Logistics companies are responding to continued weakness in airfreight demand by shifting away from longer-term contracts that lock in space commitments with airlines for months at a time to protect themselves in uncertain times, market researchers and industry professionals say.

Air cargo volumes dropped for the ninth consecutive month in November, falling 8% from the prior year and 2% month over month, according to an update this week by market intelligence firm Xeneta. The amount of goods moved on large aircraft was even 8% below November 2019, a weak year for cross-border trade. On the positive side, as previously reported and reinforced by Xeneta, the drop in volumes has stabilized this quarter.

Market conditions marginally worsened in November from the prior two months in what is normally the busiest, most lucrative time of the year for cargo airlines and air logistics providers.

Other data providers show volumes have declined even more versus 2021, but Xeneta has a huge crowdsourced database with millions of rates from shippers and freight forwarders along with a reputation for accurately normalizing the information to identify trends.

According to the Baltic Air Freight Index, a weighted basket of nearly two dozen airfreight routes for general cargo, global air rates have dropped 40.7% year over year.

Fears of a widespread recession, exacerbated by high inflation and the ongoing war in Ukraine that are stifling spending on goods, are prompting supply chain operators to prepare for less business next year.

Freight forwarders are protecting themselves from the uncertainty by signing fewer long-term commitments for space allocations sold by airlines, according to a bulletin from the TAC Index, a rate benchmarking company that enables the Baltic Exchange’s displays. Pricing for long-term contracts remains higher than on the spot market.

Under these block space agreements (BSA), freight forwarders typically agree to pay for a certain amount of tonnage per month — whether or not the full amount is used. In some cases, a forwarder can cancel its allotment on a particular flight with no penalty if it notifies the carrier in advance. Often, the freight broker is responsible for paying the full price of the allotment on every flight, even if no shipments are tendered. Contracts typically have mechanisms that equalize variable shipment quantity over the course of a month and allow the forwarder to better comply with the contract.

Xeneta also said logistics providers are increasingly opting for shorter-term deals of three months, or less, as they try to assess the market’s direction. Pricing has become much more dynamic. Close to half of transactions (45%) between airlines and forwarders are moving against a rate that is valid for less than a month. As airlines shorten the time window for transactions, forwarders are also signing more contracts with shippers with prices that are valid for three months or less.

Contracts of more than six months are nearly nonexistent, and 44% of airfreight is moving on purchases in the spot market, about 10 points higher than a year ago, its data shows.

Shippers’ air and ocean budgets should benefit from the unwillingness of forwarders to lock in capacity, “and falling rates may provide one glimmer of hope for cash-strapped consumers that potentially lower shipping costs in 2023 will make some goods more affordable,” said Niall van de Wouw, chief airfreight officer at Xeneta, in the report.

Chicago-based AIT Worldwide Logistics is making reservations based on ad hoc pricing as the market adjusts and expects to establish more long-term contracts again if rates, as some forecast, level out in the first quarter, a spokesman said in an email.

James Constantinidis, director of air freight at UWL, said the Cleveland-based logistics provider is exclusively relying on spot market transactions for exports out of Asia and most European moves to the U.S. as the market continues to weaken. BSAs could be an option again at some point to support growing export volumes.

“Naturally there is a reluctance to any long term commitment currently, while we wait to see what economic factors are at play in 2023,” he said.

Many airfreight logistics providers that signed high-price block space agreements with carriers early this year, with expectations of a strong shipping season, are now losing money.

“You have a situation where market rates out of China are $2 lower than the block space rate that they signed. So a lot of them have a huge loss,” Christos Spyrou, CEO and founder of independent cooperative Neutral Air Partner, said in an interview.

Other industry professionals said freight forwarders are trying to renegotiate the long-term contracts for allocated space and take other measures to mitigate having to pay beyond-market rates. The freight management companies are also canceling charter flights booked to guarantee capacity when conditions were expected to be tight.

2023 outlook

There was a clear consensus among ocean carriers, airlines, forwarders and cargo owners who attended Xeneta’s recent user conference that consumers will spend less on goods in 2023, suggesting that there will be less need for airfreight, especially to start the year, said van de Wouw.

