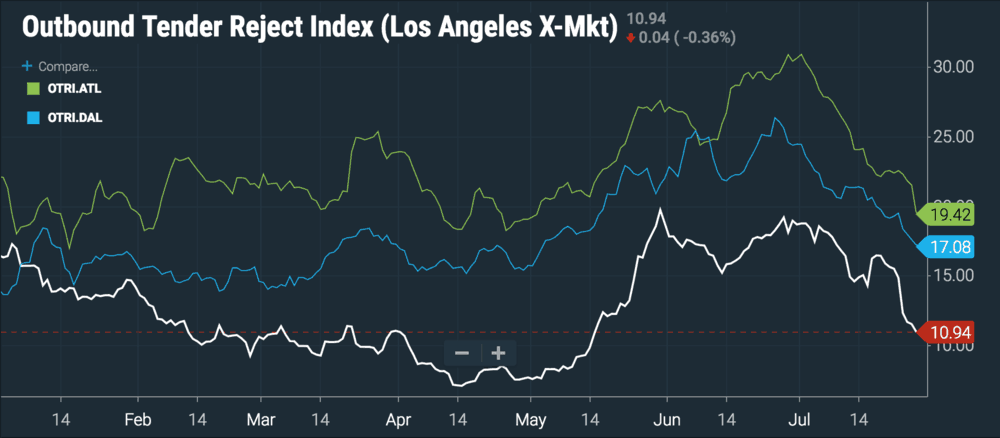

During July, we saw turndowns fall apart across the country (OTRI.USA). OTRI, the Outbound Tender Rejection Index, measures the rate at which loads tendered by shippers are being rejected by carriers. The turndown rate indicates the relative balance of trucking capacity and freight demand in a market. The chart below compares turndowns in Los Angeles (white line), Dallas (blue line), and Atlanta (green line), three of the most important freight hubs in the United States:

“We’re not surprised by the softening in those specific markets. It’s that time again for auto-shutdown & retooling, and overall July is seeing the same relative annual softening we’d expect any year,” Eric Rempel, CIO at Redwood Logistics, wrote to FreightWaves. “Furthermore, Atlanta is winding down its produce season, explaining some of the higher tender-acceptance ratios. In Dallas, the lower cost of fuel plus a flattening crude oil price further supports the trends you’ve noticed. On LA, however, we don’t believe that we’re seeing a market shift. Rather, the market seems to be getting more control over some of the irrational pricing we saw in earlier months. It’s our opinion that the LA market could go back to being more volatile pretty quickly. We still think that some of the patterns you’re reporting will be solidified as the new norm if these trends were macro and longer lasting. These appear to be more micro (both scope and geography) in nature.”

Lagging indicators like GDP growth, 4.1% for the second quarter, and business media are still painting a picture of a white-hot, overheated freight economy, even though turndown data is telling us that supply and demand have reached an equilibrium during the summer doldrums.

It’s volatile moments like the one we’re currently experiencing where sophisticated freight brokers can widen their margins even further. If spot rates fall off faster than shippers anticipate, brokers can still command high prices for loads and pay out less to the carriers. The trick for the brokers is convincing carriers to move freight at lower rates.

“It’s been really slow. We’re doing well with spot freight but we haven’t bounced back fully making margins on our primary freight. But because it’s so slow, there’s not a lot of spot freight,” a broker at Coyote Logistics wrote to FreightWaves.

Because turndowns are so low, shippers are getting some relief from the spot markets and are able to move their freight at contract rates. The problem, the broker explained, is that carriers on the other end of the deal don’t know whether the load they’re getting is spot or contract, and brokers are stuck trying to beat the carriers down to maintain their margins on loads with less money in them. While brokers are currently handling smaller spot volumes, they’re able to do very well on them because the rates they’re paying for capacity fell faster than what they’re getting paid by shippers.

If you’re a broker, volatility in either direction can be your friend, because it means that at least one party to the deal will have lower quality information about the state of the market.

