Struggling for capacity: A briefing on fleet availability

The holiday season in trucking traditionally sees lower driver activity due to the Christmas and New Year’s holidays. The driver’s home time and geographic location pose a unique challenge to carriers, as larger fleets have drivers domiciled in locations that may be far from their primary high-volume contracted lanes. This leads into an important fleet operations topic: fleet availability percentages and how these numbers impact decisions on load bookings, rejections and revenue goals. Tractors generate revenue miles by hauling loads, and revenue miles is a key unit of output fleets use to determine profitability.

Fleet availability: a quick primer

- This represents the percentage of drivers available to work; if a fleet is 500 trucks, and projected availability for the day is 450, then the fleet has a 90% availability.

- Breakdowns, trucks in shops, unseated tractors and drivers at home all contribute to decreasing this number.

- The higher the availability of ready tractors, the higher the revenue, loaded miles and loads per truck per week that a fleet can acquire.

The challenge for fleets

- Thanksgiving and the Christmas holidays are both important dates for drivers, as most want to be home with friends and family.

- Trucking networks are designed to operate year-round, and fleets adjust their load booking strategies and behavior to get their drivers home for one or both dates.

- Once home, drivers may take additional time off or even quit to take a local job, forcing the fleet to spend extra resources to recover the tractor and tow it to a terminal.

- Getting a driver back on the road after the holidays is a challenge; driver demand is extremely high, and drivers understandably take advantage of this fact by taking more time off.

Impact on the market

- Load tender rejections increase in the days leading up to Thanksgiving and Christmas, indicating capacity leaving the market and heading home.

- Tender rejections decrease in the days after New Year’s, as fleets confirm driver availability and position them to cover committed lanes.

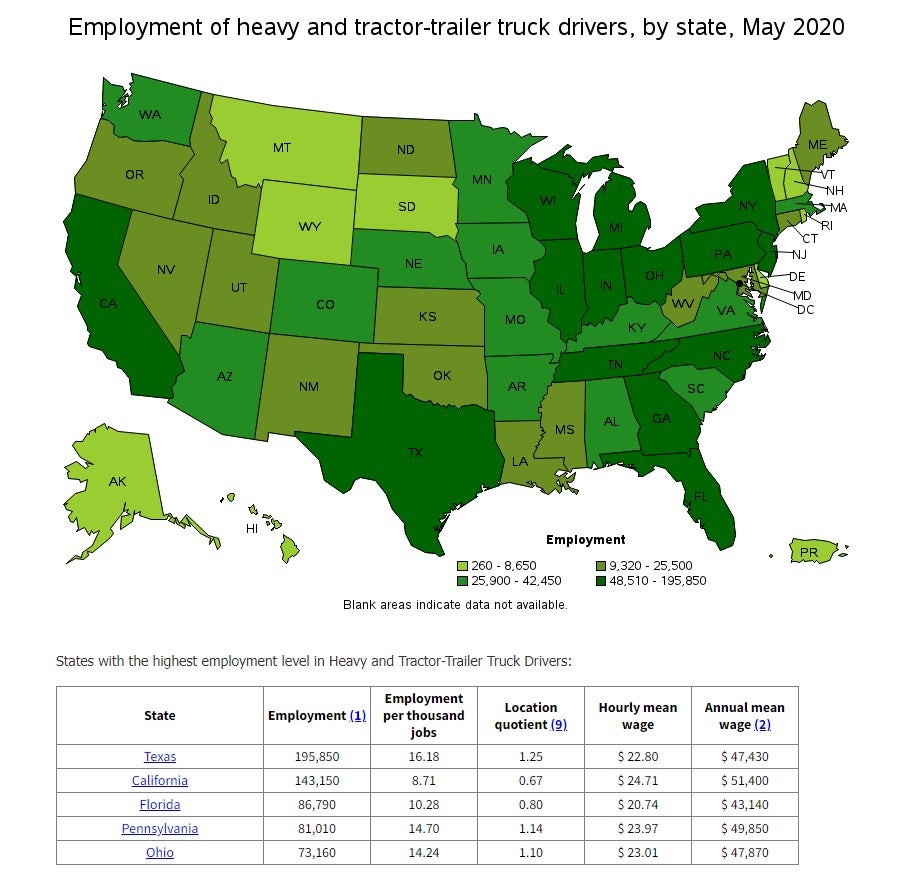

- Spot market rates in Texas, Georgia, Florida, California and Pennsylvania, which have large driver populations, experience rate volatility before and after the holidays, as many carriers are customer routed and use brokerages for backhaul lanes.

TuSimple completes 80-mile driverless truck pilot in Arizona

In a milestone for autonomous trucking, TuSimple completed an 80-mile nighttime run along Interstate 10 in Arizona with no driver in the cab. The upfitted Class 8 tractor left a rail yard in Tucson on Dec. 22 and traversed streets and highways for an hour and 20 minutes before arriving at a Phoenix distribution center.

The Arizona Department of Transportation and local law enforcement assisted with the run, which had no remote control nor traffic interventions. During the test, a lead survey vehicle remained 5 miles in front of the autonomous truck, with law enforcement vehicles following a half-mile behind for extra safety.

Why it’s important:

- The pilot program took 18 months of development to create a Level 4 autonomous semi-truck.

- TuSimple continues to partner with UPS and recently surpassed 160,000 robot-driven miles by moving loads from Arizona and Texas to UPS airfreight terminals in Orlando, Florida, and Charlotte, North Carolina.