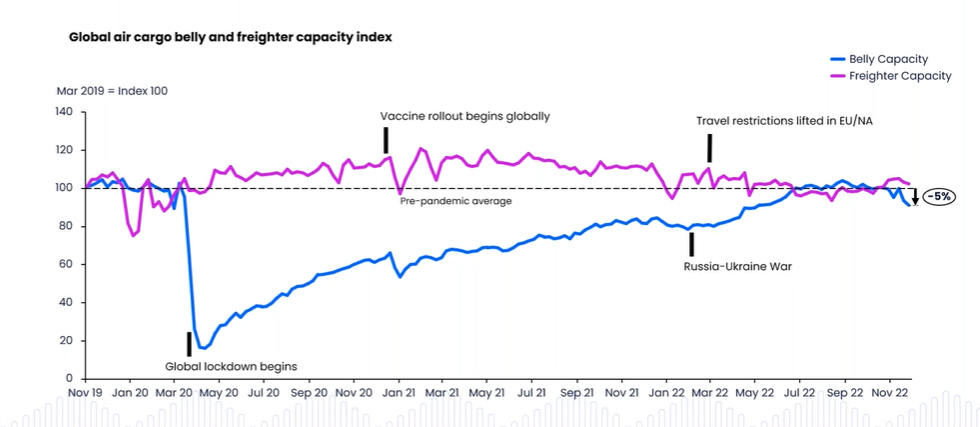

Cargo capacity is better than a year ago because the travel recovery has allowed passengers to restore many international routes. Cargo capacity on widebody passenger and all-cargo aircraft is still 2% (per Accenture’s Seabury consulting unit) to 5% (Xeneta) less than before the pandemic. There are, however, huge regional differences. Cargo capacity is greater than three years ago between Northern Europe and the U.S., and between North and South America, while sharply lower between Asia and Europe.

The reduced capacity helped airlines maintain a cargo fill rate on aircraft of 61%, on par with the previous month, but 2 points lower than in 2019 and 5 points less than in 2021, according to Xeneta. Load factors are based on a combination of weight and space occupied. Planes operating from Europe to North America, for example, in the week leading up to the Thanksgiving holiday were 74% full compared to 86% full during the same week last year, but the figure improved from October, Xeneta said. Asia-Pacific weakness was reflected in load factors dropping 10 points to 81% on the outbound lane to Europe.

