The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

Author’s Disclosure: I am not an investor in Transmetrics, either personally or through REFASHIOND Ventures. I have no other financial relationship with Transmetrics.

Transmetrics is a software-as-a-service startup that unlocks the power of data for demand forecasting and predictive optimization in cargo transportation. It was founded in 2013, and is headquartered in Sofia, Bulgaria with a distributed team residing in Belgium, Germany, Hungary and Netherlands.

This installment of the AI in Supply Chain series (#AIinSupplyChain) focuses on what Transmetrics has done since it was founded, as well as its plans for the near future.

While I specifically focus on Transmetrics in this commentary, it is just one example of some of the innovations that are taking place in logistics technology as entrepreneurs, software engineers and other technologists team up to build products and startups that solve the problems large companies have grappled with for too long because the enabling technologies were immature.

Defining the problem that Transmetrics solves for supply chain logistics companies

Lisa Laguzinskaya, Transmetrics’ Head of Commercial Operations, told me that the company’s co-founders, who have known one another for many years, came together to see if they could answer a question that they encountered frequently during their IT consulting engagements with large logistics companies.

The logistics and cargo transportation companies kept asking Transmetrics’ co-founders, “What can we do to better match our supply of cargo capacity with demand?”

Based on their experience, Transmetrics’ four co-founders decided to create a product that utilized machine learning, data mining and data analytics to forecast demand and optimize transport planning and asset management for companies in cargo logistics. The co-founders reasoned that with more accurate demand forecasts, cargo transportation companies could then optimize capacity and supply.

Since those early days in 2013, Transmetrics has developed products for less-than-truckload trucking, asset management (container, truck, trailer), freight forwarding, as well as transportation equipment rental and leasing, with more products in the pipeline.

Starting in 2013 and 2014 with pilot customers like DHL Express, Agility Logistics and ECS European Containers, the company now helps companies like Kuehne+Nagel, NileDutch, DPDGroup, Gebrüder Weiss, and others reduce their operating costs and increase their operating efficiencies.

During our conversation, Laguzinskaya emphasized Transmetrics’ unique focus on data cleansing. In her words, the team at Transmetrics made that an integral aspect of the company’s capabilities once they realized that “You can’t forecast or optimize effectively if you have bad data.”

Transmetrics works with its customers to gather, cleanse, augment and enrich historical operational data on capacity and utilization. This data is then fed to optimization models that support decision-making by Transmetrics’ customers.

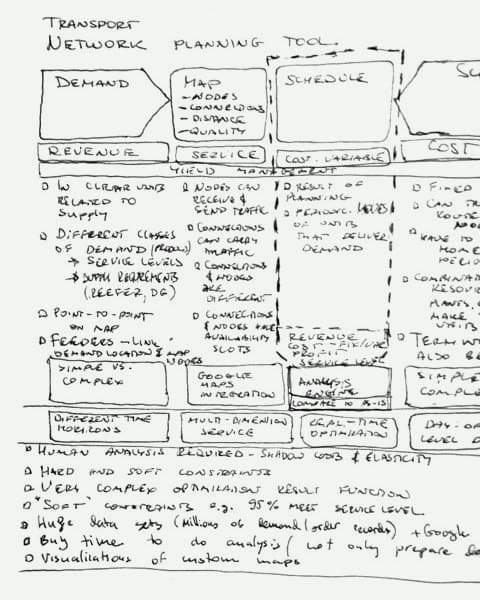

(Photo: Brian Aoaeh)

Why Transmetrics’ team believes that data cleansing is critical

Alexis Zubiolo, Lead Data Scientist at Transmetrics explained, “Data quality is often a major issue when working in logistics. The two main reasons are the lack of discipline and automation in the data acquisition process (missing scans, package dimensions, etc.) and the fact that there are many different transportation management systems (TMS) with various data structures.”

Zubiolo added, “Transmetrics combines manual and automatic approaches (outlier detection, imputations, duplicate elimination, etc.), and we have years of experience by now. The automatic approach can easily scale but the manual work cannot. Fortunately, logistics companies are realizing that data acquisition is a key point, and as a consequence, the quality of the data is increasing, which will reduce the need for manual data transformations.”

Asparuh Koev, a co-founder and CEO of Transmetrics, offered additional perspective on why data cleansing is core to how the company sees its relationship with its customers. In his opinion there are three key aspects of the data quality issue in logistics.

(Photo: Jim Allen/FreightWaves)

“The first problem is that the data contained in a TMS is in a very complex format. The data is focused on supporting daily operations and it is not suitable for business intelligence in its raw form. We have developed technology to quickly take the data from any TMS including custom-built and legacy/in-house systems, and put it into a format which makes it easy to use it for business intelligence. The first time we tried to do it years ago, we realized that it takes up to a year to do such a process properly. Now we have learned how to do it in one to two months.”