- Autonomous trucking represents a large potential for cost savings, as driver pay represents around 40% of a tractor’s operating cost to fleets.

Thoughts moving forward:

I view this moment as more of a Wright Brothers event; while they demonstrated flight in Kitty Hawk, North Carolina, in 1903, it wasn’t until 1914 that the first commercial flight was scheduled and not until the Air Commerce Act of 1926 that commercial aviation established standards and regulations.

Autonomous trucking is in a similar situation. We now have a demonstrated proof of concept, but it requires additional testing and regulatory hurdles before we begin to see the foundations of wide-scale implementation.

Market update: Tractor-trailer driver employment data

This data is useful for visualizing the challenges of fleet availability and understanding how driver density can impact rates before and after major holidays. Large carriers operate a nationwide network of freight but must adjust their pricing strategies based on where most of their drivers are domiciled. Failure to adjust their truckload network to cover these changes can increase empty miles, cause service disruptions and lead to increased turnover if drivers cannot be routed home in a timely manner.

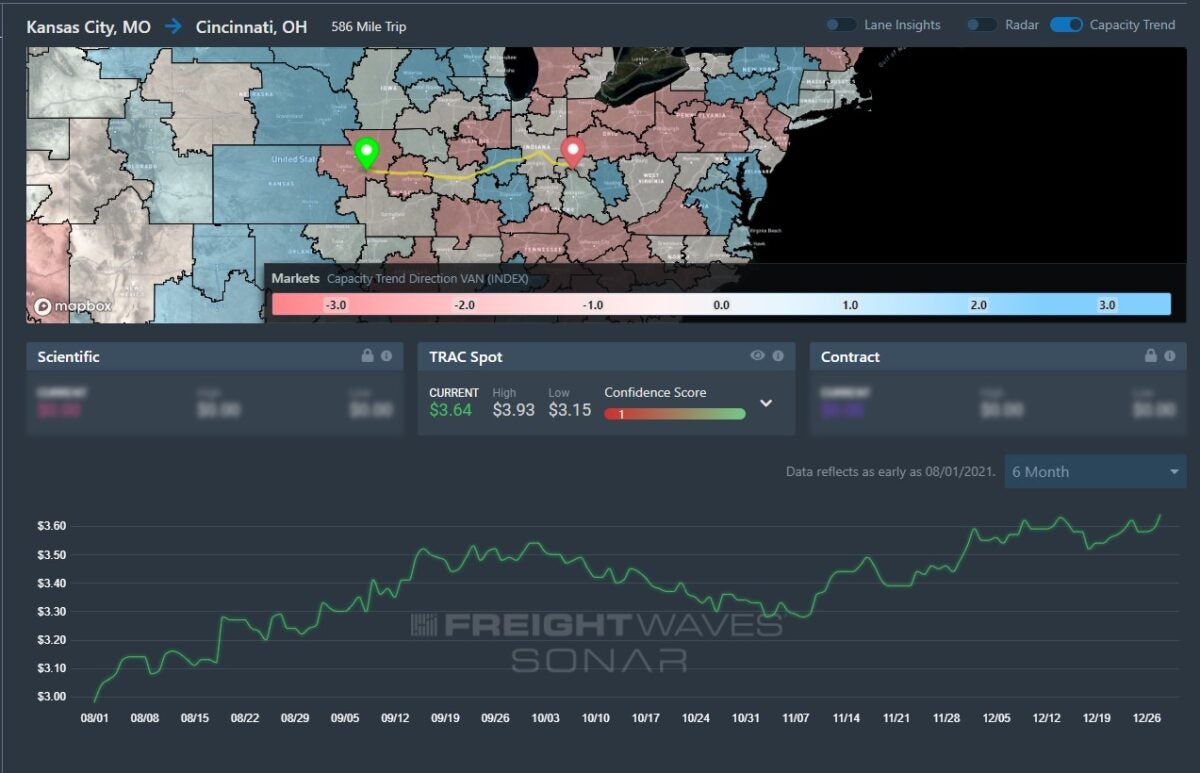

FreightWaves TRAC lane spotlight: Kansas City, Missouri, to Cincinnati

Summary: Outbound tender rejection rates from Kansas City to Cincinnati reach their highest level since mid-November. Outbound tender levels remain volatile in the Kansas City market.

Highlights:

- The Kansas City market continues to experience tender rejection volatility (from 23.5% at the end of November to 30.2% in late December).

- Outbound rejections remain high from Kansas City to Cincinnati at 28.77%, with a lack of capacity driving rejections.

- FreightWaves TRAC spot rates from Kansas City to Cincinnati remain elevated at $3.64 per mile as rejected tenders become spot market opportunities.

Carriers: Market volatility and high tender rejection rates indicate other carriers in the market are struggling to cover committed freight. High spot rates provide an opportunity to increase revenue, but the rate volatility will make timing key, as day of week and truck ready time will become key factors when negotiating rates.

The Routing Guide: Links from around the web

Central Freight Lines truckers: Final paychecks came too late for Christmas (FreightWaves)

McDonald’s rents cargo jets to fix french fry shortage in Japan (FreightWaves)

The Supply-Chain Crunch Is Like a Traffic Jam. (The Wall Street Journal)

Investors Are Piling Into Supply-Chain Technology (The Wall Street Journal)