The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

Now a third of the way into the fourth quarter, how is 2020 going to end up for the U.S. freight railroads?

It’s going to be a mixed bag.

There are plus and minus indicators as we look closely at the data year-to-date.

Yes, third-quarter economic recovery has lifted railroad volumes back up — but not for every rail-moved business commodity segment.

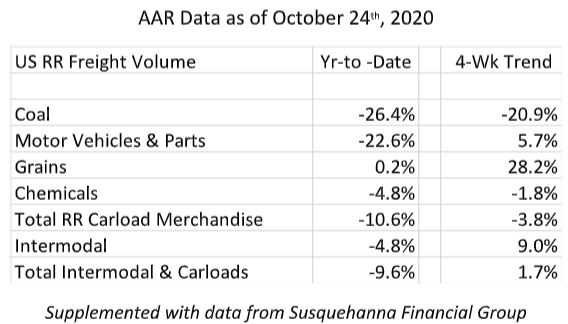

Table 1 shows two tales of the recovery as a focused list on those commodities that are most likely to somehow drive rail freight recovery.

The table identifies both the year-to-date and the latest four-week trend line into late October.

There were extremely disappointing decreases for coal and somewhat modest recovery for motor vehicles and auto parts.

Yes, high marks overall year-to-date for selected commodities like chemicals and grains.

Here are signals that bear watching if you are a railroad freight economist:

— Oil consumption demand across the U.S. is down and inventory of crude on hand is up. It is part of global destruction of energy demand. WTI traded has recently traded in the under-$40 range.

— Aggregate, minerals and metals rail traffic remain down.

Yes, the third-quarter initial U.S. surge in GDP was a stunning number. But economists will discount that relevance as a sustainable pattern for several offsetting database reasons:

— The government reported that American GDP rose at an annual pace of 33% in the third quarter, compared with the similar near one-third second-quarter drop.

— The offset is that overall economic output increased less than ~8% when compared to the second quarter versus third quarter from studies by The Economist.

— The net impact is that America’s GDP is still about 3% lower than it was a year ago.

— There are other economic headwinds ahead of the recovery.

Here are just a few railroad recovery challenges into the fourth quarter.

Consumer point of sale are lagging in certain subsectors.

While some retail sectors of the economy have seen restocking surges drive their business up by 15% or greater ranges, on the downside, other retail business areas have seen their business drop between 5% and 10%.

Products that consumers are still demanding be delivered include:

— Beauty and health care products, up in the 40%-plus range year over year.

— Beverages, up about one-third year over year.

Unfortunately, these are not typically moved on freight trains.

The net result is that railroads do not directly participate in a lot of these resupply deliveries.

While railroads do participate intermodally, too often intermodal is the second-choice carrier mode behind direct trucking.

Inside the railroad corporate suites, how are they reviewing these 2020 changes?

Not enthusiastically. Here is why.

Based on year 2020 forecasts made last year at about this same time, their internal outlook was for positive growth. Perhaps up 3% to 4.5% versus 2019.

Here are the estimated actual results. The actual year-to-date traffic volumes are as much as 13% below corporate expectations.

Anytime a railroad is in negative-double-digit year-over-year volume change, that result is troubling.

Intermodal continues to struggle to find its legs regarding shorter-haul truck competition. As a surrogate for that assertion, let’s examine the Hub Group third-quarter report. (HUBG)

HUB Group reports that its transcontinental business volume did grow along those longer-distance routes. It was up by about 18% during the third quarter.

But in the eastern United States, its intermodal volume was down by about 3% during the third quarter.

The eastern rail lanes are much shorter distances.

Schneider freight third-quarter results give us a similar reminder of the disappointing intermodal rail improvements.

Schneider intermodal traffic in the past quarter was up only 2%.

Even more telling as an operating statistic is that Schneider’s reported operating income in the quarter was down 2%, while its highway-focused trucking sector operating income was up about 27%.

Schneider (SNDR) quarterly report ($ in thousands)

Here is the bottom line for overall rail freight as October ends.

Census Bureau industrial production data shows that durable goods like wood, metals and machinery were trending down by about 7% year-over-year at the end of August.

Until that industrial sector of the economy recovers, railroad freight will remain less than last year’s.

The best news for the railroads into the fourth quarter statistically is for grains.

As illustrated in this soybean graph just released, exports are trending up markedly. Rail moves to ports are and will continue to benefit.

Bottom line for the U.S. rail freight outlook is this: I submit that overall, there will be lower rail volume levels continuing into the first quarter of 2021.

The market upside has to come once market fears related to the third wave of pandemic infections abate. Will they? That is the uncertainty. Volume trend lines don’t matter as much.