Rust Belt automotive volumes continue to disappoint

Companies in the expedited market – which includes truckload, straight truck and Sprinter van freight – said that volumes and rates have fallen faster than the normal truckload spot market, albeit off higher highs.

By now the story of the last trucking cycle is old hat. Regulatory pressure combined with strong economic growth and unusually destructive hurricanes in 2017 fueled a historic run-up in truckload spot prices, which in turn spurred record truck orders, eventually oversupplying the market with capacity and crashing rates by the fourth quarter of 2018.

There are essentially two sources for expedited freight originations. The first category is freight that is expedited by its very nature: just-in-time deliveries to automotive plants; pharmaceuticals and medical supplies; chemicals related to oilfield work; and semiconductor manufacturing; to name a few. The second category comes into play when truckload capacity tightens appreciably, shippers fall off their routing guides, and hot loads that should have been picked up yesterday start hitting the spot market.

In today’s extraordinarily loose capacity environment, that second category of expedited freight has all but disappeared.

“We’re seeing continued volume degradation going into May,” said Bob Poulos, president of V3 Transportation, a top five expedited carrier. Although the expedited market at large is about one-third Class 8 tractor, one-third straight truck and one-third Sprinter van, V3’s fleet of 300 vehicles has just a few tractors, with the rest evenly split between straight trucks and Sprinter vans. V3’s straight trucks are mostly teams, and it even runs some Sprinter van teams.

“The largest degradation is in Sprinter and cargo vans, and the reason for that is not just that demand is off, but it’s the unregulated segment of the market and the barrier to entry is very low,” Poulos continued.

While most well-established expedited carriers voluntarily comply with hours of service regulations – even in the Sprinter van segment that is unregulated by the Federal Motor Carrier Safety Administration – there are a number of under-insured, fly-by-night ‘multi-carriers’ who perform expedited moves for several carriers. These vans are often only covered by consumer automotive insurance and the drivers’ safety and compliance histories are shadowy at best.

“It’s the unregulated segment of our business, and because it’s unregulated, it’s truly the Wild West,” Poulos said. “We see capacity that has insufficient insurance, some with no insurance – you don’t have to be a motor carrier. We’re seeing rates below cost, and the reason they’re able to offer those prices is they aren’t buying insurance like general liability, cargo, occupational accident, like the traditional players do. It really comes down to insurance.”

Operating a Sprinter van fleet safely, responsibly and profitably will continue to be a challenge, Poulos said, as long as shippers remain in the dark about what kind of asset their freight is on. Still, it’s not all bad for expedited carriers; there are some markets with healthy activity.

“We’re seeing a fairly balanced Laredo on the expedited side. The West Coast on the outbound side looks good, it’s not a problem loading trucks on the West Coast at all. We see softness in the Rust Belt, Midwest and Southeast,” Poulos said. “We don’t have a doomsday scenario for 2019 – we think the market in the second half will follow more of a traditional pattern and we’ll begin to see volumes increase. Nothing like last year, but normalizing.”

Expedited freight flows tend to be more imbalanced than regular dry van or even reefer, and flows shift on a moment’s notice. There aren’t many markets that are consistently sending expedited freight back and forth to each other, and it’s nearly impossible to plan over-the-road circuits in advance because of short lead times for expedited freight. Both of those factors have implications for the efficiency of an expedited fleet. In terms of asset utilization, a good truckload carrier will aim to bring its empty miles percentage down to 10 percent, with many operating around 12 percent or slightly higher. Sprinter vans, on the other hand, run between 20 and 25 percent empty miles.

So what do expedited carriers do in a very weak spot market environment? They chase freight.

“We’re aggressively trying to grow incremental share with our existing customers, trying to bring in customers as fast as we can – it’s a new business game right now. We have to maximize load opportunity and bid on everything that comes in the door. We’re bringing in new business at the fastest pace we’ve ever done it,” Poulos said, adding that V3 is also trying to grow its brokerage.

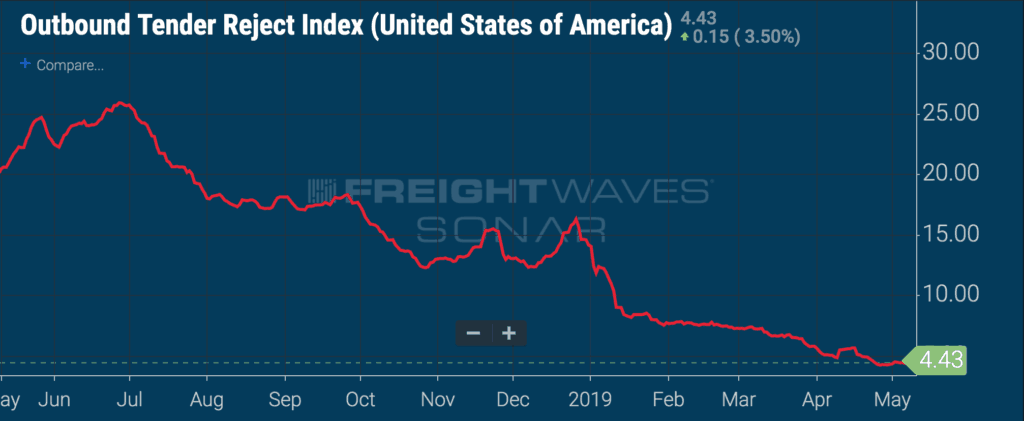

The chart below displays the national rate of tender rejections (OTRI.USA), which has a strong positive correlation to spot market activity and rates, and thus the demand for expedited services.

Kohl Forrest, a broker of expedited capacity at Summit Expedited Logistics in Chicago, was slightly more pessimistic than Poulos about the prospect of expedited markets tightening in 2019.

“Shippers are camping on their options, holding out for something better,” Forrest said. “I don’t see carriers falling off loads; the tender reject percentage says it all.” Forrest said that once he’s quoted a shipper a price for an expedited load, the customer often returns to the spot market to find a truck that will haul it for less.

“I don’t see it changing much unless there’s a huge natural disaster of some kind,” Forrest continued. “That’s the only thing I can see happening at this point that could affect the market. Companies need to diversify their customer base and commodity types.”

Forrest said that the current expedited market reminded him of another well-known freight recession in late 2015 and early 2016. At the time, he said, he brokered expedited capacity to move chemicals involved in fracking, but as the price of West Texas Intermediate crude fell from $112/barrel in June 2014 to $36/barrel in January 2016, much of that business dried up.

“My book at the time was very oil-focused, but I found Anheuser-Busch in 2015 during the oil crash,” Forrest recounted. “It’s kind of a similar mindset and spot that we’re in now – those late 2015, early 2016 doldrums.”