The benchmark Department of Energy/Energy Information Administration weekly average retail diesel price jumped 3 cents per gallon this week to $2.67 a gallon, the 10th consecutive week it has moved higher.

Such a stretch of increases is unusual. The last time the DOE/EIA price went up that long consecutively was as part of an 11-week series of increases in the summer of 2012.

The size of the increases over the 10-week period, however, is not unprecedented. There are several times in recent history when a 10-week stretch of price increases topped more than the 26.8-cents-per-gallon increase that has been posted since the price of $2.372 per gallon recorded at the start of November. That was the last DOE/EIA price before the increases began.

But in many of those other periods when the price over 10 weeks increased more than this current run of prices, the jump might have been fueled by a few weeks when it surged by a large amount. There also would have been declines in there as well.

In this case, what has been notable is not just the consecutive streak — the first in more than eight years — but the steadiness of the increases. The biggest one-week increase was a 6-cent jump. The price also has gone up as little as a half-cent. The increase has been recorded step by step.

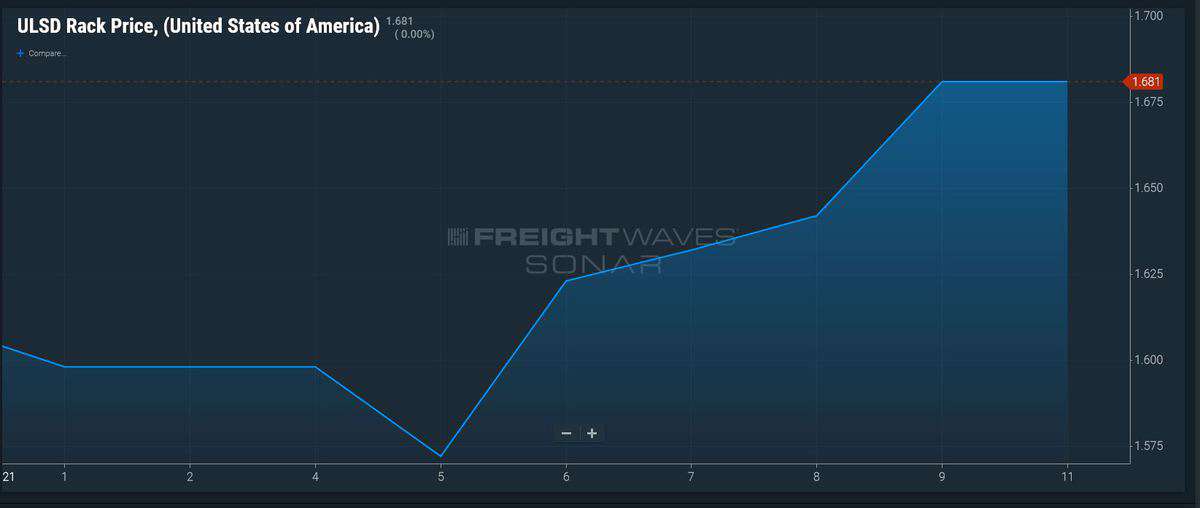

The retail market is lagging the wholesale market. Since New Year’s Day and going through Monday, the wholesale price for ultra low sulfur diesel nationally, as recorded in the ULSDR.USA data series in SONAR, has tacked on 8.3 cents per gallon. Some of that would be in the 3-cent retail price increase but clearly, it isn’t all there.

One thing that did not happen in the past week: commodity diesel prices moving significantly differently than the price of crude. The spread between Brent crude and ultra low sulfur diesel on the CME commodity exchange has held in a tight range of roughly 24.5 cents per gallon.

More articles by John Kingston

Why the feared IMO 2020 spillover effect on diesel markets didn’t happen

Key price spread in diesel market affirms tightening inventories

Diesel buyers have a problem: Capacity to make that fuel is getting cut