HMM reported Wednesday its operating profit shot up by 153% year over year, but the South Korean ocean carrier isn’t counting on revenue figures to be quite as impressive in the second half of 2022.

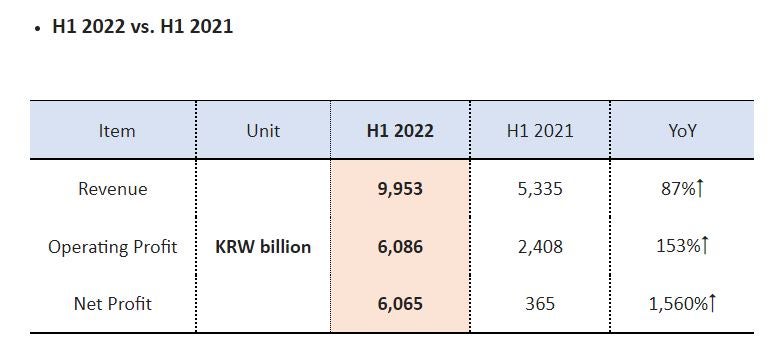

Seoul-headquartered HMM said the operating profit for the first half of 2022 was KRW 6.08 trillion ($4.68 billion), up from KRW 2.4 trillion ($1.8 billion) in the first six months of 2021.

First-half revenue leapt by 87% year over year from KRW 5.33 trillion ($4.1 billion) to KRW 9.95 trillion ($7.66 billion).

Net profit was the most impressive figure of all — up 1,560% from KRW 365 billion ($281 million) in 2021 to KRW 6.06 trillion ($4.65 billion) this year.

“HMM significantly improved earnings in H1 2022, mainly led by high freight rates and efficient fleet operations,” the company said in an earnings statement. “The Shanghai Containerized Freight Index (SCFI) in H1 2022 was 4,504 points, up 49% from 3,029 points in H1 2021.”

Second-quarter earnings also significantly improved year over year. Revenue was up 73% from KRW 2.9 trillion ($2.23 billion) to KRW 5.03 trillion ($3.85 billion). Operating profit increased 111% from KRW 1.38 trillion ($1.06 billion) in Q2 2021 to KRW 2.937 trillion ($2.264 billion) this year. Net profit leapt 1,290% from KRW 211 billion ($162 million) to KRW 2.933 trillion ($2.261 billion).

HMM said it was able to attain record results despite fuel costs rising 35% from the first to the second quarter of this year.

“The financial structure has remained strong,” it added. “HMM’s debt-to-equity ratio has improved to 46% in June 2022 from 73% in December 2021.”

HMM provided only three points in the “outlook and plans” section of its earnings release, which hint that results for the second half of 2022 might not be as astounding as those for the first six months of the year.

“Demand growth is expected to be under downward pressure due to considerable uncertainties mainly related to widespread inflation, rising oil prices and [a] recurrent coronavirus situation, in addition to geopolitical tensions,” HMM said.

It added that the “global supply chain is forecast to remain strained in the coming months” and port congestion at locations around the world is “still pervasive.”

HMM said it unveiled a mid- to long-term strategy in July and “will spearhead an effort to address the full range of future challenges and lay a solid foundation for sustainable growth.”

HMM will spend more than $11.3 billion as part of the growth strategy that includes expanding its container ship fleet from 820,000 twenty-foot equivalent units to 1.2 million TEUs by 2026.

HMM growing container ship fleet as part of $11B investment

12 HMM container ships’ sticker price $1.57 billion

Click here for more American Shipper/FreightWaves stories by Senior Editor Kim Link-Wills.