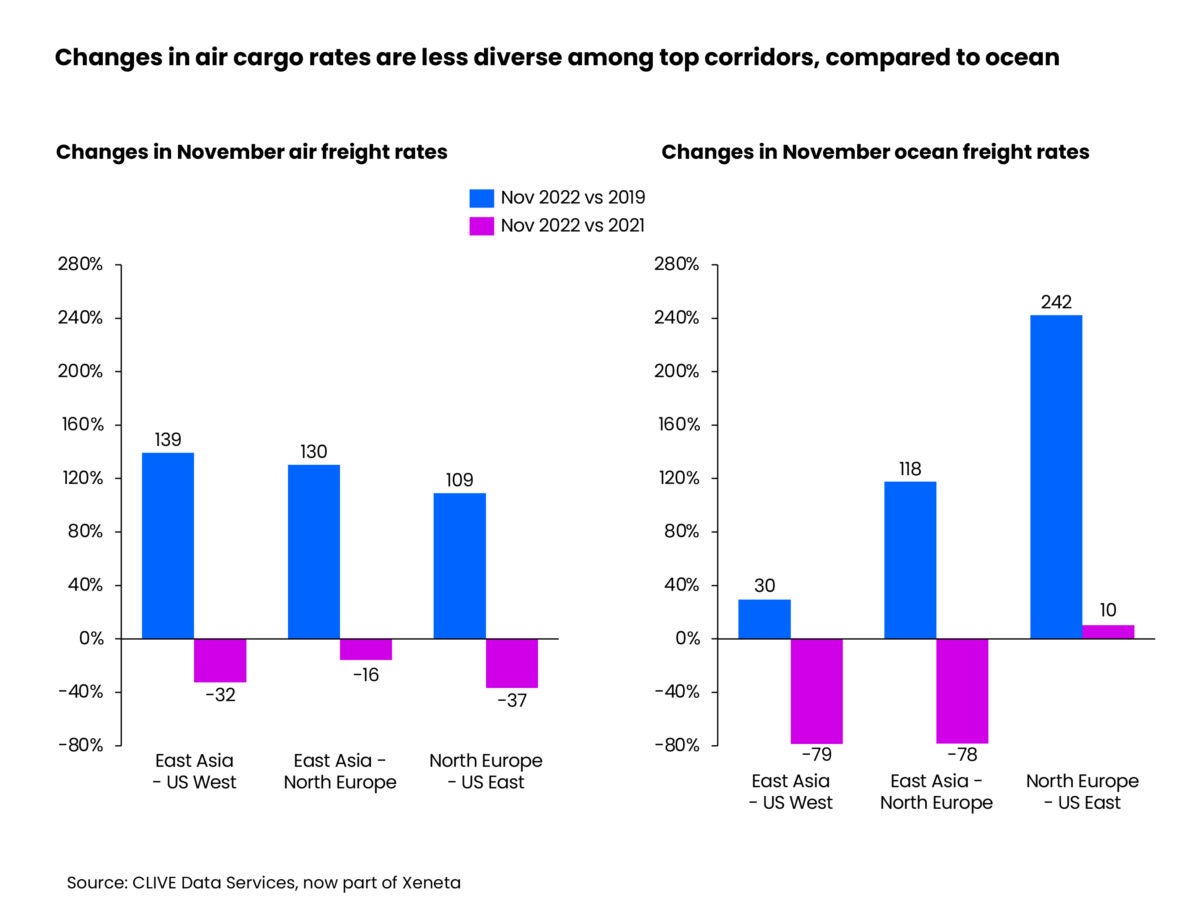

The air cargo sector’s unease should be tempered by the fact that performance in many regions is still better than in 2019 and last year had an outsized peak because of how the pandemic distorted supply chains, putting a premium on airfreight at a time of limited supply. Global airfreight spot rates have substantially retreated but remain 85% above pre-COVID levels despite falling again in the top three trade lanes during November, according to Xeneta.

In fact, air cargo prices have declined more slowly than those for ocean shipping, which has seen prices on the key Asia-to-U.S. West Coast corridor collapse to 2019 levels. The drastic fall in ocean rates is pulling many shipments back to the ocean mode, contributing to the decline in air volumes.

The average November air cargo spot rate on the trans-Pacific lane was down 32% versus last year, to $5.82 per kilogram, but still 139% above the 2019 level. Ocean rates in the same market, as well as East Asia to North Europe, are down nearly 80% year over year. The only market where air cargo remains competitive with ocean shipping is North Europe to the U.S. East Coast, where the cost to ship by water is 3.5 times the 2019 level and air cargo rates are 37% lower than a year ago.

It is noteworthy that the decline in airfreight rates has accelerated in the past three months, as airlines lose pricing power with the influx of capacity that isn’t being filled by the typical pre-holiday surge in shipments.

In a webinar, van de Wouw forecast that air cargo pricing will continue to face downward pressure next year but that the decline will likely be slower than in recent weeks. Unforeseen supply chain disruptions, strikes and labor shortages at airports and airlines, COVID restrictions in China, and the continued influx of new and converted freighters could alter current trends, he noted.

Neil Wilson, editor of the TAC Index, said in a recent commentary that the collapse in European gas prices, the Federal Reserve potentially pulling back on interest rate hikes as inflation begins to ease and signs of a full reopening in China after waves of COVID isolation policies suggest a “soft” global recession that could pave the way for air cargo demand and rates to swing up again by April.

Other industry experts anticipate big box retailers and other businesses will sell off excess inventories and need to reorder goods by next spring, leading to increased need for international air transport.

Once China eases COVID lockdowns oil demand will increase and airlines will apply fuel surcharges to recover cost from rising jet fuel prices, leading to higher freight rates next year, predicted Bruce Chan, senior logistics analyst at Stifel, in a commentary.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Air cargo market stuck in doldrums during normal busy season