(An earlier headline said U.X. Xpress’ OR had increased)

U.S. Xpress significantly improved its operating ratio in the third quarter on a modest rise in revenue excluding fuel surcharges and an overall decline in expenses.

Overall, U.S. Xpress reported Thursday that it recorded a 22 cents earning- per-share performance for the quarter, compared to a loss of 3 cents per share in the third quarter of last year.

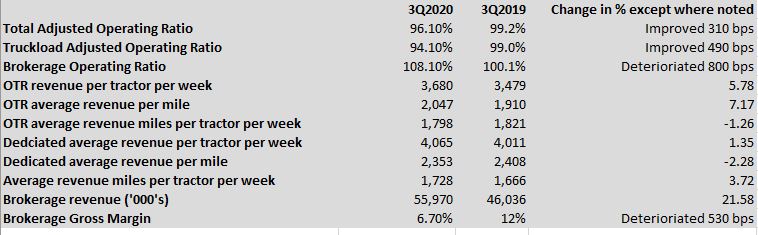

The company’s total operating ratio narrowed to 96.1% from 99.2% last year, while the operating ratio for the truckload division strengthened to 94.1% from 99%. The company’s brokerage division had a tough quarter, coming in with an operating ratio of 108.1%, up from 110.1% a year ago, and its gross margin narrowing to 6.7% from 12% in the third quarter of last year.

Operating revenue rose to $403.6 million from $386.6 million, an increase of 4.3%. Fuel surcharge revenue plummeted to $27.7 million from $41.8 million for total operating revenue of $431.4 million, up from $428.5 million.

Salaries, wages and benefits were up to $137.5 million from $134.8 million. U.S. Xpress is seen as particularly sensitive to fluctuation in spot market rates and driver turnover, so that small increase in a hot market would likely be seen as a positive sign. Purchased transportation rose to just under $126 million from $122.4 million.

In a prepared statement, U.S. Xpress CEO Eric Fuller said the improvement in OR “was tempered somewhat by a higher percentage of unseated trucks in our legacy OTR fleet due to increased competition for drivers and suspension of our student program during the second quarter, which contributed to an approximate 6% reduction in miles driven during the quarter.”

Market reaction to the earnings was not positive, with aftermarket trading pulling down the stock price more than 20% at some points. U.S. Xpress stock has been on a roll, up 21.2% in the last month up to the Thursday close at $9.33.

(Further coverage later Thursday from the company’s quarterly earnings call.)