CVSA Calls for a Crackdown on Personal Conveyance Abuse

The Commercial Vehicle Safety Alliance (CVSA) is gearing up to formally request a big change: a federal time cap on personal conveyance use by truck drivers — specifically, limiting it to no more than two hours per day.

Why? Because the data’s in — and it doesn’t look good.

After reviewing more than 41,000 roadside inspections, CVSA found that 38% of drivers are using personal conveyance incorrectly. In plain terms, that means nearly 4 in 10 drivers are stretching the rule beyond what it was designed for — and that misuse may be contributing to more crashes and a higher rate of out-of-service violations.

This isn’t just a technicality. According to federal crash records reviewed during the study, companies where personal conveyance is misused are four times more likely to be involved in a crash.

What Is Personal Conveyance Really For?

Personal conveyance is meant to allow drivers to use their truck off duty — for things like:

- Driving to grab a meal.

- Heading to a hotel or rest stop.

- Moving the truck to a safer parking spot.

- Running a personal errand after hours.

It’s not a license to drive another two hours on the back end of your day to get closer to your delivery — but that’s exactly how it’s often being used.

And inspectors know it.

As one CVSA official put it: “Drivers are either confused, or they’re using the rule as a loophole. Either way, it’s being abused.”

What CVSA Wants to See Changed

In the coming weeks, CVSA plans to file an official petition with FMCSA that includes several proposed updates:

- Cap personal conveyance use at two hours per day.

- Exclude personal conveyance from counting as “off-duty” time.

- Clarify that drivers cannot use personal conveyance to get to a “safe haven” after running out of hours.

- Draw a clearer line between personal use and business use.

- Prohibit using personal conveyance to travel home or from home for business purposes.

- Define what actually qualifies as a “yard move.”

Their argument is simple: The current guidelines are vague and inconsistent, and they leave too much room for interpretation — which opens the door for misuse.

Why This Matters to Small Fleets and Owner-Ops

If you’re a small fleet operator or an independent driver, this hits home in two ways:

- Misuse of conveyance can lead to major violations, even if you thought you were within the rules.

- Crashes tied to conveyance abuse impact your BASIC scores, which affects your insurance, your broker relationships and your DOT reputation.

It also puts more pressure on you to train your drivers properly, document everything and ensure logbook discipline, especially during roadside inspections or blitz events like the CVSA International Roadcheck.

Bottom Line

If FMCSA moves forward with CVSA’s proposal, the way carriers use personal conveyance will change — fast. But even before a rule hits the books, it’s clear the scrutiny is already here.

Take a look at how your drivers are using PC status. If it feels gray, it probably is. Get ahead of it now — because enforcement is coming with data, not guesses.

No More Safe Haven Excuses — Why the Parking Problem Is Now a Compliance Risk

If you’ve been watching the personal conveyance debate heat up, then you already know what’s coming: “I couldn’t find parking” isn’t going to cut it anymore.

With CVSA pushing for stricter limits on personal conveyance, and FMCSA considering tighter enforcement guidance, how and when drivers park is about to become more than just a daily headache — it’s becoming a legal liability.

And for small fleets and owner-operators, this lands right in your lap.

The Reality on the Ground

Let’s talk facts: Truck parking in this country is broken.

Depending on where you’re running, there’s either no space, no lighting, no safety or no legal options — and sometimes all four at once.

Drivers who time out under hours-of-service regs are often forced to:

- Park illegally on ramps or shoulders.

- Take the risk and drive a few more miles to a safer spot.

- Flip over to “personal conveyance” just to get somewhere they can rest.

And now, CVSA wants to crack down on that last one.

Here’s Where the Hammer Could Fall

CVSA’s proposal includes a direct request to FMCSA: Make it clear that using personal conveyance to reach a “safe haven” is not allowed once a driver hits the HOS limit.

That means:

- No more logging PC time just to go find parking.

- No more stretching it 10 or 20 miles down the road “just this once.”

- No more hiding behind vague logbook notations.

And when the blitz weeks roll around, don’t be surprised if this becomes a focal point — especially for ELD and logbook reviews during Level 1 and Level 3 inspections.

How to Stay Ahead of It

We can’t fix the parking shortage overnight, but you can control how your team deals with it.

Here’s how smart fleets are staying compliant without putting their drivers in a bind:

- Trip Plan with Parking in Mind

Don’t just plan loads — plan parking. Use apps like Trucker Path, truck stop networks or dispatcher support to lock in stops early. - Teach Your Drivers What Counts (and What Doesn’t)

Make sure every driver knows the difference between a personal move and a business move. You can’t drop a load, flip to PC and drive 45 minutes toward the next shipper. That’s a violation waiting to happen. - Build Parking Time into Load Assignments

If a driver’s window is already tight, assume the driver will need 30-45 minutes just to secure safe parking at day’s end. - Encourage Early Stops in Hot Zones

If they’re headed into urban areas or known parking deserts (like the I-95 corridor or California metros), plan for parking before 7 p.m. — or risk getting boxed out. - Document Everything

If a driver genuinely can’t find legal parking and must move, log the search. ELD notes, photos, fuel receipts, anything. It won’t guarantee protection — but it may help during review.

