Container volumes and trucking

Inbound container volumes into the U.S. bode poorly for future trucking volumes. Trucking is the critical node for transporting goods, handling over 70% of freight in the U.S. at a given time. If imports are declining or reverting to pre-pandemic levels, then there will naturally be a side effect of less truckload demand and tendered truckload volumes.

A downturn in inbound container volumes in the U.S. can serve as a leading indicator of future truckload volumes. FreightWaves SONAR data noted this downward trend beginning in mid-May; FreightWaves ocean intelligence expert Henry Byers penned a June 7 article titled “U.S. import demand is dropping off a cliff” after noting a 36% drop in container flows from China to the U.S. between May 24 and June 7.

The challenge with such predictions is that the subsequent volume drop at U.S. ports took longer than predicted due to backlogs processing those shipments. FreightWaves CEO and founder Craig Fuller notes, “FreightWaves did get one thing wrong – we underestimated how long it would take the volume drop to show up at U.S. ports. We expected it to be apparent by July, but the backlog of containers was so massive that it wasn’t until August that the data was clear (Port of Los Angeles down 17% year-over-year).”

The important data to watch will be point of origin bookings versus when the orders arrive in U.S. ports. For equity analysts and other commentators, this can lead to confusion, with Fuller noting that one prominent investment banking company had “confused SONAR Point of Origin bookings data with Customs clearing data in the U.S. The difference is SONAR data measures when freight is loaded at its destination port, while U.S. Customs and Border Protection measures when it clears U.S. ports.”

FedEx misses financial guidance, delivery waiting on reset

The international macroeconomic environment is in for some rough waters, as FedEx’s recent announcement of a quarterly income shortfall demonstrates. The FedEx revision, based on their exposure to Asian airfreight lanes, indicates demand appears to be falling, especially in the Asia-to-U.S. air corridors.

Regarding the airfreight exposure, FreightWaves’ Mark Solomon wrote, “No one disputes that the international macro environment has taken a turn for the worse. It is also indisputable that FedEx, with its huge exposure to Asian airfreight lanes, would take a disproportionately hard hit if demand in the region were to deteriorate.”

FedEx is also a big player in truckload transportation with its FedEx ground and freight segment. In addition to their airfreight and LTL segments, truckload carriers often will haul expedited high value loads via long-term contracts. A decline in FedEx air freight volumes could directly impact trucking companies that have a large team or expedited exposure, as lower expedited truckload volumes will equate to lower trucking margins. An old joke when I ran teams was “the solo business unit keeps the lights on, the team business unit puts steak on the table.” For trucking, steak could be replaced with SPAM if volumes decline notably moving into the holiday season.

Market update: What’s happening with peak season for 2022?

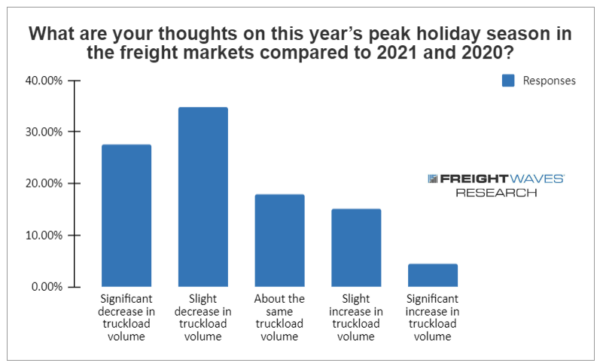

According to the latest FreightWaves Research, carriers and freight brokers are pessimistic about peak season this year. The annual rush to get products on the shelf was intense in 2021 as volumes and full truckload capacity spiked. This year is a different world though as volumes remain stagnant as consumers are battling inflation, costlier credit terms and uncertainty about recessions.

Sentiment for 2022 is running low among all transportation providers as two-thirds of respondents in the survey are gearing up for lower full truckload volumes around the holidays. In addition to lower volumes in 2022, respondents are concerned about higher diesel costs and more trucks in the market competing for loads.

Here are some of the key differences between the freight markets of 2021 and 2022 as of Sept. 23 heading into peak season:

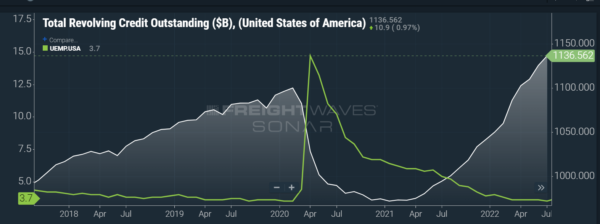

FreightWaves SONAR spotlight: The game between hawks and doves at the Fed

Summary: The chart above shows the two immovable forces the Federal Reserve is battling in its war on inflation. Total outstanding revolving credit is in white. Credit card debt is the primary category for revolving credit and it is now 16% above pre-pandemic highs. Consumers are still spending, albeit with more credit as inflation takes hold. Unemployment has also returned to its pre-pandemic lows of 3.6%.

The Fed is forecasting unemployment to increase to 4.4% in 2023. Using interest rates to manage the economy and move unemployment up and down is a dangerous game with a large margin of error baked into the cake.

One danger of using interest rates is the lag time it takes for costlier borrowing to slow economic activity. The more aggressive the Fed is now, the higher the probability it overcorrects. If it does overcorrect, then it can create a negative feedback loop with consumers. Once this happens, unemployment can spike higher than anticipated as the Fed loses control of the narrative.

The Routing Guide: Links from around the web

Senators Promote Truck Parking Access (Transport Topics)

FMCSA to recruit truck drivers for autonomous vehicle study (FreightWaves)

Bad brakes, false logs were most common 2022 Roadcheck violations (Fleet Owner)

OOIDA permitted to intervene in renewed AB5 legal battle in California (FreightWaves)

Hutcheson confirmed as FMCSA head, ending agency’s yearslong void (Transport Dive)