of 42,600 jobs back in January 2019, according to BLS data that dates back to 2011. The August figure is the fifth largest in that 10 year-plus history.

It also comes as Uber in particular has bemoaned the difficulty in securing drivers. But in the company’s latest quarterly conference call with analysts, CEO Dara Khosrowshahi told analysts that it had said it would “lean in to re-ignite driver and courier growth. We’ve done so aggressively, and we’ve made real progress.”

In his monthly commentary on the employment report, Aaron Terrazas, the director of economic research at Convoy, said the big jump in courier jobs means the industry is getting ready for Christmas already. “This likely reflected earlier than normal hiring for what is anticipated to be a busy online holiday shopping season,” he said of the large gain.

As for trucking, the industry gained 5,400 jobs on a seasonal basis to 1,498,500 jobs. That’s still less than the 1,516,200 jobs that the Bureau of Labor Statistics reported for the trucking and transportation sector in March 2020, immediately before the pandemic hit.

And since the financial world has taken to comparisons with 2019, since 2020 is such an anomaly, truck transportation employment in August 2019 was 1,527,600 jobs.

“Trucking firms added 5,400 workers to their payrolls in August (seasonally adjusted) according to the BLS data, building upon July’s 4,800 job gain and June’s 6,300 job gains after stagnating head counts for much of the first half of 2021,” Terrazas wrote.

But there’s a negative aspect to that rise: It probably isn’t enough, according to Terrazas. “For an industry that has faced record demand over the past year and that has been aggressively increasing wages, head counts have been stubbornly slow to rebound in the BLS data despite recent signs of progress,” he wrote.

Jason Miller, an associate professor of logistics at Michigan State University, has been noting in his analysis of the numbers each month that growth in total trucking and transportation employment has been masking sluggish rates of increases in over-the-road trucking. There are a lot more drivers getting hired, but the numbers are pointing to them being behind the wheel of more general, localized trucking, not in the type of freight movement where there might be a sleeper berth behind the driver’s seat.

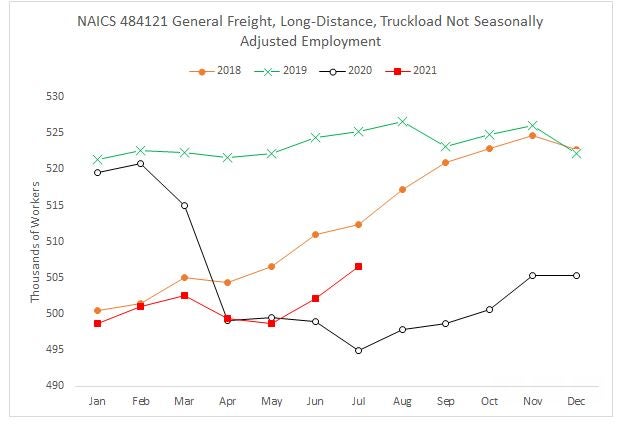

The individual sector data lags the total data by a month. Miller, in an email to FreightWaves, said the industry is “finally [his emphasis] starting to see some good hiring gains in general freight, long-distance, truckload,” referring to the specific name of the NAICS category. He noted that the July data showed growth of 4,400 truckload jobs.

In other data points from the monthly employment report:

— Recent reports have suggested that capacity is being provided in trucking by having workers put in more hours. After a dip in the most recent report, the trend reversed itself again. For all of the trucking and transportation sector, average weekly hours worked by production and nonsupervisory employees rose to 43.2 hours in July, up from 42.8 a month earlier. That’s the highest number in the history of the series going back to 2011.

— The costs of truck transportation continued to climb. In the producer price index for the sector, the number for July climbed to 165.3, up 30 basis points from June. A year ago, it was 145.

— It’s not a big move but rail employment showed signs of moving down again after having steadied following enormous cuts in 2019 into early 2020. Employment in the sector got up to 144,500 as recently as May, but the latest report had it down to 143,300.

More articles by John Kingston

Poised for acquisition, Transplace gets mostly positive outlook from Moody’s

Two divisions of Covenant settle in big case by drivers alleging no-hire conspiracy

Same

I’m a truck driver in South Africa if there is any opportunity of that particular job I’m interested

Emma

My Aunty Kaylee recently got an almost new cream Infiniti G Coupe IPL

from only working part time on a pc. hop over to this website……….. http://www.jobs70.com