A January survey of leading logistics executives published Tuesday showed “capacity continues to contract and prices continue to grow across the board.” The report found that the amount of inventory that is stuck in the system trying to reach destinations is partly responsible for the lack of transportation and warehouse capacity, which is leading to higher prices.

The Logistics Managers’ Index report, a barometer of change for several areas of the supply chain, showed the overall index with a reading of 67.2% in the month, up 0.5 percentage points from December and remaining well into growth territory.

The LMI is a diffusion index wherein a reading above 50% indicates expansion and a reading below 50% indicates contraction. The survey is intended to capture the rate of change in supply chain trends in areas like transportation, inventory and warehousing.

The overall index remained above the historical average of 62.4% during the month and much higher than the January 2020 reading of 54.1%.

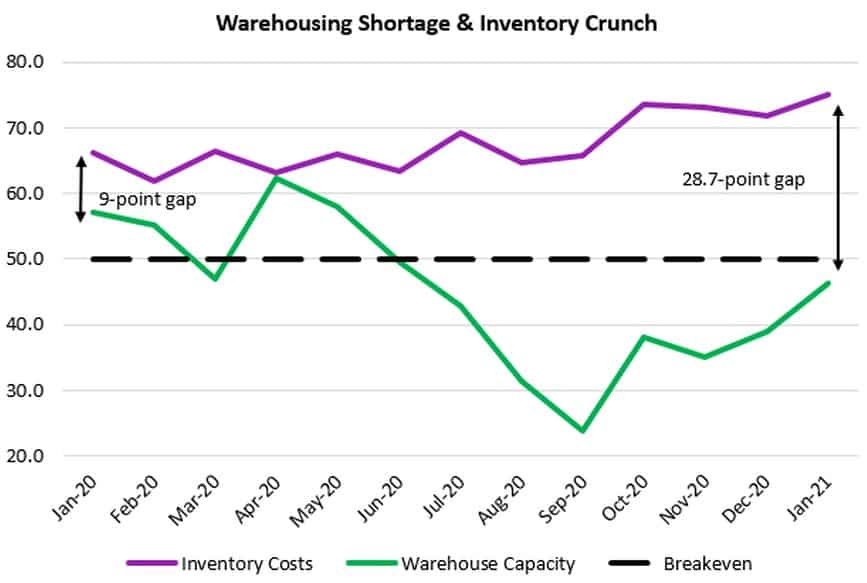

Changes in the growth rates for the inventory metrics drove the bulk of this month’s change. The reading for inventory levels increased 5.7 percentage points to 62.5%. Inventory costs read 3.2 points higher at 75%.

“Due to constricted capacity and high inventory levels, it would appear that as firms increase the amount of inventory they’re holding, the cost of doing so is increasing at an increasing rate,” the report read. “This combined with tight capacity and high prices contribute to the increasing rate of growth detected in this month’s LMI.”

Transportation capacity contracted again in the period but at a slower rate. The capacity reading was 46.3%, 7.4 points closer to parity than the December level. The report pointed to a “glut of traffic currently sitting in U.S. ports” and companies “still having difficulty digging out of the inventory and supply chain backlogs built up in the early parts of the pandemic” as the reasons.

The transportation price index declined 4.1 points to a still very high level of 81%. Rates are still moving higher albeit at a slower pace than in the second half of 2020.

The report said that the lack of a seasonal slowdown following the holidays and heading into Chinese New Year is keeping conditions tight. The recent COVID outbreak at the Los Angeles/Long Beach port complex has only complicated conditions further.

A continuation of current conditions is likely with the report noting consumer demand is expected to “grow with the rollout of the vaccine and the possibility of stimulus.” The report pointed to predictions for a 4% to 5% increase in GDP during the year.

As supply chains attempt to take on more inventory, warehouse capacity is declining and inventory costs are stepping higher. The warehousing capacity index came in at 45.6%, remaining in contraction territory for the fifth consecutive month. Inventory costs stood at 75%, above the 70% historical average and 8.9 points higher year-over-year.

“It is possible that due to the lack of capacity, that inventory prices are increasing at an increasing marginal rate, meaning that each additional increase in inventory being held is leading to ever-increasing increases in the cost to hold it,” the report added.

“In summation, the amount of inventory in the supply chain continues to grind some modes of transportation to a halt, putting a heavy burden on available capacity and driving up prices.”

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.