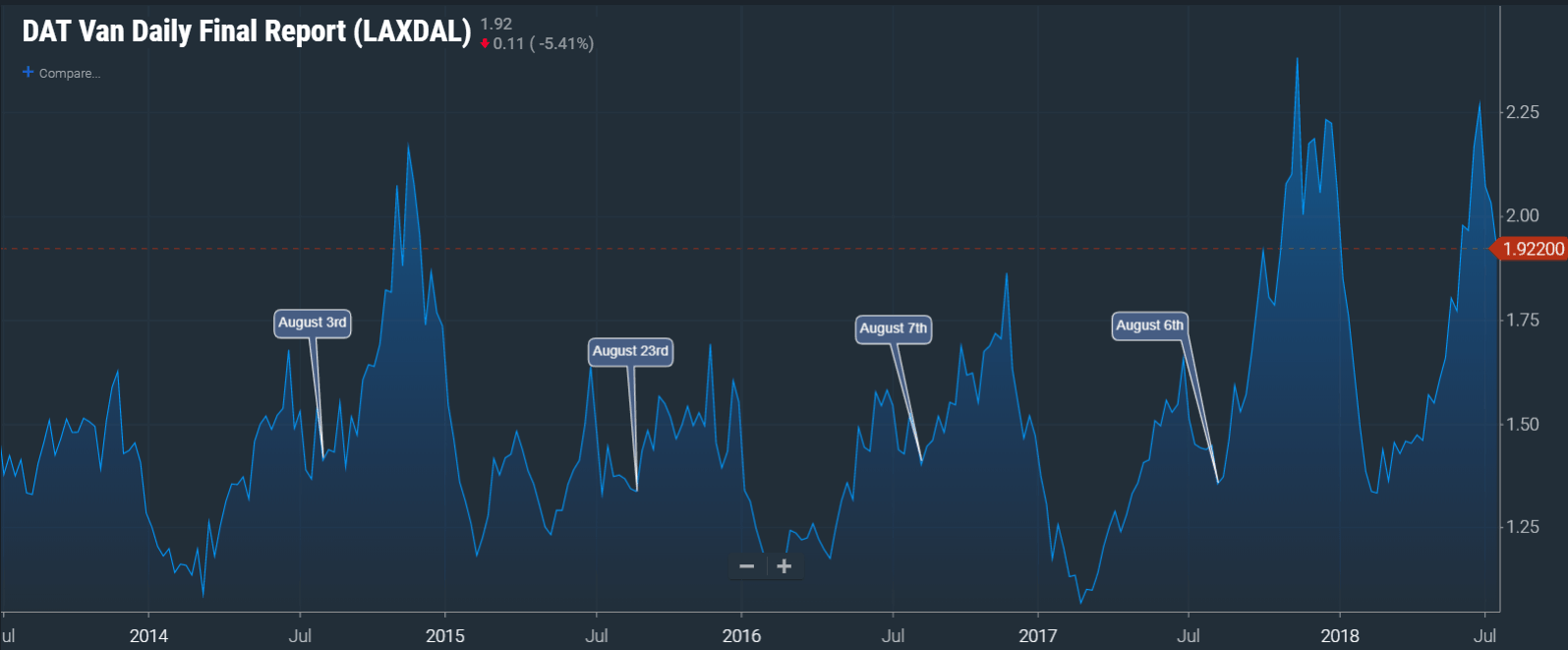

How long will the summer slowdown last? Historical data suggests that in just a few weeks, brokers will get another opportunity to exploit spot market volatility as prices accelerate. The chart below displays one of SONAR’s newest indices, the DAT Van Daily Final Report for the Los Angeles to Dallas lane (DATVF.LAXDAL), which records spot prices for that lane:

We’ve included some call-outs in the chart to show the exact date prices in that lane bottom out during the summer doldrums over the past five years: August 6, 2017, August 7, 2016, August 23, 2015, August 3, 2014, and August 11, 2013. In the next few weeks, in the first half of August, it’s highly likely that the softening freight market will roll over into increasing tightness. Watch for turndowns to increase, followed by upward pressure on spot prices.

It’s a risky time for brokers quoting spot loads because they have to anticipate rising rates. One strategy is to pre-book as many loads as possible with carriers before the load boards explode. Good brokers have long-term, mutually beneficial relationships with carriers and trust them not to gouge them when capacity is tight, in exchange for fairly priced freight during slowdowns. It often comes down to having a conversation with the shipper customer about a looming capacity crunch while at the same time trying to hold off the carriers who are hungry for richly priced spot loads.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.