BorgWarner Inc. (NYSE: BWA) beat Wall Street’s consensus revenue expectations of $2.55 billion for the fourth quarter of 2018, even though the company’s sales decreased 0.5 percent year-over-year (Y/Y), from $2.586 billion to $2.572 billion. According to Seeking Alpha, BorgWarner beat consensus revenue estimates by over $20 million, or about 0.8 percent.

However, BorgWarner missed its guidance estimates of quarterly revenue growth of between one and four percent growth Y/Y from the fourth quarter of 2017. Shares of BorgWarner stock declined over 2 percent in pre-market trading on February 14 according to Seeking Alpha.

BorgWarner Inc. is based in Auburn Hills, Michigan and is an auto-parts supplier with a focus in powertrain (motors) and drivetrain (connects engine to wheels) components for light vehicles. It provides these components to the big three U.S. auto manufacturers (Chrysler Fiat (NYSE: FCAU), Ford (NYSE: F) and General Motors (NYSE: GM). It also sells components to European and Asian original equipment manufacturers (OEMs).

BorgWarner beat consensus expectations of fourth quarter GAAP earnings per share (EPS) of $1.07 by nearly three percent. Quarterly diluted EPS were $1.10. The company beat quarterly consensus estimates of non-GAAP diluted EPS of $1.07 by 13 percent. Non-GAAP diluted EPS were $1.21. The company’s earnings release said that net income increased 257 percent Y/Y from a net loss of $146 million ($0.70 per share) in the fourth quarter of 2017 to $230 million in the fourth quarter of 2018.

Gross profit for the quarter decreased nearly 4 percent Y/Y from $564.8 million in 2017 to $542.8 million in 2018. Gross profit as a percentage of sales for the quarter also decreased Y/Y from 21.8 percent to 21.1 percent. Operating income for the quarter increased nearly 28 percent Y/Y from $207.8 million to $265.6 million. Operating income as a percentage of sales for the quarter increased Y/Y from 8 percent to 10.3 percent.

“2018 was a year of strong execution,” said Frédéric Lissalde, BorgWarner president and chief executive officer. “We had significant launches and wins across our combustion, hybrid and electric products.”

In 2018 BorgWarner accumulated a business backlog in manufacturing light vehicle components of between $2 billion – $2.4 billion, which will be completed over the next three years (2019-2021). In 2019, between $430 and $580 million of components will be completed. In 2020, between $750 million and $875 million will be completed. In 2021, $800 million to $950 million will be completed. The release said that the backlog will increase the company’s industry outgrowth basis points between 500 and 600.

Electric vehicles comprise 10 percent of the business backlog, combustion vehicles comprise 20 percent and hybrid vehicles make up 70 percent.

The Americas (Brazil, Mexico and the U.S.) made up 25 percent of net new business backlog in the fourth quarter. Europe (France, Germany, Hungary, Ireland, Italy, Poland, Portugal, Spain, Sweden and the U.K.) comprise 15 percent. Asia excluding China (India, Japan, Korea and Thailand) made up 10 percent. China was the largest contributor to new BorgWarner business backlog at 50 percent.

Business Segments

Powertrain

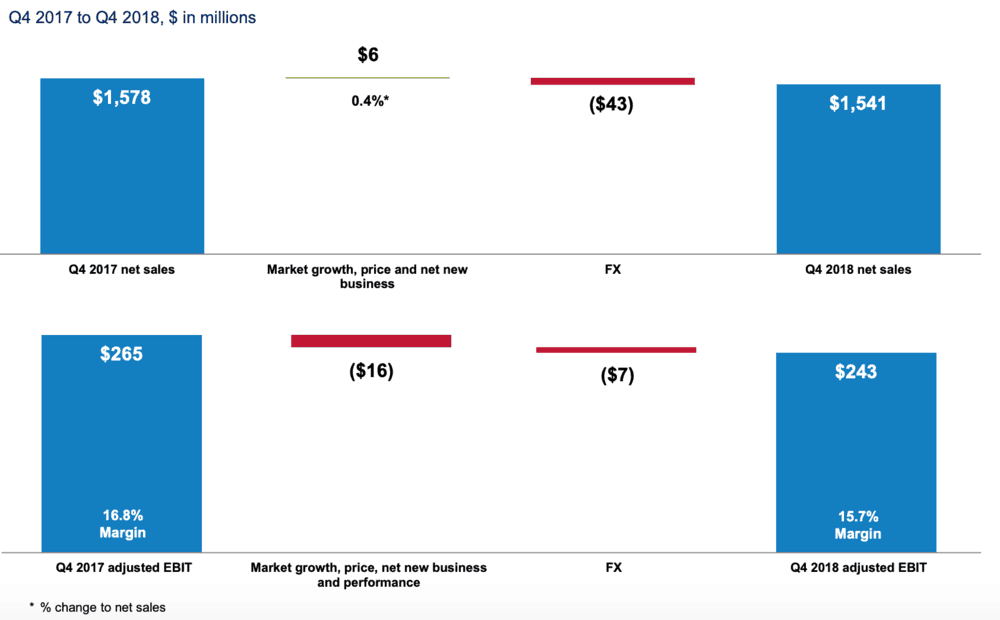

Powertrain sales for the quarter increased 0.4 percent Y/Y or $6 million. However, the effect of foreign exchange decreased sales by $43 million, causing net sales to decrease over two percent.

“We are not satisfied by this performance,” said Thomas McGill, interim chief financial officer and treasurer at BorgWarner.

Drivetrain

Drivetrain sales for the quarter increased 4.4 percent or $45 million Y/Y with the effect of foreign exchange decreasing sales by $22 million. Drivetrain net sales increased over two percent Y/Y from $1.023 billion in the fourth quarter of 2017 to $1.046 billion in the fourth quarter of 2018.

2019 Forecast

BorgWarner expects 2019 sales growth of -2.5 percent to 2 percent.