Next year, look to our trading partners in South America and Asia (outside of China and Japan) for accelerating growth.

Now that the fourth quarter is upon us, economic forecasters modeling the future have turned their attention to 2020 to help investors and companies find robust growth in a slowing global economy.

The consensus – at least for now – is that most of the world’s economic regions will grow more slowly in 2020 than they did in 2019, including the United States, while avoiding recessionary contraction. South America, and especially Brazil, should be an island of accelerating growth, while data is mixed on ‘emerging Asia’ because the ultimate impact of a Chinese slowdown is difficult to foresee.

FreightWaves looked at four models forecasting global economic conditions from BlackRock, McKinsey, Deutsche Bank and Bank of America Merrill Lynch.

First, two broad themes emerged in all of the notes that were reviewed – central banks around the world have committed to extending the economic expansion by easing the supply of money, but they can do little to affect what is perceived to be the biggest risks to growth, namely protectionism and trade wars.

BlackRock, the global investment firm with more than $6 trillion under management, was pessimistic about prospects for future growth, recommending that investors build resilience into their portfolios by purchasing government bonds. To FreightWaves, that signals a lack of confidence in corporations’ ability to grow earnings next year.

“Persistent uncertainty from protectionist policies is denting corporate confidence and slowing business spending,” BlackRock wrote in its “Global Investment Outlook: Q4 update.” It stated, “Yet we still believe the economic expansion is intact, supported by dovish central banks and a robust U.S. consumer.”

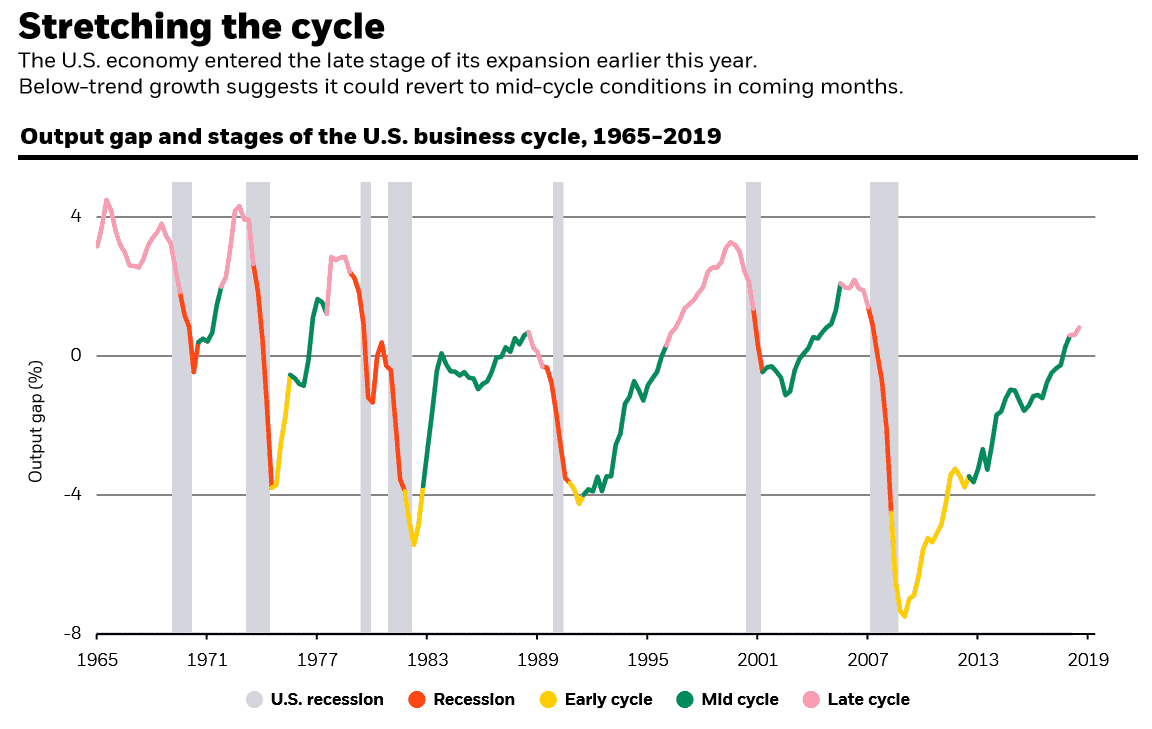

BlackRock went on to write that it counseled investors to avoid European, emerging market and Asian-ex-Japan equities. And even though BlackRock still recommends U.S. equities as the most prudent risk asset to buy, BlackRock likes stocks with minimum volatility (think utilities and consumer staples) and quality factors, and projects a looming downturn in the United States. The chart below illustrates BlackRock’s belief that the United States has already entered the ‘late stage’ of the business cycle and that a contraction is imminent.

That pessimistic view of prospects for U.S. growth in 2020 tracks with the survey results tabulated by McKinsey, the global management consulting firm, in its “Economic Conditions Snapshot, September 2019” report.