Bottom Line

What used to be an annoying part of the job is now a compliance target. And when CVSA, FMCSA and enforcement officers are all looking in the same direction, that’s your cue to get proactive.

Personal conveyance isn’t the problem. Misusing it because of a broken parking system is.

And while we all know the real fix is more truck parking infrastructure, until that shows up, your best defense is better planning and smarter logs.

Is the Market About to Flip? Here’s What the Numbers Are Telling Us

We’ve been in a grind for a long time now — low rejection rates, flat volumes and everybody fighting for scraps on the spot boards. But if you look closely, this week brought a few signals that something might finally be shifting.

And it starts overseas.

China Tariff Pause: What Just Happened

After months of economic strain on both sides of the ocean, the U.S. and China announced a temporary pause on new tariff hikes. The decision follows backchannel talks in Geneva and signals a cooling-off period in what’s been a freight-strangling trade war.

Why does that matter? Because Chinese goods = containers.

Containers = port activity.

Port activity = inland freight.

With tariff pressure temporarily lifted, expect a rush to move goods into the U.S. before the window closes — especially high-volume consumer products, electronics and machinery.

In short: Freight demand might be about to catch a tailwind.

SONAR: Volumes Are Moving — Slowly But Surely

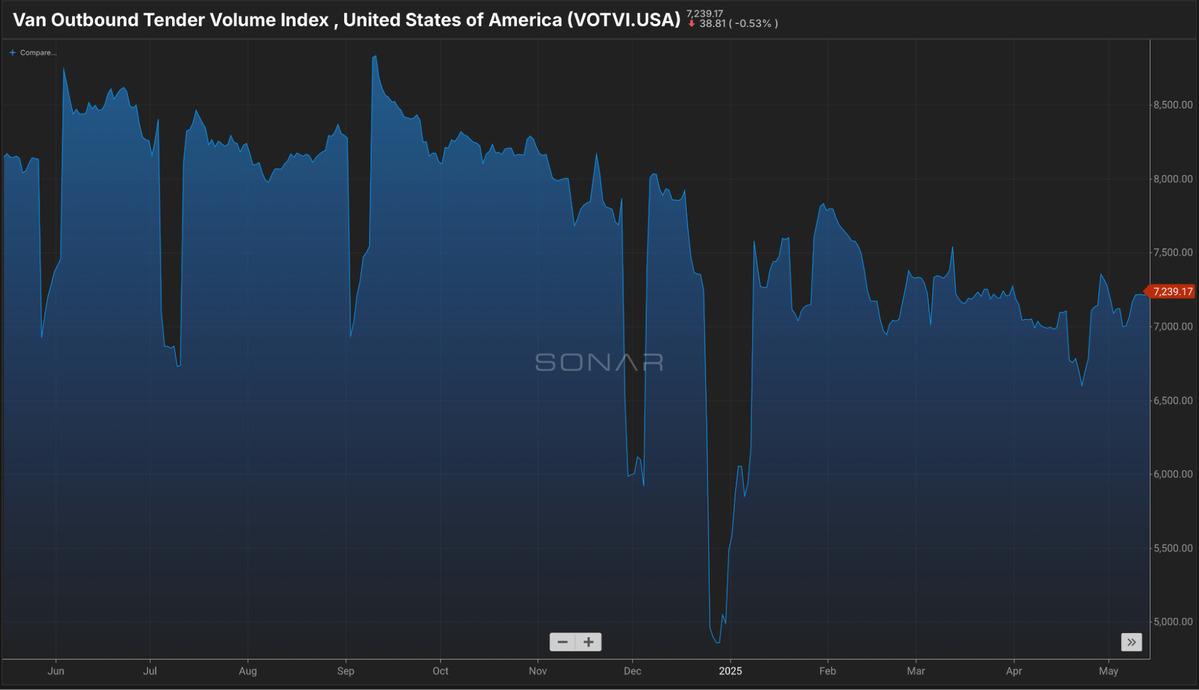

Take a look at the Van Outbound Tender Volume Index chart you see above. As of now, we’re sitting around 7,239. That might not seem massive, but it’s been inching up the past few weeks.

Compare that to the dip we saw in March and early April, and the trend is clear: More loads are entering the system — even if it’s not a full-on surge just yet.