“The second problem is missing or incomplete data. For example, if you are trying to decide on how much truck capacity you would need, you should be able to understand how big the parcels are that you are transporting. Very often, however, there is not enough data and you might know only the weight. Our algorithms use machine learning and predictive techniques in order to enrich and complete the data,” he explained.

“The third problem is related to data complexity. Logistics is not really about big data but it is about complex data. The data that describes the logistics processes is extremely complex so we have developed an entire canonical data model that helps to put all the data into perspective and connect it to other data,” Koev said.

He went on to explain, “To give you an example – to correctly capture what is going on in logistics operations, you need to have 20 to 30 tables with between 10 and 15 fields per table to understand what is going on in one connected view. We have developed a recipe – our canonical data model – that works for any logistics operation. We have applied the same recipe to container operators, parcel operators, intermodal operators, warehouses and it works everywhere. Otherwise, it would take months and months to figure out how you should position various pieces of data in relation to each other and how you should connect them.”

Koev concluded, “The bottom line is that, besides the cost-cutting, Transmetrics saves its customers a massive amount of time. Implementing Transmetrics saves our customers data headaches and moves them directly to a discussion of the business benefits and how they can save money in the second or third month of implementation.”

(Photo: Jim Allen/FreightWaves)

Transmetrics’ relationship with its customers

I noticed that Transmetrics has a Customer Board, a Board of Directors, and an Advisory Board. So I asked Anna Shaposhnikova, Chief Commercial Officer and another co-founder of Transmetrics, what roles the Advisory Board and the Customer Board play, and how having those two boards has helped Transmetrics commercialize its products and grow.

She said, “The Advisory Board plays the role of expanding our network within the industry. Professionals who are on our advisory board are industry champions and they specialize in different sectors of the supply chain (maritime, ground freight, warehousing, air freight etc.). They are all believers in data analytics and the importance for the industry to be data-driven and predictive. Our advisory board was essential for us during the first years of Transmetrics’ development when we started in 2013. They were introducing us to their network and potential customers who were open-minded and innovation-driven, which was not an “industry norm” especially back in 2013-2014. That is changing now.”

Shaposhnikova added, “The role of our customer board is to assist us with continuous improvement of our product and features, and the exploration of potential for product development. The customer board brings together the leaders of our current customers and we have strategic conversations about where the industry is going, where the changes must happen, where innovation (data analytics and forecasting) would be the most helpful to solve their everyday problems.”

She concluded by stating, “Both the advisory board and customer board are essential for our growth, as they support us with feedback, are very positive about our company and are very helpful when we come to the next customer, as they are providing references about working with us.”

Shaposhnikova’s comments confirm what I have learned since 2015 about some of the steps that startups building technological innovations for industrial supply chains must take if they are to succeed – they need ongoing engagement with the industry in order to understand the nuances that exist beneath the surface.

In a sense, supply chain technology innovators must simultaneously adopt and embody the outsider-mindset and the insider-mindset. This is one reason that innovation communities and ecosystems are critical as catalysts for technological innovation within industrial supply chains – they help close the cultural chasm between large industrial supply chain incumbents and emerging supply chain technology innovators. This observation has been reinforced by my experience building The Worldwide Supply Chain Federation and REFASHIOND Ventures.

(Photo: Jim Allen/FreightWaves)

Transmetrics’ “secret sauce”

This is a series about AI in Supply Chain, so I asked Alexis Zubiolo, Transmetrics’ Lead Data Scientist, “What is the secret sauce that makes Transmetrics successful? What is unique about your approach? Deep learning seems to be all the rage these days. Does Transmetrics use a form of deep learning?”

He said, “Transmetrics combines data cleansing, forecasting and optimization algorithms to enhance logistics companies’ performance. Too many trucks, trains and ships travel empty – or far below capacity – due to suboptimal planning.”

He added, “Even if deep learning is all the rage nowadays, many AI-related problems are solved with more traditional machine learning approaches. Deep learning models require a lot of data. At this stage, only major players have such large amounts of data at their disposal. However, for the majority of logistics companies – that also deserve predictive analytics! – the amount of data available is insufficient.”

But, Zubiolo is not completely against deep learning, because, he said, “Transmetrics does not hesitate to test deep learning approaches whenever needed but until now, these do not outperform other approaches. There is no doubt that deep learning will gain popularity in logistics as the data acquisition process improves and the quantity of data increases. But as of today, Transmetrics uses mostly Bayesian modelling, traditional machine learning algorithms and optimization – deterministic and stochastic – to tackle its customers’ problems.”