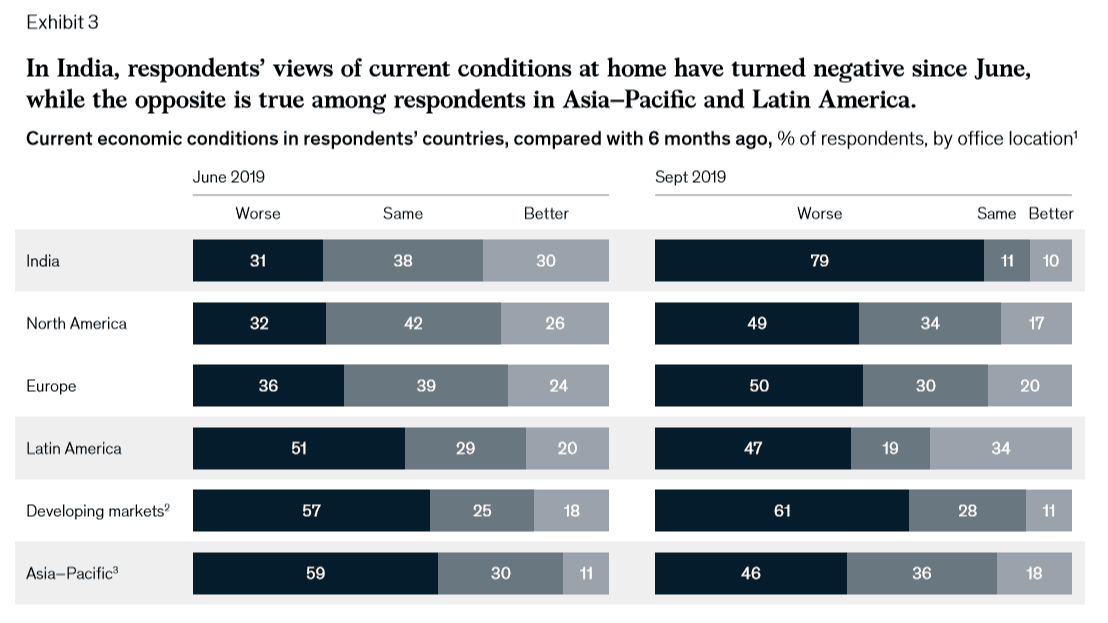

In June of 2019, 32% of North American survey respondents said current economic conditions were worse than six months prior, but by September, that number had increased to 49%. The number of North American respondents who said current economic conditions were better than six months prior fell from 26% to 17% in the same period.

Notably, in McKinsey’s research, India experienced by far the most severe deterioration in sentiment. In June, 31% of Indians surveyed said the economy was worse off than six months before; by September that number had spiked to 79%.

In only two regions did the number of respondents reporting worse conditions fall and the number reporting better conditions rise – in Latin America and Asia-Pacific. McKinsey notes that it lumps China into ‘Developing markets,’ and ‘Asia-Pacific’ includes Australia, Hong Kong, Japan, New Zealand, the Philippines, Singapore, South Korea and Taiwan.

The latest manufacturing Purchasing Managers Index (PMI) data for Europe was released this morning – Spain, Italy, and Germany continued into contractionary territory at 47.7, 47.8, and 41.7, respectively, while France fell to 50.1, which is barely in expansionary territory.

A strategist from Deutsche Bank wrote this morning that despite Peter Navarro’s walk-back of some of the more alarming recent claims about the Trump administration’s desire to impose capital controls on investment in Chinese companies, policy uncertainty was still a major factor inhibiting business spending and risk-taking.

“Our economists did note that amid the heightened political noise, the Baker, Bloom, Davis economic policy uncertainty index has risen to a six-year high,” wrote Deutsche Bank strategist Jim Reid in an October 1 investor note.

In Europe, Deutsche Bank expects German, Italian and Greek growth to accelerate in 2020, according to the bank’s October 1 weekly macro update by Marcos Arana. Deutsche Bank calls for a significant rebound in Brazil from 0.7% GDP growth in 2019 to 2% growth in 2020; India should accelerate from 5.9% in 2019 to 6.9% in 2020; but China will slow to 5.9% in 2020 from 6.2% in 2019.

The United States, according to Aranas, will slow from 2.2% growth in 2019 to 1.5% in 2020, before rebounding to 2.2% in 2021.

The forecasted relationship between energy commodities (risk assets bid up during economic growth) and precious metals (non-risk assets bid up during economic contraction) tells a broad story of a slowdown in global growth next year. Deutsche Bank’s Aranas thinks that commodities like oil and natural gas will see lower average prices next year, while precious metals like gold and silver will see higher average prices next year.

Bank of America Merrill Lynch (BoAML) also predicts GDP growth of 1.5% for the United States in 2020, but sees global growth excluding the U.S. accelerating on the back of expansions in Emerging Middle East Africa (from 1.6% in 2019 to 2.4% in 2020) and Latin America (from 0.7% to 1.4%). BoAML expects slowing growth everywhere else in the world, from Canada to Japan and the United Kingdom.

“Our economists have once again trimmed their outlook for the U.S. economy, from 1.7% to 1.5% for 2020,” wrote BoAML analyst Mary Ann Bartels in a September investor note. “Despite this, Savita Subramanian, head of quant and equity strategy, still has confidence in the U.S. consumer and continues to recommend overweight Consumer Discretionary and raises Staples to overweight from marketweight.”