The cargo holds of aircraft flying between Europe and North America are less full than a month ago as the number of passenger flights swells and shipping demand softens, but supply chain friction and high jet fuel prices are artificially propping up freight rates in a declining market, according to logistics experts.

Cargo owners could enjoy considerable pricing relief in the months ahead if airport constraints get better, Niall van de Wouw, co-founder and managing director of analytics firm Clive Data Services, told FreightWaves.

Clive’s analysis shows the dynamic load factor, which essentially measures aircraft capacity utilization as a function of both volume and weight, has fallen below 80% for the first time in two years. Total air cargo capacity increased by 15% in the last week of March from the previous week as airlines step up summer schedules to meet pent-up travel demand following the COVID crisis.

Xenata, Clive’s parent company, said in a blog post Wednesday that between mid-March and the end of April capacity from Western Europe to North America measured in volume increased by 21%, to its highest level this year. Over the same period the volume of cargo dipped 1.4%. Capacity measured in weight is up by 18.5% over the six weeks since mid-March, compared to a 6% drop in the weight of cargo carried, illustrating that higher load factors before were more a function of tight capacity than strong demand.

Anecdotal industry accounts vary about the degree to which shipping volumes tendered for air transport have slowed.

Despite looser market conditions rates on the Northern Europe-North America corridor have ticked up. Region-wide, shipping costs are leveling out and trending downward. Under normal circumstances with the influx of widebody passenger aircraft, the price of moving goods would have retreated much further, especially for air exports to North America.

The reason it hasn’t, in van de Wouw’s estimation, is that airport cargo terminals continue to struggle with labor shortages and inadequate truck capacity, slowing their ability to load and unload huge freighters and sort shipments for pickup. Much larger crews are also needed to work passenger planes temporarily dedicated to cargo operations when light boxes are stored in the cabin.

Cargo terminals at London Heathrow airport, for example, are experiencing congestion as volumes spike and ebb because cargo transshipped by truck through Europe is backlogged at the ferry crossing in Dover, France, after the operator cut back on personnel, third-party logistics provider Flexport said in an update for customers last week.

“Capacity in the air is not so much the limiting factor, it’s the capacity on the ground,” van de Wouw said in an interview while waiting for a flight in Hamburg, Germany. “So there’s a bit of a disconnect temporarily between load factors and rates because there is a bottleneck. But even so, if that load factor starts to drop or remain at this level, I think it’s logical that rates will follow.”

Another counter pressure on falling air freight rates is fuel surcharges airlines are adding to invoices on a near weekly basis to help cover record-high jet fuel prices, logistics companies say.

A barrel of jet fuel is $4.15 a gallon, 150% higher than a year ago, according to Platts. The U.S. Energy Information Agency said distillate inventories, which include diesel and jet fuel, fell to their lowest level since 2008. Crude oil production was struggling to keep up with global economic recovery from the pandemic when markets were roiled by the Russian invasion of Ukraine on Feb. 24 and subsequent sanctions against Moscow.

Airlines have increased fuel surcharges for shipments by more than 50% from the levels seen in early February, Edward DeMartini, Kuehne+Nagel’s vice president of air logistics development for North America, said in an email. Rate reductions are also limited because the widebody passenger aircraft are carrying more luggage as they fill more seats, which reduces the amount of belly space available for cargo.

Kuehne+Nagel is the largest ocean and air freight forwarder in the world.

“It would be reasonable to believe that even as more flights are added to the trans-Atlantic that rates will in fact go higher or stay high based on the lost capacity to luggage and the vast shortages of jet kerosene in the U.S. and Europe that will keep fuel surcharges at levels not seen since 2008,” DeMartini said.

Dawn of a buyer’s market?

Still, signs point to a potential buyer’s market in the near future, according to Clive Data.

Before the COVID crisis, load factors from North America to Europe averaged 45%, and 65% in reverse. Load factors in both directions jumped 20 points when passenger belly capacity evaporated at the height of the pandemic, but prices didn’t respond in parallel. Outbound rates to Europe increased about 50% to 70% the past two years, while eastbound rates soared two to three times higher than normal.

A load factor of 80% represents the tipping point for significant rate increases favoring sellers. Airlines were in a dominant position when North American-inbound load factors reached 85%, so rates increased in a nonlinear fashion.

Now the trend appears to be heading in the opposite direction.

Airlines are restoring their international fleets after two years of flying a fraction of their normal schedules because of COVID. Clive Data forecasts that the North Atlantic market will most likely be the first international one to return to normal because of the high share of belly space compared to freighter capacity.

United Airlines (NYSE: UAL), for example, has launched the largest trans-Atlantic expansion in its history in anticipation of a strong recovery in European summer travel. United announced last week it will start or resume 30 flights across the Atlantic Ocean from mid-April through early June, although many target leisure destinations with limited cargo traffic. United’s trans-Atlantic route network will be more than 25% larger than it was in 2019.