(Photo: Jim Allen/FreightWaves)

The next 18-24 months and the impact of COVID-19 on Transmetrics’ customers

I asked Koev, “What is Transmetrics focused on for the next 18 to 24 months? Are there specific problems your customers want you to solve now that everyone is dealing with COVID-19 that perhaps were not a priority before the pandemic?”

He said, “Our ambition is to serve the entire supply chain industry, but right now we have two areas of focus where we are successful. The first area is transport planning for post and parcel businesses. The second is empty container management for ocean shipping lines. We see that in both of these areas there are unique challenges created by the pandemic that we are addressing.”

He added that Transmetrics sees a big spike of volumes in the parcel market, citing as an example reports that Amazon has added 75,000 jobs during the pandemic. He points out that this is not a development that is unique to Amazon; other parcel delivery companies are also scrambling to meet demand. “People stay at home so they are ordering more. At the same time there are supply issues and it is more difficult to find the capacity to transport these increased volumes of packages.”

He added, “Therefore, we are really focused on our strength – which is to match the supply and demand and to help them rationalize how they are moving the packages in three areas – linehaul, hub and last-mile.”

However, as people who follow news about supply chain logistics know, global container shipping volumes have hit a rough patch.

(Photo: Jim Allen/FreightWaves)

Koev explained, “The other sector on which we are focusing is ocean shipping. The liner companies have a different problem with COVID-19 as there are profitability issues and they need to cut costs. Our product can generally reduce the cost of empty logistics by 10%, and in some areas like storage costs, the cost reduction can be up to 30%. So especially now, Transmetrics is a strong tool for the ocean shipping companies when they are looking to rationalize their cost-base.”

Echoing some of the sentiments that other supply chain technology startups have shared in this column (April 9 and April 23), he added, “In general, for us it is business-as-usual and to some extent, COVID-19 made us more relevant – there is an urgency to use something like Transmetrics in both of these sectors.”

Specifically about where the team at Transmetrics will focus its attention over the next 18 to 24 months, Koev said, “At the beginning of 2020, we received a EUR 1.67 million grant from the European Commission for the Horizon2020 program. We are investing part of this grant in the area of big data forecasting using external data sources. The main data source for our predictions is historical data and a number of relevant external factors. But we are now expanding the external data sources.”

The team does not intend to stop there, however, because Koev continued, “The other area we want to explore is predictive maintenance. There are strong signals from the market that predictive maintenance is needed right now. We are uniquely positioned to do that. We are looking to start several pilots on predictive maintenance using our product.”

During my conversation with Laguzinskaya, she said the company has raised a total of EUR 5.0 million, including the Horizon2020 Grant from the European Commission. Although we did not discuss this specifically, I would not be surprised if Transmetrics is out raising a round of financing in late 2021 or early 2022 in order to enable it keep up with demand for its software.

(Photo: Jim Allen/FreightWaves)

Conclusion

Returning to the issue of Transmetrics’ secret sauce, Koev said, “Our secret sauce is that we are really business-focused. From the technology perspective, we combine different algorithms and approaches to get the best result for the business challenge.”

He added, “We are passionate about algorithms but we are even more passionate about the business impact the technology has. There are many companies that are very good at technology but the reality is that to transition from the algorithm to a real-life business application is quite a difficult process and this is what we have mastered.”

It appears Transmetrics’ focus on creating meaningful business impact for its customers is paying off: The company announced on July 1 that Jonathan Fath has joined the team as Transmetrics’ Chief Operating Officer. He will have “commercial and general management responsibilities, driving revenue, and contributing to product development based on his extensive experience in logistics assets management.” Furthermore, Laguzinskaya told me the company’s number of employees has grown by about 44% from its size just a year ago and is now at 33 people.

#AIinSupplyChain will be my focus in this column for the remainder of 2020. Next week I shift the focus to decision-making in global commodities markets and breakbulk shipping. After that, I’ll move away from logistics for a while and explore what’s happening in other industries and other areas of the global supply chain.

If you are a team working on innovations that you believe have the potential to significantly refashion global supply chains we’d love to tell your story in FreightWaves. I am easy to reach on LinkedIn and Twitter. Alternatively, you can reach out to any member of the editorial team at FreightWaves at [email protected].

The reference archive – dig deeper into the #AIinSupplyChain Series with FreightWaves

- Commentary: Optimal Dynamics – the decision layer of logistics? (July 7)

- Commentary: Combine optimization, machine learning and simulation to move freight (July 17)

- Commentary: SmartHop brings AI to owner-operators and brokers (July 22)

- Commentary: Optimizing a truck fleet using artificial intelligence Why IBM Watson and Google DeepMind AlphaGo can’t do it… (July 28)

Commentary: FleetOps tries to solve data fragmentation issues in trucking (August 5)