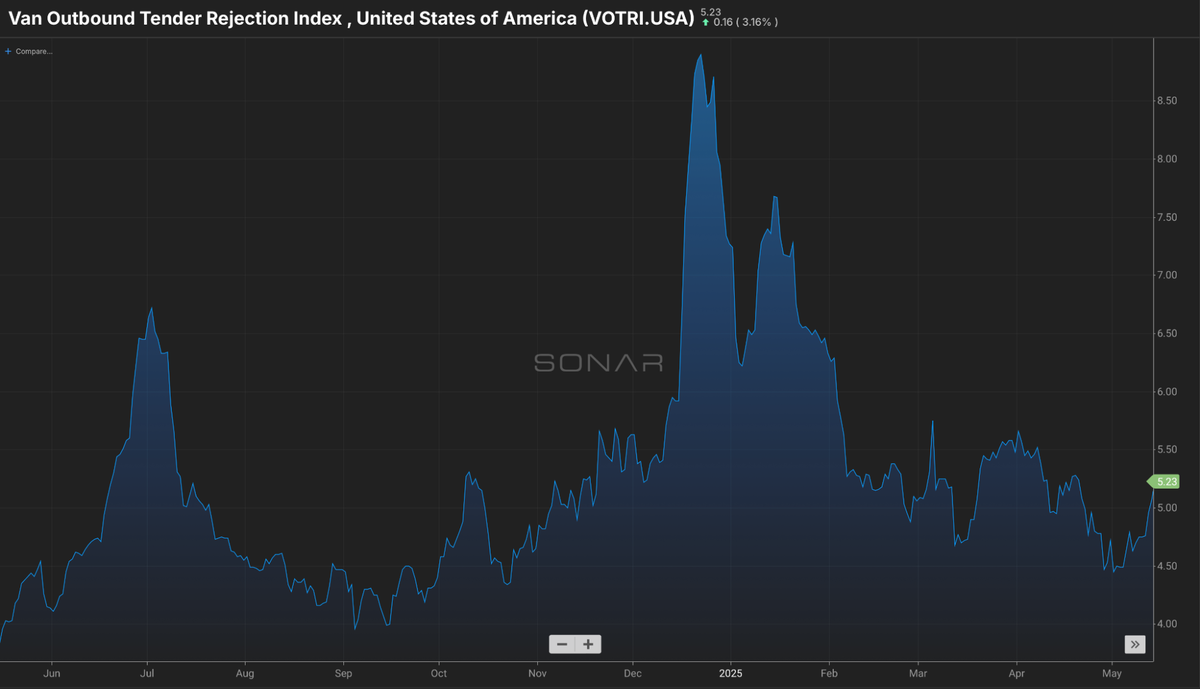

Now combine that with what we’re seeing in van tender rejections, currently at 5.23% and climbing slightly. That’s still relatively low, but it’s a step up from early May when we were hovering just above 4%.

And here’s what that really means:

- Volume is starting to increase.

- Carriers are starting to say “no” a little more often.

- That combo = upward rate pressure is coming.

Why This Could Be a Tipping Point

According to a report this week, brokerages and large carriers are already bracing for a rate spike tied directly to this tariff pause. Here’s the logic:

- Importers want to move fast before tariffs possibly return.

- That means a volume burst hitting ports and rail yards.

- Which leads to increased demand for trucks to clear that freight inland.

That’s not just a load board theory — it’s what we’ve seen in every previous tariff window. Fleets that had the ability to pivot into port or drayage opportunities cashed in. Fleets that didn’t? They chased table scraps.

What Small Carriers Should Be Doing Right Now

If you’re running dry van or intermodal lanes, especially anywhere near port markets like LA and Long Beach, California; Savannah, Georgia; or Newark, New Jersey, this is your time to get in position.

Here’s how to play it smart:

- Start watching load counts and rate shifts daily, not weekly.

- Get back in touch with brokers who move import-heavy freight.

- Consider short-term flexibility over long-term commitment for the next 30-45 days.

- If you’re running regional — get tight on your deadhead and try to align with shippers prepping for back-to-school inventory movement.

Bottom Line

The tariff pause might only last a few weeks. But the freight that comes with it? That’s very real.

And it might be the first true volume surge we’ve seen in 2025.

Small carriers that move fast, stay visible and price smart could ride this pocket of demand into a much-needed Q2 win.

Walmart Says Prices Are Going Up — Here’s What That Means for Freight

Walmart dropped two big announcements this week.

First: The company’s Q1 sales came in strong.

Second: It’s about to start raising prices, and the reason why is no surprise — tariffs.

Despite landing $165 billion in revenue last quarter, Walmart says the cost of doing business is rising, and the company is not going to be able to absorb it all. That means the low-price model that Walmart has built its brand on is about to get tested. And if Walmart’s saying it out loud, you can bet every other big-box retailer is thinking it too.