International Airlines Group, the parent company of Iberia and British Airways, on Tuesday said it has increased operations from Spain to the U.S. It now has more than 120 weekly connections, a 40% increase since March.

At the same time, companies are moving fewer goods globally. Global demand for air cargo shrank 5.2% in March compared to 2021 because of the Russia-Ukraine conflict and widespread COVID lockdowns in China that have slowed manufacturing and air exports, the International Air Transport Association reported Tuesday. Clive Data previously counted a 4.5% contraction for March.

New export orders, a leading indicator of cargo demand, are now shrinking in all markets except the U.S. The Purchasing Managers’ Index indicator tracking global new export orders fell to 48.2 in March, the lowest point since July 2020.

“The majority of our air freight volumes are consumer goods, and it is evident that the demand has declined” partly because the U.S. economy is slowing, said James Constantinidis, director of airfreight at UWL Inc., a Cleveland-based freight forwarder.

The U.S. economy contracted 1.4% in the first quarter, the government reported last week. Many people say high inflation — more than 6.3% in G7 countries — is eroding their purchasing power and motivating them to spend less on products.

Although spot rates remained relatively unchanged from Europe to North America, the share of volume being sold against real-time rates compared to longer-term contracts decreased nearly 5 points to 44% from 49% in March, indicating a potential softening of the market, Clive Data said Tuesday in its monthly market update.

But some freight management companies say demand hasn’t changed too much in Europe and that companies are booking airfreight to ensure adequate summer inventories. How much of that dynamic applies to the Asia-Europe trade versus North America-Europe is unclear. Benno Foster, senior vice president and head of airfreight for the Americas at DB Schenker, said two-way demand between Europe and North America is is still outstripping capacity and is one reason the company is expanding its controlled network of chartered freighters.

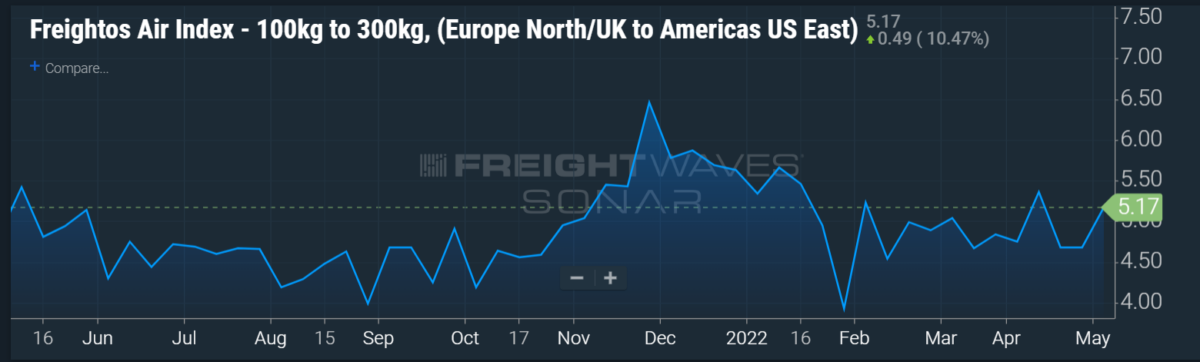

The spot rate for immediate transactions from northern Europe to the U.S. East Coast climbed from $4.68 per kilogram for the week ending April 24 to $5.17/kg as of Sunday, according to a benchmark index for shipments under 300 kilograms published by digital freight marketplace Freightos. Rates have remained more stable, at an elevated rate, when measured since the start of March.

U.S. air exports are up 20 cents to $1.58 per kilo since early March after recovering from $1.05/kg in early April.

Long-term rates have not yet followed the same downward trend as the spot market. On April 30, the average rate for contracts signed in the past three months was more than $1.70/kg higher than the average short term rate, at $5.90/kg, Xenata said. Early indications show a softening in both rates in early May.

The new demand-supply equation caused some trans-Atlantic air cargo rates to taper during April, depending on the origin and destination. Shipping from southern Europe to New York, for example, costs about $4/kg now, down 11% from early March. And rates from northern Europe to the Midwest and the West Coast decreased about 23%.

Clive Data reports load factors on the Europe-North America lane dropped in April to 70% on average, compared to 82% at the end of March. Capacity utilization is still 10 points higher than pre-COVID, but spot rates are expected to drop disproportionately.

On the eastbound transatlantic, the dynamic load factor and rates have also reacted to the increased capacity. From North America to Western Europe the dynamic load factor has fallen to its lowest level since the start of the year at 57%.

Shippers on long-term contracts are paying more than those on the spot market at about $2.30/kg, according to Xenata.

“I would expect the same to hold true, so we would see a nonlinear decline in rates if this remains the situation,” said van de Wouw, who predicted negotiating power between airlines and forwarders will change and the more favorable rates will eventually be passed down to the shippers once more ground-handling delays are resolved.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING: