Few in freight appear to have high hopes for profits in the first quarter, but the landscape is at least starting to look a little brighter for carriers, according to the Q1 2023 Freight Sentiment Indexes. The indexes, which FreightWaves Research produces via surveys in the first two weeks of each quarter, combine near-term and longer-term scores to generate a snapshot of business attitudes.

Taken together, the results paint a picture of a troubled freight market that could be starting to find some balance.

Near-term profitability — the likelihood respondents think their companies will be more profitable in the current quarter than the last one — declined for shippers, brokers and carriers alike. But longer-term profitability, which gauges how Q1 2024 will look compared to Q1 2023, went up across the board.

Top-line broker sentiment declined to 6.97 from 9.8, which was the most drastic change of the three groups. The same metric for shippers fell to 10.64 from 12.68. Carriers, meanwhile, creeped up to 5.97 from 4.87. That’s a modest gain (and still the lowest of the bunch), but it suggests more market parity.

In fact, carrier sentiment increased in three out of the five subcategories. The only category it declined in other than near-term profitability (minus 8.63) was longer-term workforce, which nonetheless held solidly positive at 11.73, down about half a point from 12.28 in Q4 2022.

The Freight Sentiment Indexes are produced from three separate outlook surveys sent quarterly to carriers, shippers and 3PL employees, respectively. Respondents are asked to indicate on sliding scales from minus 100 to 100 what their feelings are on near-term profitability, longer-term profitability, near-term workforce, longer-term workforce and business investment environment. Minus 100 would indicate apocalypse, positive 100 utopia.

Scores for each of those questions are averaged for respective index subcategories, and the averages of the subcategories are then used for top-line segment sentiment. In combination with data from FreightWaves SONAR, the results lend some credence to the theory that the bottom of the spot rate market in trucking is upon us — that is, if it hasn’t already passed.

RELATED: High-frequency truckload data suggests the freight market is stabilizing

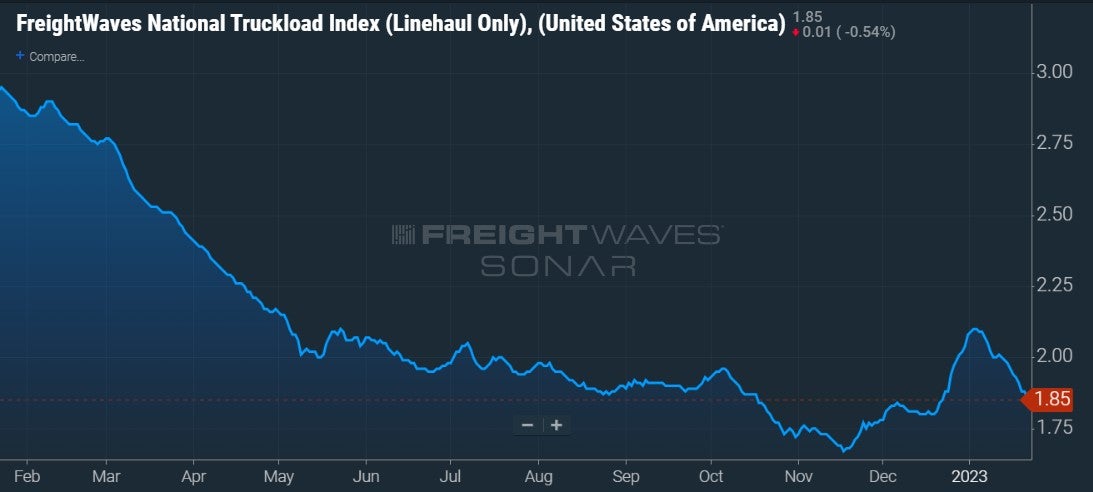

Truckload spot rates — as measured by the FreightWaves National Truckload Index less fuel (Ticker: NTIL.USA) — hit a low of $1.67 in mid-November. Then the index started climbing, and it kept climbing for a month and a half, crossing back into $2 territory for a week in late December and early January.

Since then, however, it’s been declining again — and doesn’t appear to have stabilized yet. That leaves open the possibility that carriers were in a slightly more buoyant mood when surveys were fielded at the start of the quarter than they will be when the quarter ends.

But that doesn’t discount that when including a long-term perspective, carriers see themselves in a marginally stronger position now than three months ago.

That’s not the case for brokers though. Near-term expectations declined so sharply (to minus 4.92 from 2.94) that the group’s positive longer-term feelings could not prevent the overall average from dropping.

Additionally, brokers’ near-term workforce sentiment fell to 1.60 from 6.83, suggesting a higher likelihood of layoffs this quarter (though the index is still positive, it should be noted). Similar to the score from carriers, longer-term workforce stayed steady above 10.

Shippers are once again the most positive of the bunch, with an overall average of 10.64. But that’s down about two points from 12.68 in Q4 2022. They scored near-term profitability 5.39 and longer-term profitability at the highest of all the collected scores: 22.17.

RELATED: Analysts make divergent calls on trucking in 2023

Inflation is still a large contributor to the disparity between shippers’ near- and long-term profitability. It might be a surprise to grocery store or gas station goers, but producers initially absorbed a large chunk of inflationary pressures before then passing them on downstream.

The Producer Price Index (PPI) has now declined more than 5% from its record-high reading in summer 2022. In that same timeframe, the Consumer Price Index (CPI) has grown more than 2%. That rate of growth is slowing, but shippers can expect continued benefits from falling input costs and elevated prices received.

One wrinkle in a perfectly rosy outlook for shippers though is that according to the December reading of the Logistics Managers’ Index, inventory growth actually accelerated in the month for the first time since summer 2022. That’s an early sign that demand is eroding faster than companies anticipated.

Consumers now are saving less and racking up debt at nearly the same pace they were prior to 2020. As a result of rising interest rates, this debt is more expensive than it was before the pandemic and will reduce consumers’ future spending power.

RELATED: Trucking demand falls faster than inventories in December

As noted earlier, broker sentiment (6.97) occupies a middle ground between shippers (10.64) and carriers (5.97) for a second straight quarter. It makes some sense that intermediaries would find themselves in that spot more often than not.

3PLs act as shippers when sourcing carriers and as carriers when moving loads for shippers. As cycles pass, the pendulum of freight market power swings from carrier to shipper and back again, with brokers/3PLs operating a model that in theory can benefit from either scenario.

Watch now:

In regard to the business investment subcategory, shippers scored the highest, meaning they’re the most likely to consider now to be a good time to spend money on new technology. FreightTech companies have developed a number of tools for shippers’ benefit in recent years, allowing more accurate insights into transportation prices and market trends.

FreightWaves SONAR provides access to critical freight data and intelligence as it pertains to monitoring and forecasting load volumes, capacity and rates (both spot and contract) on national and individual lane levels. FreightWaves’ Market Dashboard provides users with Trusted Rate Assessment Consortium (TRAC) spot rates, which are real-time, buy-side, all-in spot rates at the lane level.

The Market Dashboard also allows brokerages to benchmark lane-level spot rates with the National Truckload Index – Daily Report (NTID), the daily reported national dry van spot rate, based on TRAC spot rates of 250,000 lanes.

Related articles

Francisco andujo

I don’t know were you people get your data from ,here in California big time warehouses are going out of business daily,and the rates are the lowest in history,the big carriers are playing their game as always moving loads for nothing, as well as the Mexican and Canadian companies are moving loads for nothing?are they stealing fuel that’s the only way they can be doing this and that’s a fact ,put that in your index!!!