Dana Inc. (NYSE: DAN) beat Wall Street’s consensus revenue expectations of $1.91 billion for the fourth quarter of 2018. Quarterly sales increased 7 percent year-over-year (Y/Y) from $1.837 billion to $1.973 billion. Dana beat consensus revenue estimates by 3 percent, or $60 million, according to Seeking Alpha.

Dana, based in Maumee, Ohio, is a supplier of axles, drive shafts, sealing products, thermal-management technologies and universal joints. The company has nearly 100 engineering, manufacturing and distribution facilities in 34 countries.

Dana also beat Wall Street’s consensus expectations for fourth quarter non-GAAP earnings per share (EPS) of $0.65 by 9 percent. Quarterly non-GAAP diluted adjusted EPS increased 14 percent Y/Y from $0.62 to $0.71. Dana also beat quarterly consensus estimates of GAAP diluted EPS of $0.67 by nearly 3 percent. Quarterly GAAP diluted EPS increased 193 percent Y/Y from a loss of $0.74 per share to a profit of $0.69 per share.

Net income for the quarter increased 196 percent Y/Y, or $204 million, from a loss of $104 million to an income of $100 million. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for the quarter increased 13 percent or $26 million, from $197 million to $223 million. Free cash flow for the quarter increased over 372 percent Y/Y, or $190 million, from $51 million to $241 million.

Q4 Production

Light vehicle segment sales for the quarter increased by nearly 9 percent Y/Y. Commercial vehicle segment sales increased by 10 percent Y/Y. Off-highway segment sales increased by over 6 percent Y/Y. Power technology segment sales decreased by nearly 0.8 percent Y/Y.

2018 Full-Year

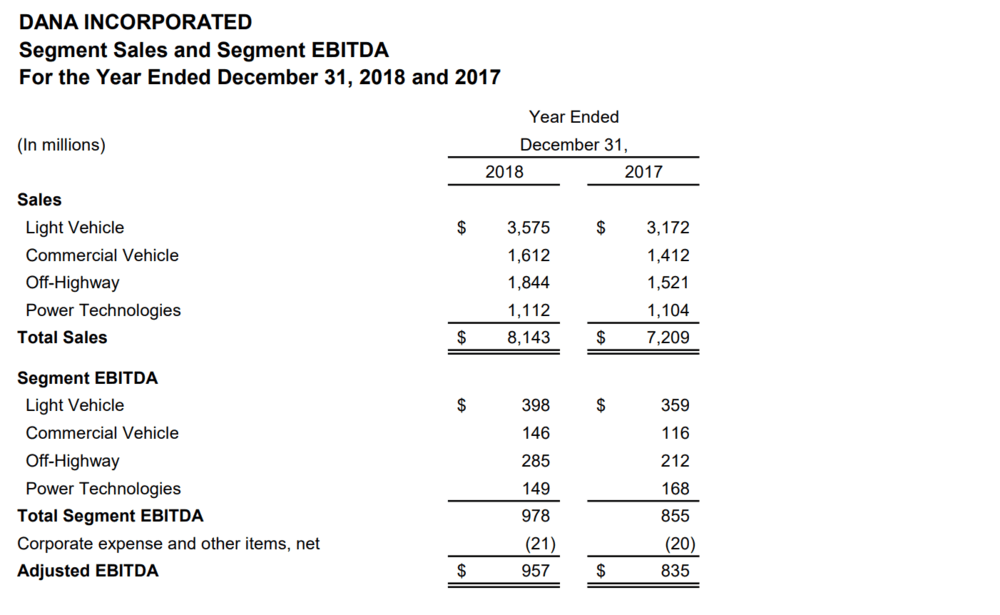

The company experienced record financial milestones as it beat its sales guidance of $7.6 billion for the full year 2018. Record annual sales were reported at $8.14 billion, increasing 13 percent Y/Y or $934 million, from $7.2 billion.

Record adjusted EBITDA was reported at $957 million, increasing 15 percent Y/Y or $122 million from $835 million. Record operating margin was reported at 11.8 percent of sales, increasing 20 basis points (bps) Y/Y from 11.6 percent. Record annual diluted adjusted EPS were reported, beating the company’s guidance of $2.90 and increasing 18 percent Y/Y from $2.52 to $2.97.

“Strong customer demand and delivery of our sales backlog, combined with our recent acquisitions, allowed us to achieve a record performance in 2018,” said Jonathan Collins, executive vice president and chief financial officer at Dana. “We have a positive outlook for 2019 due to stable end markets, our solid sales backlog, and accretive acquisitions, all of which we expect to provide us a third consecutive year of double-digit sales and profit growth.”

2018 Production

Light vehicle segment sales for 2018 increased nearly 13 percent Y/Y. Commercial vehicle segment sales increased 14 percent Y/Y. Off-highway segment sales increased over 21 percent Y/Y. Power technology segment sales increased over 0.7 percent Y/Y.