FreightWaves Owner-Operator survey results

On Tuesday, FreightWaves Research released survey data suggesting declining freight conditions are impacting owner-operators especially hard. An important takeaway is the potential for many more owner-operators to leave the industry if conditions do not improve.

“35.2% of self-identified owner-operators checked, ‘If the market does not rebound materially by the end of 2023, I will leave the industry.” wrote FreightWaves Senior Editorial Researcher Joe Antoshack in the report, adding, “about 21% said they were having trouble finding loads to haul”

In spite of growing revenue, costs such as fuel, equipment and insurance ate into profit margins. Antoshak noted, “The median owner-operator in this survey did see revenue grow 7% from 2021-22 — from $224,000 to $240,000 — but expenses far outpaced that success. They paid 22.9% more to operate in ’22.”

Declining net income appears to be a major motivating factor for capacity leaving the market. For those at-risk owner-operators who indicated they would leave, their net income reported in 2022 was $63,450, about 29% lower than the average of all respondents at $89,500.

OOIDA Freight Rate Survey

On Wednesday, the Owner-Operator Independent Drivers Association (OOIDA) released its annual Freight Rate Survey that includes demographic information and documents changes within the industry. While the demographic data goes back to 1998, it wasn’t until 2010 that OOIDA started collecting freight rate data from its membership.

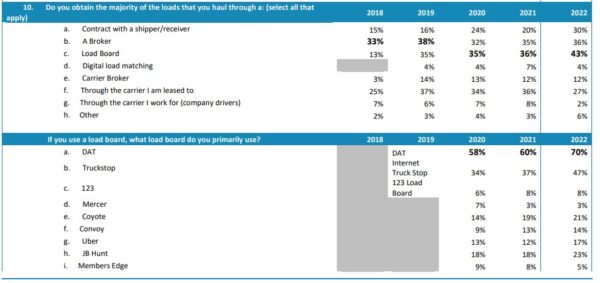

One area I noticed that deserved more attention is how exposed to spot rates smaller carriers and owner-operators are. While the past two years saw a record number of new entrants in the market seeking to take advantage of record spot market rates, many of these newer carriers lacked access to contracted freight and heavily relied on loadboards or freight brokers.

Buried at the bottom of the report, which can be found here, is a striking picture of why trucking capacity leaves the market when spot conditions deteriorate. Notably, only 30% of respondents booked loads via a contract with a shipper/receiver, with a majority utilizing freight brokers or load boards: 36% and 43%, respectively.

I believe this data suggests we may see truckload capacity supply destruction at a greater pace than in previous years, as digital brokerages utilize AI-driven pricing algorithms to more efficiently price, and undercut competition to secure loads. Quantifying this destruction can be tricky. One surefire way to determine if enough truckload capacity leaves the market will be in spot rates, as a pricing bottom is one indicator that enough truckload supply has left the market relative to the demand for truckload orders.

Market Update: ACT Research finds January trailer orders lower with longer wait

January trailer orders, while fewer than the record December reading, suggest strong demand into 2023. According to a recent report by ACT Research, January net trailer orders came in at 24,300 units, 58% less than in December, but only 9% lower than January 2022. ACT Research noted that in spite of lower order numbers, demand remains strong with low cancellations. The report added that replenishment of dealer stock rather than direct-to-customer deliveries are taking place.

In spite of lower orders in van and flatbed trailers, there was an increase in demand for lowbeds and tanks, with dumps remaining unchanged.

“OEM conversations continue to suggest supply-chain constraints, including labor, are likely to remain a limiting factor to production in 2023,” noted Jennifer McNealy, director–CV Market Research & Publications at ACT Research.

For carriers looking to update their aging trailer fleets, the wait time to receive the equipment increased. The January backlog-to-build ratio rose to 9.9 months, after averaging around 8 months since August 2021.

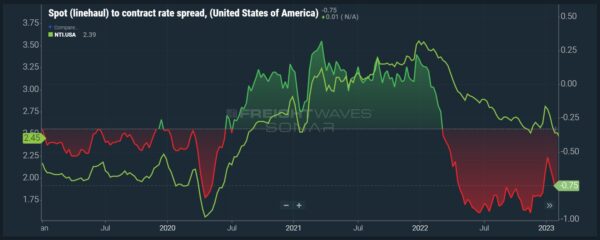

FreightWaves SONAR spotlight: Falling rates exacerbate spot-to-contract spread

Summary: Lingering excess truckload capacity continues to create downward pressure on rates. The spot-to-contract rate spread index (RATES) measures the difference between the FreightWaves National Truckload Index (Linehaul Only — NTIL) which excludes fuel costs, and the Van Contract Rate Per Mile Initial Report Index (VCRPM1).

The continued decline of transactional spot rate costs is putting greater pressure on carriers that rely on dedicated, year-round contracts. The current spread of 75 cents per mile can create situations in which shippers tender the bare minimum contracted tenders and push any overflow freight volumes onto the spot market for more savings. Additionally, truckload contracts lack an enforcement mechanism if the carrier or shipper declines or fails to send a load. Some customers, accustomed to record-high tender rejection rates from carriers in their routing guide from the past two years, may return the favor by throttling contracted freight volumes if they are under pressure to cut transportation costs.

Anecdotally, many shippers are finding that carriers and brokers are proactively reaching out to cut rates in advance to remain the incumbent on their high-volume lanes. For carriers and brokers of all sizes, the main strategy in this softer freight environment is to secure volume at all costs. Typically, this behavior eventually prices out less efficient carriers until the balance of truckload supply to demand right-sizes. The bigger question remains when and what that destruction of capacity will look like in the data. Typically, spot market rates and rejection rates are great indicators of trucking pricing power.

The Routing Guide: Links from around the web

Fleets’ 2022 Q4 earnings show the pandemic party might be over (Commercial Carrier Journal)

Department of Labor denies trucking company’s bid to hire foreign truckers (LandLine)

Falling used truck prices push largest dealership network to sidelines (FreightWaves)

Nikola will make Plus autonomous truck technology standard in 2024 (FreightWaves)

‘We don’t give directions’ — how GPS is changing our social selves (Overdrive)

Brake module corrosion continues to vex Daimler Truck (FreightWaves)