Marten Transport had a first quarter in which it drove more miles than in the first quarter of 2022, but in its truckload segment in particular recorded a significantly worse performance.

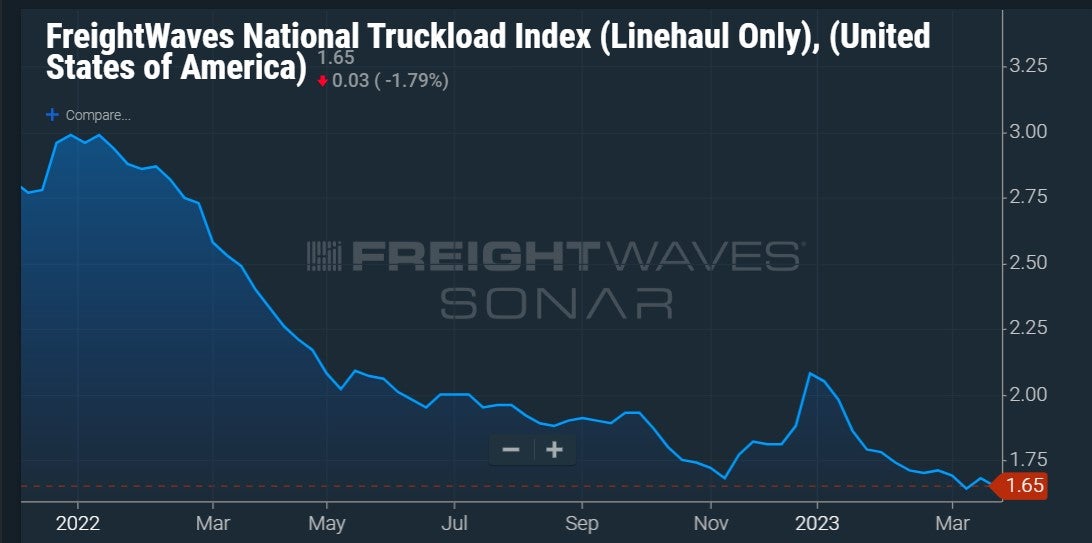

That was not surprising in a quarter during which truckload rates as measured by the National Transportation Index for linehaul only (NTIL) in SONAR plummeted to a first-quarter range of $1.65 to $2.05 per mile, compared to a range of approximately $2.30 to $2.95 in the first quarter of 2022.

Several operating statistics showed Marten (NASDAQ: MRTN) kept itself busy hauling freight in the quarter. Its total truckload revenue net of fuel rose to $102.3 million from $95.1 million in the first quarter of 2022. Total miles in truckload climbed to 38.3 million from 35.3 million. Total miles in its dedicated division were 34 million compared to 32.7 million a year earlier, and dedicated revenue was $106.5 million compared to $96.8 million.

The bottom-line measurements were a mixed bag in comparison to the first quarter of 2022. The truckload segment’s OR deteriorated to 91.7% from 86.2%, as truckload operating income declined to $10 million from $15.6 million. The OR in dedicated improved to 87.1% from 89%, and operating income in that group rose to $13.7 million from $10.6 million.

The part of Marten that suffered the most was its intermodal group, which is relatively small compared to the rest of the company. It was a lot smaller in the first quarter of 2023 than it was a year earlier, when it had operating income of $5 million and accounted for about 14% of operating income. Intermodal operating income declined to $787,000 in the first quarter of this year, and OR plummeted to 97.2% from 84.1%. But the decline in earnings was not because of a significant drop-off in revenue; intermodal revenue net of fuel was $23.4 million, compared to $25.6 million a year ago.

Brokerage’s bottom line showed little change, with its OR improving slightly to 89.4% from 90% a year earlier, though operating income declined to about $4.5 million from $4.6 million a year earlier on a drop in revenue to $42.4 million from $46 million.

Marten management does not hold a conference call with analysts. In the release announcing the results, Chairman Randolph Marten, in praising the company’s “bright and determined people,” described the results as “solid … despite the impact of widespread severe winter weather and a freight market which has considerably softened from the exceptionally tight conditions during the first half of last year.”

He also projected that competition may ease as capacity departs the market. “The market has become unsustainable for the smaller carriers who comprise a significant portion of total capacity, and who are expected to continue the recent increased industry exit rate.”

Among other highlights from Marten’s earnings:

- The overall OR for the company net of fuel was 88.6% compared to 85.4% a year earlier.

- Salaries, wages and benefits rose to $98.5 million from $89.3 million, not surprising given that the company drove more miles even in a tougher environment. But purchased transportation dropped to $54.1 million from $57.3 million.

- GAAP EPS of 28 cents per share was better than forecasts by 1 cent, according to SeekingAlpha. A year ago, GAAP net income was 33 cents. The actual dollar figure for net income was $22.5 million compared to $27.5 million a year ago.

- Even in a tough quarter, the company’s cash pile rose to $96.2 million from $80.6 million at the end of the fourth quarter.

More articles by John Kingston

Amogy: Don’t burn hydrogen, split ammonia instead

Trucking slowdown? No sign of it in March employment figures

New trucking trade group has 1 focus: DOL’s independent contractor rule

Steven Manson

Just wait…1.65 a mile is crap for an owner op, doesn’t even pay the cost to transport much less profit. Prices keep going down and we gonna lose a LOT more drivers then what do you think is going to happen? I make 1800 a week to be away from a house I pay mortgage on and a wife I never see….I. Will NOT take less than that in my pocket