The Tariff Squeeze Is Real — and It’s Already Impacting Freight

Here’s what’s happening behind the scenes:

- The Trump administration recently paused some of the harshest tariffs for 90 days.

- Importers are rushing to bring in goods from China before that window closes.

- Retailers — especially ones that rely on global supply chains — are passing those added costs down to consumers.

- And while Walmart sources a lot of groceries from within the U.S., the categories under tariff pressure include toys, clothing, automotive parts and electronics — all freight-heavy lanes.

That “pause” may be helping load volumes rise temporarily (like we covered in Section 3), but it’s also setting the stage for price inflation and logistics cost pressure in the second half of the year.

What This Means for Carriers

If you run contract or retail freight, especially through companies that distribute general merchandise, here’s what you need to watch for:

- Load consistency could spike in the short term as retailers restock inventory before the next round of tariffs.

- Rates may go up slightly — but so will input costs (fuel, port congestion, insurance).

- If tariffs return at full strength after the 90-day pause, Q3 could bring another slowdown if consumer spending dips under pressure.

Walmart also hinted that shipping costs are on the rise due to limited vessel space and increased demand for port slots. That kind of congestion means longer lead times, more drayage bottlenecks and a likely shift in delivery expectations from some shippers.

Walmart doesn’t raise prices unless it has to. But now it has to — and that’s a flashing red light for the rest of the supply chain.

Carriers that stay nimble, control costs and pivot to stable freight segments will weather this.

Those that overextend on volatile lanes tied to tariff-sensitive imports? They’ll feel the pinch hard.

After the I-75 Tragedy, Every Carrier Needs to Rethink Accountability

This past week, tragedy struck in East Ridge, Tennessee, where a multivehicle crash involving a tractor-trailer claimed two lives and left several others — including young children — with severe injuries.

The driver behind the wheel is facing over a dozen charges, including reckless homicide, felony endangerment and aggravated assault. Reports say he was swerving through lanes at high speed, failed to brake when traffic slowed and caused a deadly chain reaction.

His truck was branded with the Amazon logo — but he wasn’t an Amazon employee.

He was a contracted owner-operator working under a small Florida-based carrier.

And now, every part of that supply chain is under scrutiny.

What the Safety Record Tells Us

While the carrier’s owner claims the company has “no crash history,” FMCSA records tell a different story.

Recent violations against the carrier include:

- Falsified logs.

- Unauthorized passengers.

- Speeding violations.

- Incorrect license endorsements.

These aren’t paperwork errors, they’re signals — signals that something was off in the operation’s safety culture long before the crash ever happened.

The Outsourcing Dilemma

This story highlights something many small fleets deal with every day: When you outsource freight, you’re still tied to the behavior of the person in that truck.

It doesn’t matter if they’re a 1099 contractor, an owner-op leasing your authority or a sub-brokered carrier — if they mess up, your name is going to get pulled into the spotlight.

And if that trailer says Amazon on the side? Multiply the attention tenfold.

This isn’t just a warning for enterprise-level freight networks. It’s a reality check for any carrier putting someone else behind the wheel.

Lessons for Small Fleets and Owner-Ops

If you’re running your authority — especially if you work with contractors — here’s what to take away from this:

- You can’t just distance yourself after the fact.

“He’s a grown man” isn’t a legal defense when that man’s in your operating structure. - CSA violations are your warning lights.

Speeding. Endorsement gaps. Logbook issues. These aren’t random — they’re your early indicators of risk. - You’re judged by your subcontractors.

The public doesn’t separate you from the guy wearing your DOT number — and neither will the FMCSA or a courtroom. - Every contractor should meet your standards.

Background checks, safety briefings, insurance verification, logs audit — even if they’re not “your employee,” they’re your responsibility.

Bottom Line

The crash on I-75 is a reminder of just how fast things can go wrong — and how long the consequences can last.

Two people lost their lives. Children were burned. And now, a carrier, a shipper and a driver are all caught in a storm of legal and moral accountability.

If you’re building a business in this industry, build it with safety, systems and ownership at its core — or risk having everything undone by one moment behind the wheel.

Final Word: It’s All Connected

This week’s stories have a common thread: accountability.

Whether it’s personal conveyance abuse, unsafe subcontractors or rising prices from tariff fallout, the trucking industry is showing once again that you can’t afford to look the other way.

If you’re a small carrier or owner-op, these moments aren’t just headlines — they’re warnings. Warnings to tighten up your books, your partnerships, your safety practices and your daily decisions behind the wheel.

Because whether it’s FMCSA enforcement, a courtroom or a mother watching a horrific scene on I-75, nobody cares whose name is on the truck. They care who took responsibility.

Stay sharp. Watch the signs. And don’t just move freight — move right.